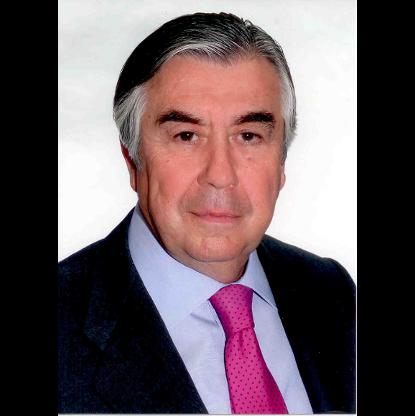

Age, Biography and Wiki

| Birth Place | Madrid, Spain, Spain |

Net worth: $1.4 Billion (2024)

Alberto Alcocer, a prominent name in the world of investments in Spain, has amassed an impressive net worth estimated to be around $1.4 billion by 2024. With his keen business acumen and astute investment decisions, Alberto Alcocer has been able to build an empire that spans various sectors, including real estate, finance, and technology. His strategic investments have not only yielded substantial financial gains but have also contributed significantly to the growth and development of the Spanish economy. Alberto Alcocer's entrepreneurial prowess and impressive net worth are a testament to his remarkable success in the competitive world of investments.

Biography/Timeline

Alcocer studied Law in the Universidad Complutense de Madrid. In 1969 he married in separation of goods with Esther Koplowitz. After it, the cousins started being employed at the company Constructions and Contracts, which the Father of his wives had founded.

In 1976, Alberto Alcocer and Alberto Cortina were already managing Directors, transforming the company in a group of more than 30 societies. In 1978 they were acquiring 5% of the Development bank, belonging to the Central Bank and, three years later, the cousins acquire some participations in the cement company Portland Valderrivas, which was property of Banesto.

In 1982, they acquire the Bank Zaragozano and, in 1987, they get in the mass media across with the group Estructura. One year later, close to the Group KIO, to that they sold the majority of control of the society Urbanor in exchange for 12% that the Kuwaiti group had in the Central Bank (causative operation of the spectacular revaluation of Urbanor's actions), they create the society Cartera Central. But in 2003 both had to sell his participation of the control in the Bank Zaragozano to Barclays because one of his associates in Urbanor, the Architect Pedro Sentieri, denounced them for racket, giving place to the case Urbanor.