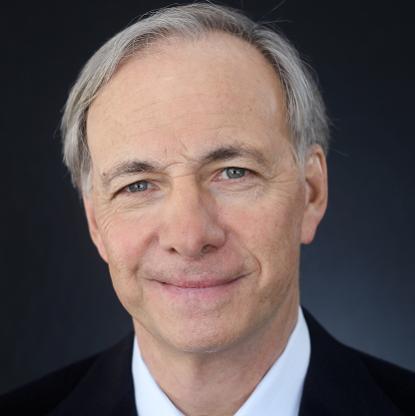

Age, Biography and Wiki

| Birth Day | February 19, 1959 |

| Birth Place | United States |

| Age | 65 YEARS OLD |

| Birth Sign | Pisces |

| Residence | London |

| Education | BS Carnegie Mellon University MBA Harvard Business School |

| Occupation | Investment manager |

| Known for | Founder of Pamplona Capital Management |

| Spouse(s) | Irina Knaster |

| Children | Four |

Net worth: $2.1 Billion (2024)

Alexander Knaster, a renowned investor, is projected to have a net worth of a staggering $2.1 billion by 2024. With his sharp business acumen and exceptional investment strategies, Knaster has managed to accumulate substantial wealth throughout his career. Known for his notable investments in the United States, he has proven his expertise in identifying lucrative opportunities in various sectors of the American market. The success of his ventures has greatly contributed to his rising net worth, solidifying his position as a prominent figure in the world of finance and investments.

Biography/Timeline

Knaster was born in Moscow in 1959 to a Jewish family of academics. His Father, Mark Knaster, who held several patents relating to metal coatings, batteries and solar cells, worked in a number of respected scientific institutions, including USC. His mother, Tatyana Knaster, is a civil Engineer who taught at Pennsylvania Institute of Technology.

Knaster immigrated to the United States at the age of 16 with his family. He graduated with a B.S. electric engineering and mathematics from Carnegie Mellon University which he attended on a scholarship. In 1980, he accepted a job as an Engineer with Schlumberger working on their oil platforms in the Gulf of Mexico.

After graduating in 1985 with an MBA from Harvard Business School and working at several investment banks, he returned to Russia in 1995 to work as CEO of the Russian branch of Credit Suisse First Boston. He also earned a PhD in Economics from the Russian Academy of Science. In 1998, he resigned from CSFB and accepted an offer from Mikhail Fridman to become CEO at Alfa Bank. He was very successful and due to his background in investment banking, Knaster established Pamplona Capital Management in 2004, in which the Alfa Group would invest some of its profit. He chose the name Pamplona after the Pamplona San-Fermin Festival which he attended after graduating from Harvard Business School. His investor pool has since grown beyond Alfa. As of 2013, Pamplona managed over $6.5 billion in assets of which $2.0 billion belongs to the Alfa Group. Knaster also serves as Executive Fellow, London Business School, member of faculty at Department of Strategy and Entrepreneurship.

Knaster is an active philanthropist, who has made significant contributions to different academic institutions, including Carnegie Mellon University and Harvard Business School, where he serves as a regional Campaign Leadership volunteer. In 1993, Knaster established the Alexander M. Knaster Scholarship Fund for undergraduates in the Department of Electrical and Computer Engineering at Carnegie Mellon University. In 2011, in partnership with fellow alumnus Bruce McWilliams, Knaster helped to establish the Knaster-McWilliams scholarships, which allow for increased access to faculty and early research opportunities in addition to tuition assistance. The Alexander M. Knaster Professorship in Mathematical sciences is named in his honor.

In 2014 Knaster established The Mark Foundation for Cancer Research. He has transferred the bulk of his assets to it and plans to develop it to become a leading global donor to early stage cancer research.

Knaster has also generously supported the Dana Farber Cancer Institute and the Dr. Maria I. New Children’s Hormone Foundation, which supports research, physician education, and the cost of care for children suffering from genetic hormonal disorders.