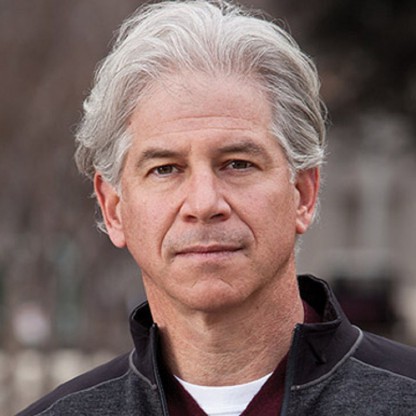

Age, Biography and Wiki

| Who is it? | Former CFO of Enron |

| Birth Day | December 22, 1961 |

| Birth Place | Washington, D.C., USA, United States |

| Age | 62 YEARS OLD |

| Birth Sign | Capricorn |

| Education | Tufts University, Northwestern University |

| Criminal charge | Conspiracy, wire fraud, securities fraud, false statements, insider trading, and money laundering |

| Criminal penalty | Six years, followed by two years of probation |

| Criminal status | Released December 17, 2011 |

| Spouse(s) | Lea Fastow |

Net worth: $1.5 Million (2024)

Andrew Fastow, the former CFO of Enron in the United States, is currently estimated to have a net worth of $1.5 million as of 2024. Fastow gained notoriety for his involvement in one of the most infamous corporate fraud cases in history. While serving as the chief financial officer of Enron, he played a pivotal role in concealing the company's financial distress and manipulating accounting practices to present a false image of success. Eventually, Enron collapsed in 2001, leading to significant financial losses for many employees and investors. As a result, Fastow faced legal consequences and was convicted of multiple charges, serving a prison sentence. Despite his troubled past, Fastow's current net worth reflects the aftermath of his actions and the penalties imposed upon him.

Biography/Timeline

Fastow graduated from Tufts University in 1983 with a B.A. in Economics and Chinese. While there, he met his Future wife, Lea Weingarten, daughter of Miriam Hadar Weingarten (a former Miss Israel 1958), whom he married in 1984. Fastow and Weingarten both earned MBAs at Northwestern University and worked for Continental Illinois National Bank and Trust Company in Chicago. Both he and his wife attended Congregation Or Ami, a conservative synagogue in Houston where he taught Hebrew School.

While at Continental Illinois, Fastow worked on the newly emerging "asset-backed securities". The practice spread across the industry "because it provides an obvious advantage for a bank", noted the Chicago Tribune. "It moves assets off the bank's balance sheet while creating revenue." In 1984, Continental became the largest U.S. bank to fail in American history until the seizure of Washington Mutual in 2008.

Deregulation in the US Energy markets in the late 1990s provided Enron with trade opportunities, including buying Energy from cheap producers and selling it at markets with floating prices. Andrew Fastow was familiar with the market and knowledgeable in how to play it in Enron's favor. This quickly drew the attention of then chief executive officer of Enron Finance Corp Jeffrey Skilling. Skilling, together with Enron founder Kenneth Lay, was constantly concerned with various ways in which he could keep company stock price up, in spite of the true financial condition of the company.

On October 31, 2002, Fastow was indicted by a federal grand jury in Houston, Texas on 78 counts including fraud, money laundering, and conspiracy. On January 14, 2004, he pleaded guilty to two counts of wire and securities fraud, and agreed to serve a ten-year prison sentence. He also agreed to become an informant and cooperate with federal authorities in the prosecutions of other former Enron executives in order to receive a reduced sentence.

Also in 2003, Bethany McLean and Peter Elkind wrote the book The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron ISBN 1-59184-008-2. In 2005, the book was made into a documentary film Enron: The Smartest Guys in the Room.

On May 6, 2004, his wife, Lea Fastow, a former Enron assistant treasurer, pleaded guilty to a tax charge and was sentenced to one year in a federal prison in Houston, and an additional year of supervised release. She was released to a halfway house on July 8, 2005.

In 2005, Kurt Eichenwald's Conspiracy of Fools features Fastow as the book's antagonist.

Prosecutors were so impressed with his performance that they ultimately lobbied for an even shorter sentence for Fastow. He was finally sentenced to six years at Oakdale Federal Correctional Complex in Oakdale, Louisiana. On May 18, 2011, Fastow was released to a Houston halfway house for the remainder of his sentence.

After entering into a plea agreement with a maximum penalty of 10 years in prison and the forfeiture of US$23.8 million in family assets, on September 26, 2006, Fastow was sentenced to six years, followed by two years of probation. U.S. District Judge Ken Hoyt believed Fastow deserved leniency for his cooperation with the prosecution in several civil and Criminal trials involving former Enron employees. Hoyt recommended that Fastow's sentence be served at the low-security Federal Correctional Institution in Bastrop, Texas. Fastow was incarcerated at the Federal Prison Camp near Pollock, Louisiana. Soon after his release on December 16, 2011, he began working as a document review clerk for a law firm in Houston. In March 2012, Fastow spoke on ethics to students at the University of Colorado Boulder Leeds School of Business. In June 2013, Fastow addressed more than 2,000 anti-fraud professionals at the Association of Certified Fraud Examiners' 24th Annual ACFE Global Fraud Conference. In April 2014, Fastow spoke at Miami University in Oxford, Ohio, regarding Business ethics. In February 2015, he spoke at the University of St. Thomas, the University of Minnesota, the University of Texas (Austin campus), the University of Houston Bauer College of Business, the University of Southern California's Leventhal School of Accounting, and the University of Missouri School of Accounting. In April 2016, March 2017, and March 2018 Fastow spoke at the Ivey Business School. The University of Tampa's Center for Ethics hosted Mr. Fastow in October of 2017. . April 11, 2018 he spoke at Fresno State in California.