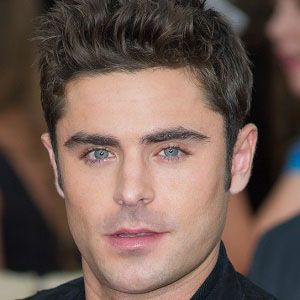

Age, Biography and Wiki

| Who is it? | Economist |

| Birth Day | April 23, 1899 |

| Birth Place | Klippan, Scania, Swedish |

| Age | 120 YEARS OLD |

| Died On | 3 August 1979(1979-08-03) (aged 80)\nÅre, Jämtland County |

| Birth Sign | Taurus |

| Prime Minister | Per Albin Hansson |

| Preceded by | Nils Hønsvald |

| Succeeded by | Sigurður Bjarnason |

| Political party | People's Party |

| Alma mater | B.A. Lund University (1917) MSc. Stockholm School of Economics (1919) M.A. Harvard University (1923) Ph.D. Stockholm University (1924) |

| Bertil OhlinKnown forAwardsFieldsInstitutionsDoctoral advisor | Bertil Ohlin Known for Heckscher–Ohlin model Heckscher–Ohlin theorem Awards Nobel Memorial Prize in Economic Sciences (1977) Scientific career Fields Economics Institutions University of Copenhagen (1925–1930) Stockholm School of Economics (1930–1965) Doctoral advisor Gustav Cassel Heckscher–Ohlin model Heckscher–Ohlin theoremNobel Memorial Prize in Economic Sciences (1977)Scientific careerEconomicsUniversity of Copenhagen (1925–1930) Stockholm School of Economics (1930–1965)Gustav Cassel |

| Known for | Heckscher–Ohlin model Heckscher–Ohlin theorem |

| Awards | Nobel Memorial Prize in Economic Sciences (1977) |

| Fields | Economics |

| Institutions | University of Copenhagen (1925–1930) Stockholm School of Economics (1930–1965) |

| Doctoral advisor | Gustav Cassel |

Net worth

Bertil Gotthard Ohlin, a renowned economist from Sweden, is projected to have a net worth ranging from $100,000 to $1 million in the year 2024. He is widely recognized for his significant contributions in the field of economics. Ohlin's expertise lies in international trade theory, where he developed the famous Heckscher-Ohlin model, which analyzes the impact of factors such as labor, capital, and resources on international commerce. With a wealth of knowledge and experience, Ohlin has undoubtedly earned his well-deserved reputation as a prominent economist.

Biography/Timeline

Having received his B.A. from Lund University 1917 and his MSc. from Stockholm School of Economics in 1919. He obtained an M.A. from Harvard University in 1923 and his doctorate from Stockholm University in 1924. In 1925 he became a professor at the University of Copenhagen. In 1929 he debated with John Maynard Keynes, contradicting the latter's view on the consequences of the heavy war reparations payments imposed on Germany. (Keynes predicted a war caused by the burden of debt, Ohlin thought that Germany could afford the reparations.) The debate was important in the modern theory of unilateral international payments.

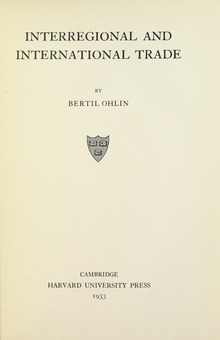

In 1930 Ohlin succeeded Eli Heckscher, his Teacher, as a professor of economics, at the Stockholm School of Economics. In 1933 Ohlin published a work that made him world-renowned, Interregional and International Trade. In this Ohlin built an economic theory of international trade from earlier work by Heckscher and his own doctoral thesis. It is now known as the Heckscher–Ohlin model, one of the standard model economists use to debate trade theory.

In 1937, Ohlin spent half a year at the University of California, Berkeley, as a visiting professor.

Ohlin was party leader of the liberal Liberal People's Party from 1944 to 1967, the main opposition party to the Social Democrat Governments of the era, and from '44 to '45 was minister of commerce in the wartime government. His daughter Anne Wibble, representing the same party, served as Minister of Finance from 1991 to 1994.

In 2009, a street adjacent to the Stockholm School of Economics was named after Ohlin: "Bertil Ohlins Gata".

The Heckscher–Ohlin Theorem, which is concluded from the Heckscher–Ohlin model of international trade, states: trade between countries is in proportion to their relative amounts of capital and labor. In countries with an abundance of capital, wage rates tend to be high; therefore, labor-intensive products, e.g. textiles, simple electronics, etc., are more costly to produce internally. In contrast, capital-intensive products, e.g. automobiles, chemicals, etc., are less costly to produce internally. Countries with large amounts of capital will export capital-intensive products and import labor-intensive products with the proceeds. Countries with high amounts of labor will do the reverse.

The theory does not depend on total amounts of capital or labor, but on the amounts per worker. This allows small countries to trade with large countries by specializing in production of products that use the factors which are more available than its trading partner. The key assumption is that capital and labor are not available in the same proportions in the two countries. That leads to specialization, which in turn benefits the country’s economic welfare. The greater the difference between the two countries, the greater the gain from specialization.