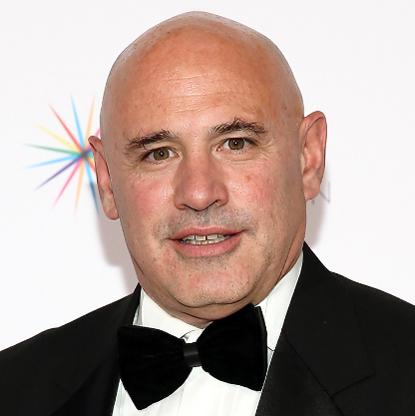

Age, Biography and Wiki

| Birth Place | Toronto, Canada, Canada |

| Type | Public |

| Traded as | TSX: BAM.A NYSE: BAM Euronext: BAMA S&P/TSX 60 component |

| Industry | Asset management |

| Founded | 1899 |

| Founder | William Mackenzie Frederick Stark Pearson |

| Headquarters | Brookfield Place Toronto, Ontario, Canada |

| Area served | Global |

| Key people | Frank McKenna, Chairman Bruce Flatt, CEO |

| Services | Financial services |

| Revenue | $24.4 bn (2016) |

| Operating income | $2,165 million (2016) |

| Net income | $3.3 billion (2016) |

| AUM | $239.825 billion (2016) |

| Total equity | $69.7 billion (2016) |

| Number of employees | 70,000 operating employees 700 investment professionals |

| Subsidiaries | Brookfield Residential Brookfield Property Partners Brookfield Infrastructure Partners Brookfield Renewable Partners Brookfield Business Partners |

| Website | www.brookfield.com |

Net worth: $2.7 Billion (2024)

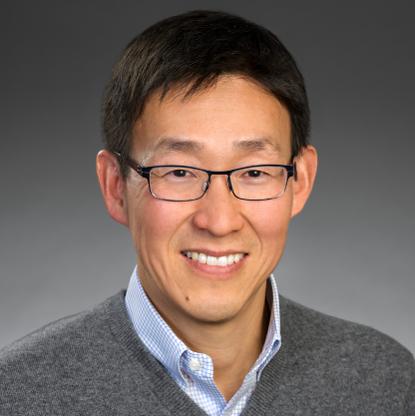

Bruce Flatt, a prominent figure in the field of finance and investments in Canada, is projected to have a net worth of $2.7 billion by 2024. As a highly successful entrepreneur and executive, Flatt has amassed considerable wealth through his strategic expertise in the world of finance. Co-founder and CEO of Brookfield Asset Management, Flatt has consistently proven his ability to navigate complex markets and deliver impressive returns. With his sharp business acumen and extensive experience in the industry, it is no surprise that his net worth continues to soar, cementing his status as one of Canada's most influential financial figures.

Biography/Timeline

In 1899 the São Paulo Railway, Light and Power Company was founded by william Mackenzie, Frederick Stark Pearson and others. (The word "Railway" would later be changed to "Tramway.")

In 1904 the Rio de Janeiro Tramway, Light and Power Company was founded by Mackenzie's group.

In 1916 Great Lakes Power Company Limited was incorporated to provide hydro-electric power in Sault Ste. Marie and the Algoma District in Ontario.

In 1969 Brazilian Light and Power Company Limited changes its name to Brascan Limited (BL)

In 1979 the company's Brazilian assets were transferred to Brazilian ownership (e.g., Eletropaulo and Light S.A. - now AES Eletropaulo), the company meanwhile having Diversified to other areas.

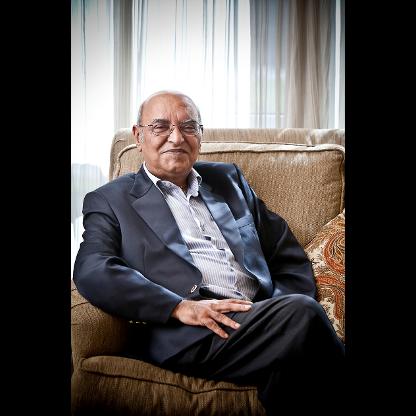

J. Bruce Flatt is senior managing partner and chief executive officer. Mr. Flatt was appointed to this position in February 2002 after having served as chief executive officer of Brookfield Properties since 2000. He was trained as an accountant at Clarkson, Gordon and Company, which is now part of Ernst & Young. As of fiscal year 2014, his basic compensation was $6.65 million.

In 2005, the company changed its name to Brookfield Asset Management (BAM). As part of a number of purchases in 2007, Brookfield acquired Multiplex for $6.1 billion and renamed it Brookfield Multiplex. In 2016 the company was re-branded as Multiplex. It also acquired Longview Fibre Company, expanding its timberland platform to 2.5 million acres (10,000 km²). In 2008, Brookfield Infrastructure Partners was spun out of the holding company, and subsequently merged with Australia's Prime Infrastructure in a $1 billion transaction.

The Birch Mountain class action lawsuit has consistently been dismissed, with judges finding in favour of Brookfield and against the plaintiffs. In a process supervised by the Alberta courts, PricewaterhouseCoopers (PwC) was appointed receiver of Birch Mountain Resources in November 2008 after Birch Mountain had defaulted on its debts. Birch Mountain’s assets were transferred to Tricap Partners Ltd, now operating under the Hammerstone Corporation, a subsidiary of Brookfield Special Situations Group, for approximately $50 million.

Also in 2010, Brookfield led a successful restructuring of General Growth Properties, the second largest owner of U.S. shopping malls, out of bankruptcy after rebuffing Simon Property Group's attempt to acquire GGP. In 2011, the company increased its share of General Growth Properties to 38%. By 2012, Brookfield's stake in GGP grew to 42% which prompted investor Activist william Ackman to request that GGP create a special committee unaffiliated with Brookfield to consider a sale to Simon. On Dec. 31, 2012, Pershing Square agreed to sell a portfolio of its stake in GGP to Brookfield and struck a four-year agreement to be a passive investor in the shopping mall company. By May, 2014 Pershing Square had sold all of its shares in GGP.

In July 2012, Brookfield and Spanish toll road operator Abertis announced plans to acquire a toll road network in Brazil. At the same time, Brookfield acquired full control of toll road assets in Chile. In December, 2012, Brookfield Renewable Energy Partners agreed to acquire a portfolio of 19 hydroelectric power stations in Maine from Nextera Energy Resources LLC for $760 million.

In August 2013, Brookfield Property Partners, acquired Industrial Developments International, an Atlanta-based owner of distribution facilities, from Japanese construction company Kajima Corp. in a $1.1 billion transaction.

In March 2014, Brookfield Renewable Energy acquired a portfolio of Irish wind farms for $680 million as part of a privatization by the Irish government.

In August, 2015, Brookfield Infrastructure bid approximately $6.6 billion for Australian rail, port and Logistics company Asciano Limited. The next year, Asciano's Patrick Container Terminals Business became owned by the Ports HoldCo joint venture which is controlled by Brookfield Infrastructure Partners, GIC Private Limited, British Columbia Investment Management Corporation, Qatar Investment Authority, and Qube Holdings Limited. The Patrick Bulk and Automotive Port Services Business became owned by Brookfield Infrastructure Partners, GIC Private Limited, British Columbia Investment Management Corporation, and Qatar Investment Authority, changing its name to LINX Cargo Care Group.

In April 2017, the company announced an agreement to purchase 100% of the gas station operations of Loblaw Companies, Canada’s largest retailer.

Brookfield’s private equity arm, Brookfield Capital Partners, acquired a number of industrial companies, including GrafTech International, North American Palladium and Armtec.