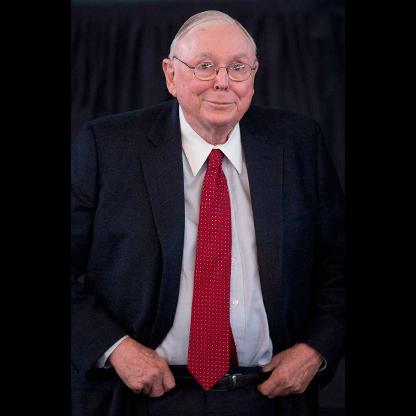

Age, Biography and Wiki

| Who is it? | Vice Chairman, Berkshire Hathaway |

| Birth Day | January 01, 1924 |

| Birth Place | Los Angeles, California, United States |

| Age | 99 YEARS OLD |

| Birth Sign | Aquarius |

| Alma mater | University of Michigan California Institute of Technology Harvard University |

| Occupation | Vice Chairman, Berkshire Hathaway |

| Known for | Leading investments at Berkshire Hathaway with Warren Buffett |

| Salary | US$100,000 |

Net worth: $2.2 Billion (2024)

Charles Munger, the esteemed Vice Chairman of Berkshire Hathaway in the United States, is estimated to have a net worth of $2.2 billion in 2024. Munger has made a significant impact on the world of finance and investment, alongside his longtime business partner Warren Buffett. With his astute business acumen and sharp intellect, Munger has played an integral role in the success of Berkshire Hathaway, contributing to the company's impressive growth over the years. As a highly respected figure in the financial industry, his net worth serves as a testament to his immense achievements and contributions to the business world.

Famous Quotes:

...the system is responsible in proportion to the degree that the people who make the decisions bear the consequences. So to Charlie Frankel, you don’t create a loan system where all the people who make the loans promptly dump them on somebody else through lies and twaddle, and they don’t bear the responsibility when the loans are good or bad. To Frankel, that is amoral, that is an irresponsible system.

Biography/Timeline

After enrolling in the University of Michigan, where he studied mathematics, he never returned to Omaha except to visit. In early 1943, a few days after his 19th birthday, he dropped out of college to serve in the U.S. Army Air Corps, where he became Second Lieutenant. He continued his studies in meteorology at Caltech in Pasadena, California, the town he was to make his home.

Through the GI bill he took a number of advanced courses through several universities; without an undergraduate degree, he entered Harvard Law School and graduated magna cum laude with a J.D. in 1948. At Harvard he was a member of the Harvard Legal Aid Bureau.

Although Munger is better known for his association with Buffett, he ran an investment partnership of his own from 1962 to 1975. According to Buffett's essay, "The Superinvestors of Graham-and-Doddsville", published in 1984, Munger's investment partnership generated compound annual returns of 19.8% during the 1962–75 period compared to a 5.0% annual appreciation rate for the Dow.

In addition to the University of Michigan, Munger and his late wife Nancy B. Munger have been major benefactors of Stanford University. Nancy Munger was an alumna of Stanford, and Wendy Munger, Charlie Munger's daughter from a previous marriage, was also an alumna (A.B. 1972). Both Nancy and Wendy Munger served as members of the Stanford board of trustees. In 2004, the Mungers donated 500 shares of Berkshire Hathaway Class A stock, then valued at $43.5 million, to Stanford to build a graduate student housing complex.

During a talk at Harvard in 1995 entitled The Psychology of Human Misjudgment, Munger mentions Tupperware parties and open outcry auctions, where he explained "three, four, five of these things work together and it turns human brains into mush," meaning that normal people will be highly likely to succumb to the multiple irrational tendencies acting in the same direction. In the Tupperware party, you have reciprocation, consistency and commitment tendency, and social proof. (The hostess gave the party and the tendency is to reciprocate; you say you like certain products during the party so purchasing would be consistent with views you've committed to; other people are buying, which is the social proof.) In the open outcry auction, there is social proof of others bidding, reciprocation tendency, commitment to buying the item, and deprivation super-reaction syndrome, i.e. sense of loss. The latter is an individual's sense of loss of what he believe should be or is his. These biases often occur at either conscious or subconscious level, and in both microeconomic and macroeconomic scale.

In 1997, the Mungers donated $1.8 million to the Marlborough School in Los Angeles, of which Nancy Munger was an alumna. The couple also donated to the Polytechnic School in Pasadena and the Los Angeles YMCA.

Munger is a major benefactor of the University of Michigan. In 2007, Munger made a $3 million gift to the University of Michigan Law School for lighting improvements in Hutchins Hall and the william W. Cook Legal Research Building, including the noted Reading Room. In 2011, Munger made another gift to the Law School, contributing $20 million for renovations to the Lawyers Club housing complex, which will cover the majority of the $39 million cost. The renovated portion of the Lawyers Club will be renamed the Charles T. Munger Residences in the Lawyers Club in his honor.

Munger has been a trustee of the Harvard-Westlake School in Los Angeles for more than 40 years, and previously served as chair of the board of trustees. His five sons and stepsons as well as at least one grandson graduated from the prep school. In 2009, Munger donated eight shares of Berkshire Hathaway Class A stock, worth nearly $800,000, to Harvard-Westlake. In 2006, Munger donated 100 shares of Berkshire Hathaway Class A stock, then valued at $9.2 million, to the school toward a building campaign at Harvard-Westlake's middle school campus. The Mungers had previously made a gift to build the $13 million Munger Science Center at the high school campus, a two-story classroom and laboratory building which opened in 1995 and has been described as "a science teacher's dream". The design of the Science Center was substantially influenced by Munger.

Munger states that high ethical standards are integral to his philosophy; at the 2009 Wesco Financial Corporation annual meeting he said, "Good businesses are ethical businesses. A Business model that relies on trickery is doomed to fail." During an interview and Q&A session at Harvard-Westlake School on January 19, 2010, Munger referred to American Philosopher Charles Frankel in his discussion on the financial crisis of 2007–08 and the philosophy of responsibility. Munger explained that Frankel believed:

On December 28, 2011, Munger donated 10 shares of Berkshire Hathaway Class A stock (currently valued at $202,285 per share, or $2.02 million total) to the University of Michigan.

On April 18, 2013, the University of Michigan announced the single largest gift in its history: a US$110 million gift from Munger to fund a new "state of the art" residence designed to foster a community of scholars, where graduate students from multiple disciplines can live and exchange ideas. The gift includes US$10 million for graduate student fellowships.

In October 2014, Munger announced that he would donate $65 million to the Kavli Institute for Theoretical Physics at the University of California, Santa Barbara. This is the largest gift in the history of the school. The donation will go toward the construction of a residence building for visitors of the Kavli Institute in an effort to bring together physicists to exchange ideas as Munger stated,"to talk to one another, create new stuff, cross-fertilize ideas".

In March 2016, Munger announced a further $200 million gift to UC Santa Barbara for state of the art student housing, tripling the record gift he gave for the Kavli Institute for Theoretical Physics.

As of February 2018, Munger has an estimated net worth of $1.74 billion according to Forbes Magazine.