Age, Biography and Wiki

| Who is it? | Founder and Partner, Lowercase Capital |

| Birth Day | May 12, 1975 |

| Birth Place | Lockport, New York, United States, United States |

| Age | 48 YEARS OLD |

| Birth Sign | Gemini |

| Education | B.A. and J.D. Georgetown University, University at Buffalo |

| Occupation | Proprietor of Lowercase Capital |

Net worth: $1.1 Billion (2024)

Chris Sacca's net worth is projected to reach an impressive $1.1 billion by the year 2024. Widely recognized as the founder and partner of Lowercase Capital, a prominent venture capital firm based in the United States, Sacca has made a significant impact in the investment world. With a keen eye for identifying promising startups, Sacca has amassed his fortune by investing in numerous successful companies, including Airbnb, Twitter, and Instagram, among others. Through his expertise and strategic investments, Sacca has solidified his position as one of the most influential and affluent figures in the business and technology sectors.

Famous Quotes:

"I get close to people easily. But do something to me, I will light that bridge on fire."

Biography/Timeline

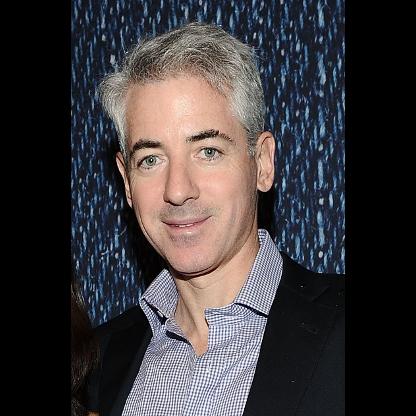

Chris Sacca was born on May 12, 1975 and raised in a suburb of Buffalo. His Father was an attorney, while his mother was a professor at SUNY Buffalo State. Sacca is of Irish and Italian descent, with family originating from Calabria, Italy. Sacca's parents exposed him to a variety of interests, and he recalls being pulled out of school to attend science museums and book-readings.

Sacca attended The Edmund A. Walsh School of Foreign Service at Georgetown University in Washington, D.C. He spent semesters abroad at the Pontificia Universidad Católica del Ecuador in Quito, Ecuador, University College Cork, in Cork, Ireland, and the Universidad Complutense in Madrid, Spain. He graduated in 1997 cum laude with a B.S. in foreign Service and was an Edmund Evans Memorial Scholar as well as a Weeks Family Foundation Scholar. He was a member of The Tax Lawyer law review and was honored as the school's Philip A. Ryan and Ralph J. Gilbert Memorial Scholar. He recalls that he managed to graduate without attending class, obtaining class notes, by throwing an annual keg party where entry required classmates to dump their notes in a bin. He graduated from Georgetown University with a Juris Doctor cum laude in law and Technology in 2000.

Sacca used his student loans to start a company during law school, and when the venture proved unsuccessful he used the remaining funds to start trading on the stock market. By leveraging trades for significant amounts (discovering a flaw in the software of online trading brokers in 1998) he managed to turn $10–20 thousand dollars into $12 million by 2000. Eventually, when the market crashed, Sacca found himself in debt with a four million dollar negative balance. He negotiated to have it reduced to $2.125 million and had repaid it by February 2005.

In 2000 Sacca began his career as an associate at Fenwick & West in Silicon Valley where he handled venture capital, mergers, acquisitions, and licensing transactions for Technology clients including Macromedia, VeriSign, and Kleiner Perkins. Laid off in September 2001, after approximately 13 months he spent the next few years attending networking events and ‘surviving’ in Silicon Valley by drafting contracts and doing voice over work as a freelancer. Creating the consulting firm The Salinger Group for networking purposes, he eventually landed at Speedera Networks. At Speedera he held a number of executive roles and was responsible for legal and corporate development efforts,helping fend off continual lawsuits from corporate rival Akamai.

In November 2003 Sacca was hired at Google as Corporate Counsel, where he reported to General Counsel David Drummond. As part of the legal and Business development team, his first mandate was to find large amounts of data space, by negotiating and signing agreements around the world. Sacca served as Head of Special Initiatives at Google Inc. leading the alternative access and wireless divisions. Among his projects were the 700 MHz and TV white spaces spectrum initiatives, Google's data center in Oregon, and the free citywide WiFi network in Mountain View, California. Sacca also led many of Google's Business development and mergers and acquisitions transactions and was on the founding team of the company's New Business Development organization. He was among the first Google employees given the Founders’ Award, the company's highest honor.

Sacca has stated that a turning point in his angel investing was in 2007, when he moved to the town of Truckee in the mountains close to Lake Tahoe. Entrepreneurs including Travis Kalanick and Sacca would spend hours discussing ideas at the residence, and Sacca eventually bought the house next door to host various visiting entrepreneurs. When money began to run low Sacca raised a new fund with Investors such as Brad Feld, Marissa Mayer, Eric Schmidt, and J P Morgan Chase's Digital Growth Fund.

Sacca worked for Barack Obama's 2008 presidential campaign as a Telecommunications, Media, and Technology advisor and campaign surrogate, as well as a field office volunteer. Following Obama's victory, Sacca served as co-chair of Finance for the Presidential Inaugural Committee. During Obama's successful 2012 reelection campaign, Sacca served as a member of the campaign's National Finance Committee member and as co-chair of the "Tech for Obama" group. During the 2016 U.S. Presidential election, Sacca was a vocal supporter of Democratic Nominee Hillary Clinton, appearing in various fundraisers around the country. He spoke against Trump, and in response to President Donald Trump's 2017 executive order banning travel from seven predominantly Muslim nations, Sacca donated $150,000 in matching donations to ACLU.

Through 2009 he invested in companies such as Kickstarter, Twilio and Lookout. Sacca opened a new $1 billion investment fund in the summer of 2010, and later that year the fund began to buy large blocks of shares from Twitter stockholders, deepening Sacca's position in the company. By February 2011 Sacca's funds had purchased about $400 million worth of Twitter shares, giving it "a stake of roughly 9 percent." When Twitter went public in late 2013, Sacca's affiliated funds owned almost 18% of the company, raising the value of Sacca's investment in the company to around $1 billion.

Sacca founded Lowercase Capital LLC in Truckee, California in 2010 when he closed his Lowercase Ventures Fund I, an $8.4 million seed fund, in 2010, with Investments in Uber, Docker, Optimizely, StyleSeat, Instagram, and Twitter. Lowercase provides capital and advisory services to start-ups and late-stage companies in Technology and media. Lowercase also has some non-tech-related companies in its portfolio, including Blue Bottle Coffee Company and a high-end restaurant in Truckee. Without the corporate backup funding available to many venture capitalists, Sacca became very involved in his portfolio companies on a personal level. He attended meetings at Twitter and Uber, and he negotiated the rights for Uber.com fromUniversal Music Group when the company changed its name from Uber Taxi. Although not on Twitter's payroll, he "served as a crucial adviser during its formative years and worked closely with its early employees."

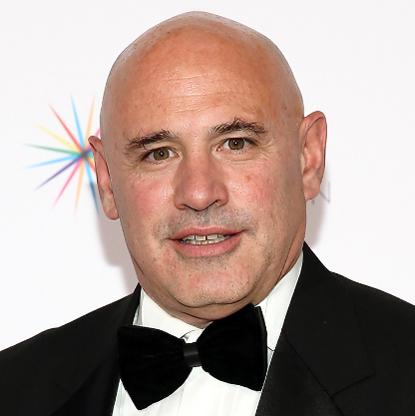

Sacca brought in Matt Mazzeo to Lowercase Capital as a partner in 2013, with Mazzeo heading a new early-stage fund, Lowercase Stampede, out of Los Angeles. Mazzeo had worked at Creative Artists Agency (CAA), an entertainment and Sports agency. Sacca had a 4% stake in Uber by March 2015, and Lowercase was "sitting on" Investments in Stripe, Lookout and WordPress parent Automattic. Forbes estimated that Sacca was personally worth $1.2 billion. By that time the value of his first Twitter fund, Lowercase Industry, had reached 1,500% of its original value, and his Twitter deals overall had "returned $5 billion to Investors." Also in 2015, Forbes said that Sacca had built "the best seed portfolio in history" with funds such as his Lowercase Ventures Fund I, which had Investments in companies such as Twitter, Instagram, and Uber. Fortune had also labeled Lowercase as one of the most successful venture capital funds in history.

In 2015, Sacca was featured on the cover of Forbes magazine listed as number 3 on its Midas list. In 2017, he was listed as number 2 on the Midas List Top 20.

Lowercase Capital had an investment portfolio of around 80 startups and a variety of more mature companies by 2017, including Medium and Uber. Sacca was fully divested from Twitter by 2017. That April, Sacca announced that he was retiring from venture investing and along with it his role on Shark Tank, saying he was "two years late" on his plan to retire at 40 years old. He said his firm would continue to support its portfolio companies, but would not take on any new Investments or raise more money from Investors.

Sacca regularly speaks about venture capital and investing in media. He has been characterized an expert by Business Week, Fortune magazine, CNBC, the BBC, CNN, Fox and NPR. Also, Sacca’s interview during the initial Startup podcast inspired the pilot episode of the ABC television version of Start Up starring Zach Braff with Sacca to play himself.