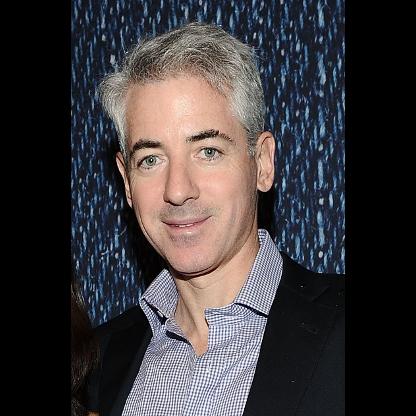

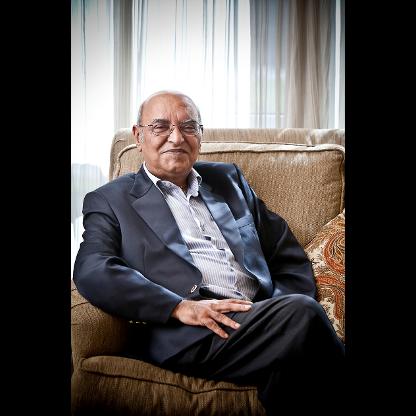

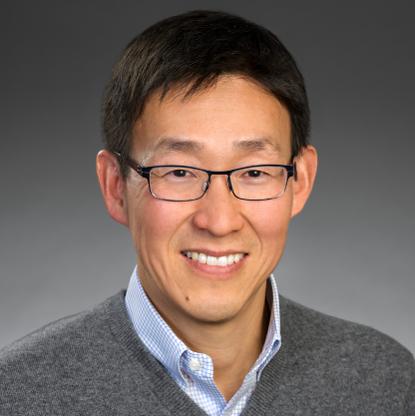

Age, Biography and Wiki

| Who is it? | AQR Capital Management |

| Birth Day | October 17, 1966 |

| Birth Place | Greenwich, Connecticut, United States |

| Age | 57 YEARS OLD |

| Birth Sign | Scorpio |

| Alma mater | University of Pennsylvania University of Chicago Booth School of Business |

| Employer | AQR Capital Management Goldman Sachs |

| Spouse(s) | Laurel Elizabeth Fraser |

| Parent(s) | Carol Asness Barry Asness |

Net worth: $1.6 Billion (2024)

Clifford Asness, the renowned finance executive, is projected to have a net worth of $1.6 billion by 2024. As the founder of AQR Capital Management, an esteemed investment firm based in the United States, he has successfully built a reputation as a skilled investor and fund manager. Having been in the industry for several years, his exceptional expertise and strategic approach have not only garnered him substantial personal wealth but have also cemented his position as a leading figure in the financial world. With his notable accomplishments, Clifford Asness continues to shape the investment landscape and inspire aspiring entrepreneurs in the field.

Biography/Timeline

After completing his PhD, Asness accepted a job with Goldman Sachs as managing Director and Director of quantitative research for Goldman Sachs Asset Management. At Goldman, he founded the Goldman Sachs Global Alpha Fund, a systematic trading hedge fund and one of the earliest "quant vehicles" in the industry. The fund used complicated computerized trading Models to first locate underpriced equities, bonds, currencies, and commodities and then use short selling to take advantage of upward or downward price momentum. The fund was designed to make money regardless of the direction the market was moving. In 1997 he left to found AQR Capital Management.

In 1999, Asness married Laurel Elizabeth Fraser of Seward, Nebraska, the daughter of a retired Methodist pastor. Asness has four children.

He is known for taking some outspoken contrarian stances, like in calling out the tech bubble (Bubble Logic, 2000) and those who claimed options should not be expensed (Stock Options and the Lying Liars Who Don't Want to Expense Them, 2004). He is also known as an outspoken critic of U.S. President Barack Obama. Two tracts he authored protest the Obama administration's treatment of Chrysler senior bondholders.

Asness' dissertation, in opposition to his mentor, asserted that profits consistently beating market averages were attainable by exploiting both value and momentum; in his context, value means using fundamental analysis to assess the true worth of a security and momentum means betting that it will continue to go up or down as it has in the recent past. Neither idea was original with Asness but he was credited with being the first to compile enough empirical evidence across a wide variety of markets to bring the ideas into the academic financial mainstream. However, the strategy for accumulation is subject to the same constraints as any other and systemic effects in markets can invalidate it: AQR and other similar ventures lost massive amounts of wealth in the Financial crisis of 2007-2010 with assets declining from $39 billion in 2007 to $17 billion by the end of 2008.

In 2008, he complained about short-selling restrictions in The New York Times. In a 2010 Wall Street Journal op-ed (written with Aaron Brown) he claimed the Dodd-Frank financial reform bill would lead to regulatory capture, crony capitalism and a massive "financial-regulatory complex." In Bloomberg columns, he discussed taxation of investment managers and Health care reform. He posts commentary on financial issues, generally from a libertarian and efficient markets viewpoint.

In 2012, he was included in the 50 Most Influential list of Bloomberg Markets Magazine.

In 2013, Asness was a signatory to an amicus curiae brief submitted to the Supreme Court in support of same-sex marriage during the Hollingsworth v. Perry case.

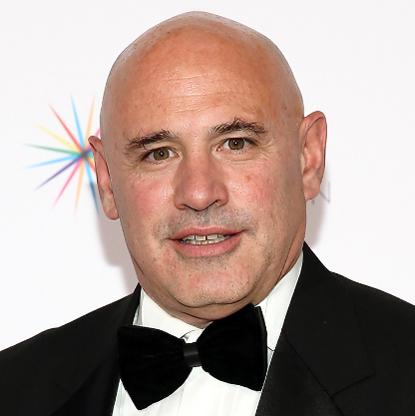

Asness’s younger brother, Bradley David Asness, is Chief Operating Officer at AQR.