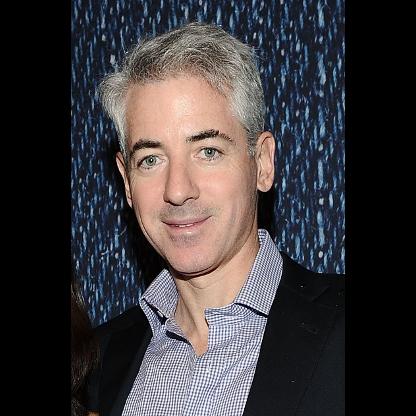

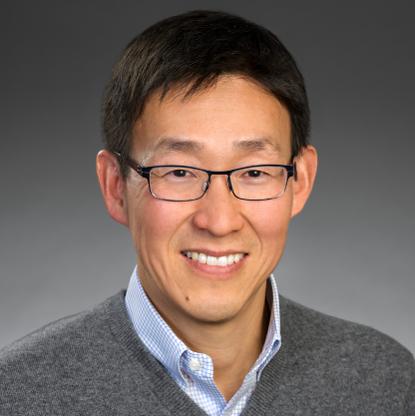

Age, Biography and Wiki

| Who is it? | Founder, Third Point |

| Birth Day | December 18, 1961 |

| Birth Place | New York, New York, United States |

| Age | 62 YEARS OLD |

| Birth Sign | Capricorn |

| Residence | New York City, New York, U.S. |

| Alma mater | University of California, Berkeley Columbia University |

| Occupation | Investor, hedge fund manager, and philanthropist |

| Known for | Founding and leading Third Point Management |

| Spouse(s) | Margaret Davidson Munzer (m. 2004) |

| Children | 3 |

Net worth: $3.5 Billion (2024)

Daniel Loeb, the renowned founder of Third Point in the United States, is anticipated to have a net worth of $3.5 billion by 2024. Loeb's incredible success as a hedge fund manager and activist investor has propelled him to great heights within the financial industry. With his astute investment strategies and knack for identifying undervalued companies, Loeb has consistently delivered impressive returns for his clients and himself. As the head of Third Point, he continues to navigate the complexities of the market and generate substantial wealth, further solidifying his reputation as a prominent figure in the world of finance.

Famous Quotes:

Loeb is well known in Hedgeworld for his attacks on what he views as greedy execs who also happen to be depressing shareholder value. Of shares he owns. "The moral-indignation business", Loeb sometimes calls it. "Hedge-fund guys love to read Loeb's attacks; 'he articulates what people feel', says one."

Biography/Timeline

From 1984-87, Loeb worked at private equity firm Warburg Pincus. He then worked as Director of corporate development at Island Records, a record label, where he focused on securing debt financing. After Island Records, Loeb worked as a risk arbitrage analyst at Lafer Equity Investors and then, from 1991-94, as senior vice-president in the distressed debt department at Jefferies LLC, where he focused on bankruptcy analysis, trading bank loans and selling distressed securities. He moved on to become a Citigroup vice President from 1994–95, in charge of high-yield bond sales.

Loeb started Third Point Management in 1995 "with $3.3 million from family and friends". Under Loeb's guidance, Third Point Management’s annualized returns since inception (Dec. 1996 – Dec. 2015) total approximately +16.2%. In 2012, the firm returned +21.2%, outperforming the S&P 500's return of +16.0% and making it one of best performing hedge funds that year. In 2013, the firm returned +25.2%, while the S&P 500 returned +32.4%. Loeb appeared in Forbes' 2013 list of the world's 40 richest hedge-fund managers and traders. In 2014, the firm returned +5.7%, while the S&P 500 returned +13.7%. In 2015, the firm returned -1.4%, while the S&P 500 returned +1.4%. In 2017, it was reported the firm returned 18.1% net of fees in the first 11 months of the year.

He endowed the Daniel S. Loeb Scholarship for undergraduate study at Columbia University. Since 2004, he has been a trustee of Prep for Prep, an organization in New York City that prepares underprivileged children to attend competitive private schools. He is active in the Jewish Enrichment Center, which provides young people with an education in Judaism. Additionally, he is a co-founder of Students First New York, the state branch of the national education advocacy organization.

A 2005 New York Times article reported that many hedge-fund managers were now writing letters to the SEC demanding executives take specific actions and cited Loeb's letter to Sevin as exemplary of the genre, noting that three weeks after the letter was sent, "Sevin was gone, and a jubilant Mr. Loeb sent out an e-mail message to friends and associates declaring a 'huge victory for Third Point.'"

In January 2007, when John Higgins became CEO of Ligand Pharmaceuticals, Loeb bought into the biotech firm to cut its losses and grow revenue. Loeb invested $50 million, increased the company’s profit to $250 million, and bought back $68 million in stock.

In 2011, 2012, and 2013, Loeb and his wife made significant donations to the Alzheimer's Drug Discovery Foundation (ADDF), which funds over 400 Alzheimer's drug discovery programs in academic centers and biotechnology companies in 18 different countries.

On May 3, 2012, Loeb revealed that the new CEO of Yahoo!, Scott Thompson, did not have a computer science degree, as had been commonly assumed for many years. Thompson resigned on May 13, 2012. Reuters then announced that Loeb, Wilson and Wolf would become members of the Yahoo! board.

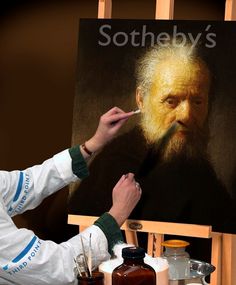

He is a prominent art collector and the walls at his Park Avenue office are covered with paintings", according to a New York Times August 26, 2013 article. At a Sotheby's auction in 2009, Manhattan dealer Larry Gagosian purchased Jeff Koons' Baroque Egg With Bow (Turquoise/Magenta) for $5.4 million from Loeb, who had bought it from the Gagosian Gallery in 2004 for about $3 million.

On February 20, 2014, Loeb attended a discussion between the American Enterprise Institute and the Dalai Lama. The two worldviews debated the morality of capitalism and free enterprise. In Loeb's presentation, he said he practices Ashtanga yoga and applies yoga principles to his Business and his decision-making. He noted that these principles aided in his decision to donate to a charter school in the Bronx, which is now ranked third in the state of New York.

In 2015, Loeb, Paul Singer and Tim Gill helped fund Freedom For All Americans to promote LGBT issues in states and local communities in the United States.

In April 2016, Loeb won a battle in his drive to shake up corporate Japan who had "been sheltered from agitating Investors." Seven & I Holdings Co.'s board was planning to replace Ryuichi Isaka as head of the company however, Loeb recommended Isaka as a successor to Toshifumi Suzuki, chairman and chief executive. On April 7, Suzuki resigned after losing a boardroom dispute with Loeb. Loeb wrote in a March 27, 2016 letter to Seven & I Directors, "Mr. Isaka should be rewarded—not demoted—for his performance and commitment to delivering results for shareholders... This isn’t a dynasty. This is a corporation." Loeb has pushed for the company to focus on its convenience store line while ridding its plans to expand its department and supermarket store franchises.

In June 2017, Third Point disclosed its ownership of approximately 40 million shares of Nestlé, making it the company's sixth-largest shareholder according to Standard & Poor’s Global Market Intelligence.

According to Forbes Magazine, his net worth is $3.2 billion USD as of February 16, 2018.