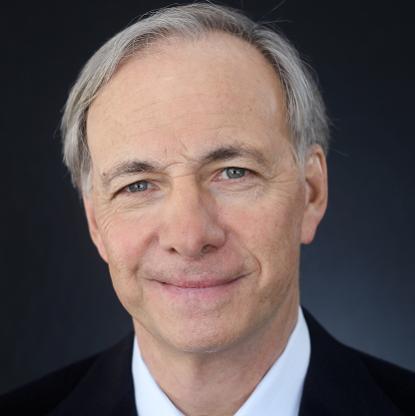

Age, Biography and Wiki

| Who is it? | President and Founder, Appaloosa Management |

| Birth Day | September 11, 1957 |

| Birth Place | Miami Beach, Florida, United States |

| Age | 66 YEARS OLD |

| Birth Sign | Libra |

| Alma mater | University of Pittsburgh (A.B.) Carnegie Mellon University (M.B.A.) |

| Occupation | Investor, hedge fund manager, and philanthropist |

| Known for | Founding and managing the funds of Appaloosa Management |

| Spouse(s) | Marlene Tepper (m. 1986; div. 2014) |

| Children | 3 |

Net worth: $18.5 Billion (2024)

David Tepper, renowned as the President and Founder of Appaloosa Management in the United States, is a highly successful figure in the world of hedge funds. As of 2024, his net worth is estimated to be an astonishing $18.5 billion, solidifying his position as one of the wealthiest individuals in the finance industry. Over the years, Tepper has made astute investment decisions, enabling him to accumulate immense wealth and establish himself as a prominent figure in the industry. His expertise and strategic insights have earned him immense respect within the financial community, making him a significant force to be reckoned with.

Famous Quotes:

I am the animal at the head of the pack. I generally am. I either get eaten or I get the good grass.

Biography/Timeline

He graduated from the University of Pittsburgh in 1978 with a bachelor's degree in economics. He also earned his MBA (then known as an MSIA) from Carnegie Mellon in 1982. In 2013, he donated his largest gift of $67 million to Carnegie Mellon University, whose Tepper School of Business is named after him.

After graduation he entered the Finance industry, working for Equibank as a credit analyst in the treasury department. In 1980, unsatisfied with this position, he enrolled at Carnegie Mellon University's Business school to pursue its then version of an MBA, a Master of Science in Industrial Administration (MSIA).

After earning his MBA in 1982, Tepper accepted a position in the treasury department of Republic Steel in Ohio.

In 1984, he was recruited to Keystone Mutual Funds (now part of Evergreen Funds) in Boston, and in 1985, Tepper was recruited by Goldman Sachs, which was forming its high yield group. He joined the firm in New York City as a credit analyst. Within six months, Tepper became the head trader on the high-yield desk at Goldman where he worked for eight years. His primary focus was bankruptcies and special situations. He left Goldman in December 1992 and started Appaloosa Management in early 1993.

In 1986, he married Marlene Resnick Tepper; they have three children: Brian, Randi, and Casey. In 2014, several media outlets reported that he separated from his wife.

In 2001, he generated a 61% return by focusing on distressed bonds, and in the fourth quarter of 2005 he pursued what he saw as better opportunities in Standard & Poor's 500 stocks. He makes significant gains year after year by “investing in the diciest of companies,” such as MCI and Mirant. Investments in Conseco and Marconi also led to huge profits for the company’s hedge funds while Tepper “keeps the market on edge.”

On March 19, 2003, Tepper announced that he would make a single donation of $55 million to Carnegie Mellon University's Business school (then called the Graduate School of Industrial Administration—GSIA). This donation was made after he had been encouraged by Kenneth Dunn, his former professor (who became dean of the school). Tepper accepted the suggestion but made the contribution a “naming gift” and suggested that the school's name be changed to the David A. Tepper School of Business. Further, in November 2013, Carnegie Mellon announced a $67 million gift from Tepper to develop the Tepper Quadrangle on the north campus. The Tepper Quad will include a new Tepper School of Business facility across the street from the Heinz College as well as other university-wide buildings and a welcome center which will serve as a public gateway to the university. This brings Tepper's total gift to Carnegie Mellon to $125 million.

In 2006, Tepper donated $1 million to United Jewish Communities of MetroWest New Jersey toward their Israel Emergency Campaign.

Tepper serves as a member of the Business board of advisors for the Tepper School of Business at Carnegie Mellon and serves on various boards and committees for charitable and community organizations in New York and New Jersey. On September 25, 2009, Tepper purchased a 5% stake in the Pittsburgh Steelers.

In March 2012, Tepper and his former colleague, Alan Fournier founded a political action group, Better Education For Kids. "Better Education for Kids is entering the fray as private organizations are poised to play a larger role in education in New Jersey. Christie wants more charter schools, and he’s pushing legislation that would allow private companies to take over struggling public schools. According to the NJ Star Ledger on June 24, 2011, "Last week, the fledgling group launched a $1 million campaign to advertise its mission and solicit donations. Unlike traditional non-profits, Better Education for Kids is a type of non-profit not required to disclose its donors. Though the group cannot formally coordinate its work with lawmakers, it will be advised by two of the state’s top political consultants: mike DuHaime, a Republican strategist with close ties to Christie, and Jamie Fox, a Democrat who served as former Gov. James E. McGreevey’s chief of staff."

Tepper contributed $10,400 to the 2013 Jersey City Mayoral Candidate, Steve Fulop. According to the Jersey Journal on October 24, 2012, "David Tepper, the Billionaire who supports tenure reform and charter schools, contributed $10,400 to Fulop's council candidates, while Tepper's wife gave the team an additional $10,400." Fulop's former campaign manager Shelley Skinner became the Deputy Director of Tepper's non-profit Better Education for Kids.

In 2014, and in 2017 Forbes listed Tepper as one of the 25 highest-earning hedge fund managers in 2013 and 2016 respectively.

Tepper supported the 2016 Jeb Bush presidential campaign.

According to Forbes, Tepper has a net worth of $11.4 billion as of February 2017. The Bloomberg Billionaires Index ranked him as the wealthiest person in New Jersey.