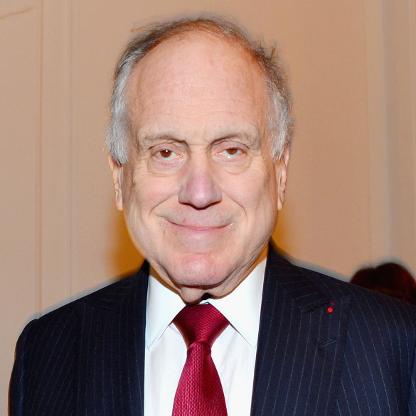

Age, Biography and Wiki

| Who is it? | Owner, Selfridges Group |

| Birth Day | October 29, 1940 |

| Birth Place | Toronto, Canada, Canada |

| Age | 83 YEARS OLD |

| Birth Sign | Scorpio |

| Alma mater | University of Western Ontario |

| Known for | Executive Chairman of George Weston Limited and Chairman The W. Garfield Weston Foundation |

| Spouse(s) | Hilary Weston |

| Children | Galen Weston Jr. Alannah Weston |

| Relatives | W. Garfield Weston (father) George Weston (grandfather) |

Net worth: $7 Billion (2024)

Galen Weston, the renowned owner of Selfridges Group in Canada, is expected to have a staggering net worth of $7 billion by 2024. With his abundant wealth, Weston has established himself as a prominent figure in the business world. Serving as the owner of Selfridges Group, which encompasses several luxury department stores, including the renowned Selfridges & Co in the UK, he has played a pivotal role in shaping the retail and fashion industry. Galen Weston's incredible net worth is a testament to his remarkable entrepreneurial skills and his ability to navigate the ever-evolving market.

Famous Quotes:

Southern Ireland in the early Sixties, in terms of growth, was where the real opportunities existed. The population was coming to Dublin, the European Community was becoming more and more aware of Ireland. Lemass was beginning to take a different perspective upon capital coming into the country and it looked like there was going to be a major opportunity for growth.

Biography/Timeline

Weston was born to Reta and W. Garfield Weston at Marlow, Buckinghamshire, near London, in October 1940 – the youngest of nine children. Garfield, a Canadian businessman whose Father George Weston established George Weston Limited, had successfully expanded overseas during the 1930s by acquiring and modernising biscuit and bread factories throughout the United Kingdom. In 1945, Weston and family returned to Canada but moved frequently as Garfield pursued various Business ventures, which included supermarket chains in North America and Europe. Growing up, Weston worked in the stores that comprised his father's Retail holdings. He once noted, "I've been a bag boy a thousand times in five languages."

In 1961, after studying Business administration at Huron University College at the University of Western Ontario, Weston moved to Dublin to set up a grocery store with his own money. A second location followed and the outlets evolved into the Powers chain of supermarkets. Weston found the Republic of Ireland a land of opportunity:

By 1965, Weston’s Business had grown to six grocery stores. Four years later, he expanded his Business interests with the purchase of a bankrupt department store Todd Burns which he renamed Penneys. Within a year, four more stores opened, all with a similar discount format. Two years later, the first Penneys outside of Dublin was launched, followed by eleven more stores, including one in Northern Ireland. Meanwhile, Weston married Hilary Frayne, one of Ireland’s top fashion Models, in 1966. In the early Seventies, Weston expanded his grocery holdings with the acquisition of competitor Quinnsworth. Weston also purchased an interest in Brown Thomas, the upscale Dublin department store, and eventually acquired full ownership in 1984.

Well into the 1970s, the company continued to sell assets to shore up its balance sheet. In 1978, both Loblaw and George Weston Limited returned to profitability and in 1980 Weston’s showed record earnings of $76 million on sales of $6 billion.

In 1971, Weston was asked by Garfield Weston, Chairman of George Weston Limited, to take a look at Loblaws, the company’s Ontario-based supermarket chain, which appeared headed for bankruptcy. He found a company deeply in debt with too many small, aging outlets, and a market share recently cut in half. "The big question then was should this chain be closed up or should we make the enormous investment in money and time to return it to its former place ... I felt that from a Retailing standpoint Loblaws was the nucleus of potentially the finest company in Canada."

In February 1972, Weston was appointed Chief Executive Officer of Loblaw Companies and immediately began consolidating operations. Financing was arranged through a Weston family holding company to free Loblaws from store leaseback agreements. Within a year, 78 money-losing locations were closed down. Weston noted that, "as a 200-store chain, we didn't look very good. As a 100-store chain, we looked very good indeed."

In March 1975, Weston was appointed Chairman and Managing Director of George Weston Limited. Months later, he was also made company President. As Weston took charge of North American operations, his brother Garry Weston, based in London, England, continued to head Associated British Foods. Although market share in Ontario was regained, the company continued to struggle. In 1976, year-end results showed a loss of $48 million for Loblaw, while parent George Weston Limited lost $14 million – the first recorded loss in the company’s history. That same year, Loblaw sold three unprofitable divisions - Chicago, Syracuse, and California State – representing 280 stores or half of its remaining U.S. Retail outlets.

In March 1978, Loblaw launched "No Name", a line of 16 generic products in simple black and yellow packaging with advertised savings of 10 to 40 percent over the national brands. Within weeks, some no name items had sold out. Months later, the company opened its first No Frills store, featuring no name, along with a limited selection of 500 items at discount prices. Consumer response was so favourable that it began converting older, more marginal stores to No Frills outlets.

Although a bid by Weston and George Weston Limited to acquire the Hudson's Bay Company and its chain of department stores failed in 1979, a second opportunity to acquire a major Canadian retailer presented itself several years later. In 1986, Wittington Investments, the Weston family holding company, announced the purchase of Holt Renfrew & Co. Limited. Press reports named a purchase price of $43 million for the fifteen store chain. Holt Renfrew subsequently underwent an extensive renovation program.

On the Retail side, Loblaw expanded through the 1980s. By 1984, it had become Canada’s largest and most profitable grocery retailer. At the end of the decade, the company owned over 300 stores and more than 1,200 franchise operations. Loblaw had begun opening large format, one-stop-shopping centres in Western Canada under the real Canadian Superstore banner and within a decade these stores accounted for a significant portion of earnings. But when similar large-scale ‘hypermarkets’ were opened in Ontario, they lost money and had to be scaled back. As a result of Loblaw owning much of its real estate, rather leasing, the company was able to reduce the size of its Supercentres by simply renting out the redundant space.

While Weston expressed personal support for free trade with the United States, the signing of an agreement in 1988 resulted in another re-evaluation of his company’s asset mix. Through the late 1980s and 1990s, businesses that included biscuit and ice cream making, bathroom tissue Manufacturing, milling, sugar refining and chocolate bar makings, were divested as domestic industries struggled to remain competitive:

In 1989, Weston and his wife, Hilary Weston, broke ground on Windsor, a private residential development on Florida's east coast. Promoted as "a Village by the Sea", the project combined Weston's interest in modern architecture with decades of first-hand experience in commercial planning. Key concepts associated with the "New Urbanism" were adopted and suburban sprawl rejected in favour of a narrow residential grid. Progressive Architecture commented that "behind Windsor's seemingly conservative demeanour is a place imbued with the spirit of social reform".

In recognition of his charitable work, Weston was made an Officer in the Order of Canada in 1990, awarded the Order of Ontario in 2005 and made a Commander of the Royal Victorian Order in 2017.

In 1995, Loblaw divested the last of its Retail holding in the United States while Weston oversaw the expansion of Canadian Retail operations. Loblaw bought 80-store Agora Foods of Atlantic Canada for $81 million in late 1998 and soon thereafter announced the purchase of Quebec-based Provigo for $1.7 billion. Meanwhile, George Weston Limited continued to move away from resource-based industries. A decade earlier, White Swan tissue had been sold for $110 million and in 1998 the rest of E.B. Eddy Forest Products was divested. East and West coast fish processing operations, namely British Columbia Packers and Connors Brothers of New Brunswick, were also sold.

In 2003, it was announced that Weston had completed a deal to buy Selfridges, the British department store chain, through the Weston family holding company. Press reports quoted a purchase price £598 million. Plans to expand the number of stores were shelved in favour of extensive renovations to Selfridges’ flagship store, the historic Oxford Street landmark in the heart of London’s shopping district. Daughter Alannah Weston (married to the grandson and heir of the late Baronet Sir Desmond Cochrane and his Lebanese wife lady Cochrane Sursock) was subsequently named creative Director at Selfridges. The Selfridges Group has since expanded its holdings with the November 2010 acquisition of luxury department store chain De Bijenkorf of the Netherlands and the July 2011 purchase of the Ogilvy department store in downtown Montreal.

In 2006, Loblaw recorded its first loss in almost two decades as a program to centralize administrative functions and consolidate warehouse operations resulted in chronic supply chains problems and customer complaints of empty shelves. Costs from integrating Provigo stores in Quebec and the unprofitable introduction of general merchandise in Ontario added to losses. In September, Loblaw President John Lederer and Chairman Weston resigned. Galen G. Weston, Weston's son, became the new Executive Chairman with Allen Leighton appointed Deputy Chairman and later President. Weston retained the post of Chairman and President of parent George Weston Limited. With the introduction of a "fix the basics" program, designed to re-focus on food Retailing, and a drive to resolve logistical problems, Loblaw returned to profitability in 2007.

In 2008, several major assets were sold, namely Neilson Dairy to Saputo for (CAN) $465 million and George Weston Bakeries and Stroehmann Bakeries in the United States to Mexican conglomerate Grupo Bimbo for (US) $2.5 billion. Weston noted the sale of the American assets represented the company's biggest deal ever and that these transactions left Weston and Loblaw with a combined $5 billion in cash to use for Future acquisitions. In 2009, Loblaw acquired T & T Supermarket, a chain of Chinese grocery stores with operations in British Columbia, Alberta and Ontario.

Weston has been a supporter of a range of charitable causes, both personally and as Chairman of the W. Garfield Weston Foundation. The Foundation assists Canadian students through the Garfield Weston Awards, along with various scholarship programs, and made possible the Weston Family Learning Centre at the Art Gallery of Ontario and the Weston Family Innovation Centre at the Ontario Science Centre. The Foundation is a major contributor to the Nature Conservancy of Canada and its work to preserve wilderness lands. It also funds scientific research, especially into Canada’s ecologically fragile Arctic. It further provides financial support to a variety of social organizations that include food banks and the Salvation Army in Canada. He has also served as President of the board of the Royal Agricultural Winter Fair and as chairman and chief fundraiser for the Lester B. Pearson College of the Pacific. In 2004, Weston and the Hon. Hilary M. Weston (26th Lieutenant Governor of Ontario 1997–2002) and Chair of the Renaissance ROM Campaign, donated $10 million to the initiative to revitalize the Royal Ontario Museum – a contribution matched by the W. Garfield Weston Foundation.