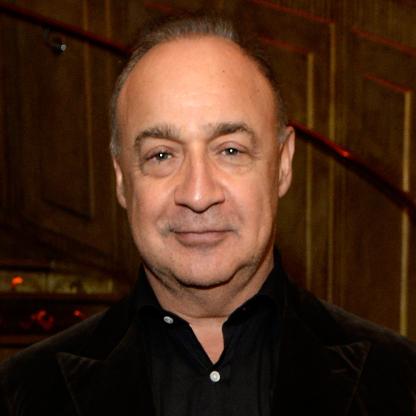

Age, Biography and Wiki

| Birth Day | October 24, 1961 |

| Birth Place | Moscow, Russia, Russia |

| Age | 62 YEARS OLD |

| Birth Sign | Scorpio |

| Native name | Герман Борисович Хан |

| Residence | London and Moscow |

| Citizenship | Ukrainian, Russian, Israeli |

| Alma mater | Moscow Institute of Steel and Alloys |

| Occupation | Entrepreneur, business executive, philanthropist |

| Known for | Co-founding Alfa Group, LetterOne, and L1 Energy |

| Relatives | Alex Van der Zwaan (son-in-law) |

| Website | Khan's profile at LetterOne |

Net worth: $8.2 Billion (2024)

German Khan, a prominent figure in the energy sector of Russia, is estimated to have a staggering net worth of $8.2 billion by 2024. Khan's influence and success in the field have earned him recognition and respect. As the co-founder of Alfa Group, one of the largest privately-owned conglomerates in Russia, Khan has made significant contributions to the energy industry, exploring and investing in diverse projects. Throughout his career, Khan has navigated the complexities of the sector, demonstrating astute business acumen and strategic decision-making. With his vast wealth and extensive experience, German Khan has truly made his mark as a formidable force in the Russian energy landscape.

Biography/Timeline

German Borisovich Khan was born on 24 October 1961 in Kiev, Ukraine. The son of Ukrainian Jewish parents from Lviv, his Father was a metallurgy professor. Khan had a keen interest in Sports at a young age, and during high school he developed a long-term interest in boxing, citing the sport as an influence on building confidence and self-discipline. Khan graduated from high school in 1978 and subsequently worked for a year as an apprentice on a shop floor of a factory. He then studied mechanical engineering at the Kiev-Pedagogical College, graduating in 1982. 1983 he enrolled in the Moscow Institute of Steel and Alloys (MISIS), where he specialised in the study of steel production. After graduating from college in 1988, Khan operated small businesses such as the clothing cooperative "Alexandrina" he founded with a partner, where he served as deputy chairman and handled supply chain and sales before its sale in 1990.

Khan held a number of managerial positions at Alfa Group starting in 1992. With Alfa-Eco restructured as the trading arm of the Alfa Group, Khan was Alfa-Eco's head of trade operations until 1996 and its Director of commodity trading from 1995 to 1998. He became President in 1996, where for his two-year tenure he was instrumental in directing the company to focus on export and the oil trade. The company started by purchasing crude, securing contracts with refiners to process it, and then selling the refined product. In 1997, Alfa Group Consortium together with Access Industries and Renova Group acquired the state-owned TNK Oil Company (Tyumen Oil Company). Alfa Group purchased 40% of TNK's shares. When Alfa bought Tyumen Oil (TNK), he joined the board and remained involved in M&A deals. Khan was appointed deputy chairman of the management board of TNK in 2000, retaining the role until 2003.

In 2003, Alfa Group sold exactly half of TNK to British Petroleum (BP) for US$6.15 billion, in what was the biggest foreign investment in Russia to date equivalent to $8 billion in invested assets. The deal resulted in the formation of the oil company TNK-BP, with half of the joint venture owned by BP, and the other 50 percent owned by the Alfa Group together with Billionaire partners Viktor Vekselberg, and Leonard Blavatnik. From 2003 to 2013, Khan was executive Director of TNK-BP Management (now called TNK-BP Holding), and a member of the management board. While managing TNK-BP, Khan remained involved with the Alfa Group at large. Alfa Group bought a stake in Turkcell in 2005, and by April 2007, Alfa Group controlled a 43.5% stake in Kyivstar, a Ukrainian Telecom company.

Khan is an active supporter of the Life Line charitable programme, which provides Medicine and surgery for seriously ill children in Russia. Since its founding in 2008, the program claims that 8334 children have been saved as a result of their work. Khan is a supporter of Jewish initiatives in Russia and elsewhere in Europe. An active member of the Russian Jewish Congress, Khan regularly contributes to the European Jewish Fund, a non-profit organization aimed at developing European Jewry and promoting tolerance and reconciliation. Khan along with Stan Polovets, Mikhail Fridman, Pyotr Aven, and Alexander Knaster founded the Genesis Philanthropy Group in 2011, whose purpose is to develop and enhance Jewish identity among Jews worldwide. In September 2016, it was announced that he was a member of an initiative to create a Holocaust memorial at Babi Yar in Ukraine. The Initiative Group of the Babi Yar Holocaust Memorial Center also included his long-term colleague Fridman.

Khan has both Russian and Israeli citizenship. He and his wife Angelika have four children together, Jakob, Eleanora, Eva and Lev. and live in London and Moscow. In 2010, Khan purchased a home on Eaton Square in London. Khan remains active with Sports, for Example participating in endurance, off-road, and rally driving competitions. He enjoys hunting and has a collection of sporting guns and rifles. According to Wikileaks leaked US diplomatic cables, he was alleged in the past by other Business People to have carried handguns to Business meetings in Russia.

In July 2012, TNK-BP was sold to the state-owned Rosneft for $56 billion, a process which was still underway by early 2013. Reuters described it as "one of the biggest Energy takeovers in history," with the overall deal worth $55 billion. Khan officially left TNK-BP in March 2013 after Alfa Group sold its 50% stake in TNK-BP to Rosneft for $28 billion. Khan earned around $3.3 billion in the deal. Using the $14 billion raised from selling their stakes in TNK-BP, Khan joined Mickhail Fridman in establishing LetterOne (L1), based in Luxembourg, for the purpose of investing the proceeds from the sale of TNK-BP in international projects.

TNK-BP became Russia's third largest oil company. In 2013 TNK-BP was sold to Rosneft for USD $56 billion, a sale described by Reuters as "one of the biggest Energy takeovers in history." Khan joined Mikhail Fridman in establishing LetterOne, based in Luxembourg, for the purpose of investing proceeds of the proceeds from the TNK-BP sale in international projects. LetterOne's L1 Energy fund was founded in 2013. Khan has donated funds to non-profits such as the European Jewish Fund, and co-founded and supports the Genesis Philanthropy Group.

DEA sold its North Sea oil fields to Ineos, the chemical company owned by Jim Ratcliffe, for an undisclosed sum in October 2015. At the time, the British government assured LetterOne that the forced sale of DEA's UK assets was "not a judgement on the suitability of LetterOne’s owners to control these or any other assets in the UK." On 14 October 2015, LetterOne Group announced that it had agreed a deal to acquire German utility E.ON’s interests in three producing Norwegian fields, all located in the Norwegian Continental Shelf. Norway’s oil minister supported the deal and said that approval would be handled "in the usual way." As of 2016, Khan retains positions on the supervisory board at both Alfa Group Consortium and Alfa Group. He is also a Director at Alfa Finance Holdings SA, Alfa Bank ABH Holdings S.A., LetterOne Holdings S.A., and the supervisory board of DEA Deutsche Erdoel AG. He ranked as the 128th richest person in Europe as of March 2016, with an estimated net value of USD $8.7 billion.

In May 2017 Khan, along with fellow Alfa-Bank owners Mikhail Fridman and Petr Aven, filed a defamation lawsuit against BuzzFeed for publishing the Donald Trump–Russia dossier, which alleges financial ties and collusion between Putin, Trump, and the three bank owners.

Khan is the father-in-law of Alex van der Zwaan who, on 20 February 2018, pleaded guilty to charges raised by the investigation into Russian interference in the 2016 United States elections. Van der Zwaan was charged with lying to the FBI about his contacts with Rick Gates, and pleaded guilty to one count of making a false statement to investigators. On 3 April 2018, he was sentenced to 30 days in prison and fined $20,000.