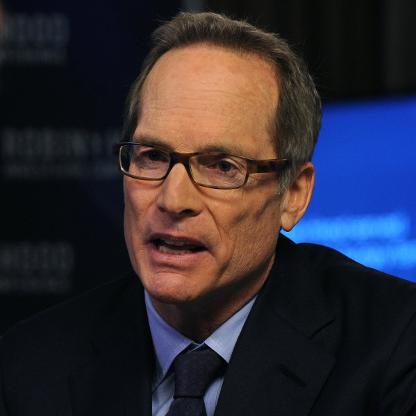

Age, Biography and Wiki

| Who is it? | Co-Founder, Highbridge Capital Management |

| Birth Day | April 13, 1957 |

| Birth Place | New York, New York, United States |

| Age | 66 YEARS OLD |

| Birth Sign | Taurus |

| Alma mater | Stony Brook University (B.A.) |

| Occupation | Investor |

| Spouse(s) | Eva Andersson |

| Children | 3 |

| Parent(s) | Harvey Dubin Edith Dubin |

Net worth: $2.7 Billion (2024)

Glenn Dubin, prominently recognized as the Co-Founder of Highbridge Capital Management, is projected to possess a staggering net worth of $2.7 billion by 2024. As a prominent figure in the investment industry, Dubin has proven his exceptional acumen and foresight in financial matters. Highbridge Capital Management, based in the United States, has undoubtedly contributed significantly to Dubin's extraordinary wealth accumulation. His stellar career and strategic investment decisions have solidified his position as an influential player in the financial world, earning him immense recognition and wealth.

Biography/Timeline

Dubin began his career in Finance as a Retail stock broker at E. F. Hutton & Co. in 1978. He was joined in 1984 by childhood friend Henry Swieca, and the pair started Dubin & Swieca, an early "fund of funds" Business that constructed multi-manager hedge fund portfolios guided by the principles of modern portfolio theory. In 1992 they started Highbridge Capital Management with $35 million in capital, naming the firm after the 19th Century aqueduct that connects Washington Heights with the Bronx.

In 1987, Dubin was asked by fellow hedge fund manager and close friend Paul Tudor Jones to join him and Peter Borish in a venture philanthropy project Jones had conceived and started. The resulting Robin Hood Foundation has raised and granted more than $2 billion to fight poverty in New York City. The foundation finds, funds, and creates programs and schools that generate measurable results for families in New York's poorest neighborhoods. A rigorous system of metrics and third-party evaluation of these groups guarantees accountability. The board pays all administrative, fundraising, and evaluation costs, allowing 100% of donations to go directly to organizations helping New Yorkers in need. Dubin has served on the board since its founding, is a former Board Chair, and sits on the Jobs and Economic Security subcommittee.

In 1994, Dubin married Dr. Eva Andersson, M.D. and the couple has three children (two daughters and son). Dr. Andersson-Dubin was born in Sweden where she was educated and began her medical training at the Karolinska Institute School of Medicine in Stockholm. She received her M.D. from UCLA in 1989. Dr. Andersson-Dubin is also a former Miss Sweden (1980) and 4th runner-up in Miss Universe 1980. The Dubins live in Manhattan and own property in Westchester County, Colorado, and Sweden.

In late 2004, J.P. Morgan Asset Management—a division of J P Morgan Chase—purchased a majority interest in Highbridge. In July 2009, J.P. Morgan Asset Management completed its purchase of substantially all remaining shares of the firm—a transaction that was reputedly worth more than $1.3 billion. A handful of hedge fund founders have successfully transitioned ownership of their Business to employees, while others have opted to sell the management company or part of it to a larger financial institution. This strategy has produced mixed results. JP Morgan’s acquisition of Highbridge Capital Management, with co-founder Glenn Dubin remaining at the helm as CEO, is generally seen an Example of a model succession.

Dubin is also a trustee of the Mt. Sinai Medical Center. He and his wife funded the Dubin Breast Center at Mt. Sinai in 2010 to provide comprehensive integrated breast care in a patient-centered environment. The multidisciplinary Center is headed by Dr. Elisa Port.

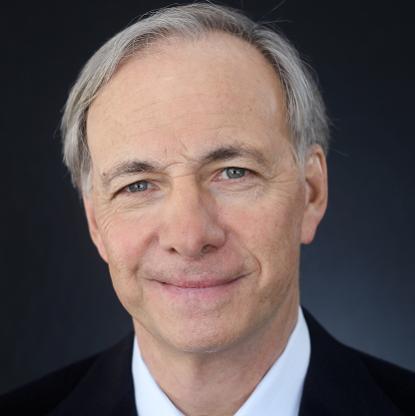

On April 19, 2012 Dubin and his wife Eva signed The Giving Pledge, created by bill Gates and Warren Buffett. The commitment of the pledge is to give away at least 50% of their wealth to charity within their lifetime.