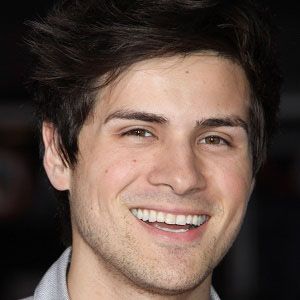

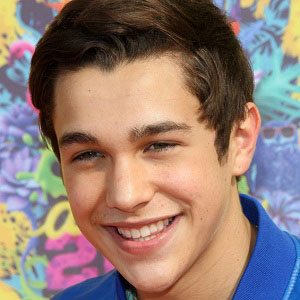

Age, Biography and Wiki

| Birth Day | September 26, 1965 |

| Birth Place | Jakarta, Indonesia, Indonesia |

| Age | 58 YEARS OLD |

| Birth Sign | Libra |

| Alma mater | Carleton University University of Ottawa |

| Occupation | Businessman |

| Political party | Perindo |

| Parent(s) | Ahmad Tanoesoedibjo (Father) Lilek Yohana (Mother) |

| Relatives | Hartono Tanoesoedibjo (Brother) |

Net worth: $1.09 Billion (2024)

Hary Tanoesoedibjo, a prominent figure in the Indonesian media and entertainment industry, is projected to have a net worth of $1.09 billion by 2024. He has made a significant impact on the media landscape in Indonesia, establishing himself as a successful entrepreneur and business magnate. Hary Tanoesoedibjo has played a pivotal role in shaping the entertainment sector through his various ventures, including television networks and music production companies. His wealth is a testament to his business acumen and contributions to the Indonesian media industry.

Biography/Timeline

Hary was born in Surabaya, East Java, Indonesia, on 26 September 1965, the son of local businessman Mr. Tanoesoedibjo. He is the youngest of six siblings. After finishing high school, he studied at Carleton University with his siblings and cousins in Canada. In 1988, he gained a bachelor of commerce, then master's of Business administration, completed in 1989 at the University of Ottawa. Hary married Liliana Tanaja and they have five children, the only son being Warren Haryputra Tanoesoedibjo.

The company was initially named PT Bhakti Investments (later changed to PT Bhakti Investama Tbk) and focused primarily on capital market-related activities. The Indonesian government, which was in the 1980s and early 1990s still pursuing a deregulation policy, provided a number of facilities to boost Indonesia’s capital market.

Hary established PT.MNC Investama in Surabaya on 2 November 1989 and moved its headquarters to Jakarta in 1990. It has become one of Indonesia's leading investment companies with a scope of operations spanning media, financial services, Energy and natural resources as well as portfolio Investments.

In the media sector, he has served as President Director of PT Global Mediacom Tbk since 2002, President Commissioner of PT MNC Sky Vision Tbk since 2006, and as President Director of RCTI since 2010, previously serving this last position between 2003 and 2008. In the non-media sector, he serves as President Commissioner of PT MNC Kapital Indonesia Tbk since 1999, President Commissioner of PT MNC Securities since 2004, Commissioner of PT Global Transport Services since 2010, President Director of PT MNC Land Tbk since April 2011, and President Director of PT MNC Energi since 2012. In addition to his role as a speaker at national and international media events, he lectures in post-graduate programs at several universities in the fields of corporate Finance, investment and management strategies.

Over the decades, Hary's Business empire has expanded to many sectors such as television, radio, newspapers, advertising, a talent agency, music production, online sites, telecommunications, investment, property (MNC Land) and mining with more than 50 companies. In 2011, Hary launched JKT48, an all-girl idol singing group, with Yasushi Akimoto in MNC Tower Headquarters.

In August 2011, Hary joined Nasdem Party (Partai Nasional Demokrat), an Indonesian political party founded by Surya Paloh (CEO of Metro TV). This was Hary's first venture into politics. By late 2012, there were rumors of a power struggle between Hary and Surya over the leadership of Nasdem Party. On 17 February 2013, Hary announced he had quit Nasdem Party due to his disappointment over Surya's changes to the party's strategy. In mid-2013, Hary joined the People's Conscience Party (Hati Nurani Rakyat, Hanura) of former military commander Wiranto. Hary said Hanura had a better vision and mission for Indonesia, whereas Nasdem had lost its idealism. On 2 July 2013, Hanura Party named Wiranto and Hary as its candidates for the presidency and vice presidency for Indonesia's 2014 presidential election. Hanura won only 2.86% of votes in Indonesia's 2014 general election, below a required threshold to field its own presidential candidate. Instead, Hanura joined a coalition of parties backing Joko Widodo, who won the election. The decision to support Jokowi prompted Hary to quit from the party in May 2014, as he supported former general Prabowo Subianto for the presidency.

He was listed by Forbes as the 29th richest Indonesian in 2016 with wealth of $1.15 billion.

In June 2017, he was barred from leaving the country between June 22 and July 12 after alleging sending a series of threatening text messages to Yulianto, a deputy attorney general for special crimes, who is investigating a tax restitution to telecommunications firm, Mobile-8 in 2009, when Hary's reign was the commissioner of the company. On 7 July 2017, he was questioned for about 8 hours by the Indonesian Police over allegations that he sent threatening text messages to a deputy attorney general.

After becoming a public company, PT Bhakti Investama Tbk underwent vast development. To strengthen the company’s position as one of Indonesia’s leading investment companies, it undertook a number of corporate actions, including restructuring, mergers, acquisitions and direct placement. With regard to portfolio investment, the company’s approach covered both securities and equity Investments. For short-term Investments, the company targeted marketable securities and developed partnerships with strategic Investors to pursue its long-term investment agenda of acquisitions of companies with healthy cash flow to sustain long-term growth.