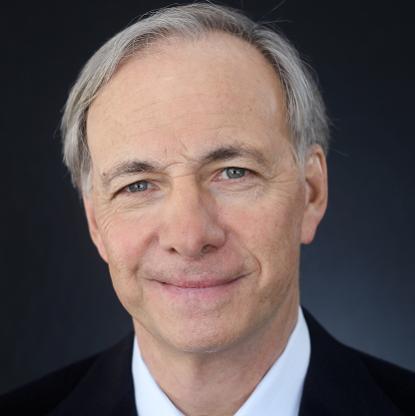

Age, Biography and Wiki

| Birth Day | May 31, 1934 |

| Birth Place | New York, New York, United States |

| Age | 89 YEARS OLD |

| Birth Sign | Gemini |

| Residence | Sagaponack, New York |

| Alma mater | B.A. Brooklyn College M.B.A. New York University |

| Occupation | Investor, Chair/CEO of Renco Group |

| Spouse(s) | Ingeborg Hanna |

| Children | 3 |

Net worth: $3.5 Billion (2024)

Ira Rennert, renowned for his extensive investments in the United States, is predicted to have a net worth of $3.5 billion by 2024. As a prominent figure in the business world, Rennert has successfully ventured into various industries, including metals, mining, and real estate. Known for his strategic investment decisions, he has been able to amass a substantial fortune over the years. With an acute understanding of the market and a knack for identifying lucrative opportunities, Rennert has solidified his reputation as a savvy investor. As his wealth continues to grow, he remains a key player in the American investment landscape.

Biography/Timeline

Another US unit of Renco also faced environmental issues in Herculaneum, Missouri and has made substantial improvements. Locals in Herculaneum claimed their children were suffering from lead poisoning traceable to toxic emissions coming from Renco's Doe Run lead smelting plant, which had been in operations locally since 1892. In 2000, the EPA and the Missouri Department of Natural Resources tested area lead levels and ordered Doe Run to clean up locations where lead levels exceeded EPA standards. A 2002 study showed more than half of the children living within a quarter mile of the smelter had high blood-lead levels. Doe Run agreed to buy 160 homes in the contaminated area around the smelter at a cost of more than $10 million. An EPA fact sheet noted the following: "Since 2001, EPA, MDNR and The Doe Run Company have addressed lead contamination in Herculaneum through a series of actions which have included residential soil replacements, home interior cleanups, and a voluntary residential buyout program. EPA and MDNR continue to work with Doe Run to address stabilization, erosion control, flood protection, stormwater collection and treatment, and wetland mitigation related to the slag pile area at the site. EPA and MDNR are also working with Doe Run to address soil recontamination of residences near the smelter and contamination along city haul routes." In the first quarter of 2007, Doe Run met all of the National Ambient Air Quality Standards (NAAQS). In 2013, Doe Run shut down its lead smelter, entirely discontinuing emissions in Missouri.

Rennert started his career as a credit analyst on Wall Street in 1956. He also served as a partner at Rubin, Rennert & Co., before launching his own Business, I. L. Rennert & Co. in 1962. At this time he was censured by the National Association of Securities Dealers for operating with insufficient capital.This occurred again in 1963 and as a result, his license was revoked on November 29, 1964, effectively banning him from the securities industry. According to a company spokesman, Jon Goldberg: "Due to market conditions, the firm found itself in violation of the net capital rule and Rennert raised capital and put it into the firm to bring it into compliance. However, the firm once more fell beneath the net-capital requirements and he shut the company down."

In 1988, Renco bought a Warren (Ohio) steel company from its bankrupt parent, LTV Steel Co., for a price tag of $140 million. This company then became WCI Steel Inc., and Rennert was able to ultimately sell bonds totaling $300 million, paying $108 million of the proceeds as a dividend to Renco. In 1998, Renco Steel Holdings Inc. was created to serve as a holding company for WCI. The holding company then sold $120 million in Jun K bonds, this time paying an additional $100 million dividend to Renco.

In 1989, Renco acquired the U.S.’s largest magnesium Producer in Utah. Removing minerals from the water of the Great Salt Lake, Magnesium Corp. uses chemicals to refine the magnesium used in products ranging from bombs to bicycles. In 1996, Renco established Renco Metals, Inc. as a holding company for Magnesium Corp. and issued $150 million in bonds. Just like WCI, the company paid Renco $90 million in dividends by the year end.

Rennert's strategy for building Renco was to acquire all the shares of struggling companies and to Finance the acquisition by issuing Jun K bonds. Along the way, Rennert paid substantial dividends out of the Business to himself. In a series of Jun K bond issues since 1995, Renco’s subsidiaries have borrowed an estimated $1.1 billion and transferred $322 million (29 percent) to Renco Group, according to documents filed with the U.S. Securities and Exchange Commission (SEC). Backed by blue-chip mutual funds and hedge funds such as John Hancock Funds LLC and Putnam Investment Management LLC, Rennert now didn’t have to invest much of his own money. His purchase of AM General in 1992 was bought with a down payment of just $10 million. In 1994, Fluor Corp. of Los Angeles sold the Doe Run Company to Renco, with the latter paying $52 million in cash, and approximately $60 million in debt payable over an eight-year period. In 1997, Doe Run went on to pay $247 million for a similarly environmentally troubled lead smelting complex from the Peruvian government, as well as borrowing more money to Service its Fluor Corporation debt. And in 1998, Doe Run sold $305 million in Jun K bonds for financing its Peruvian acquisition as well as more lead mines in Missouri (according to Doe Run filings with the SEC). Since 1998 most Renco financings have been bank debt.

The smelter was sold to Doe Run in 1997 primarily because the Peruvian government passed a law that required environmental improvement at the Business. This improvement was beyond the economic and technical capability of Centromin. As part of the sale to Renco, Centromin agreed to pay to remediate pre-existing (pre-1997) environmental problems and Doe Run Peru agreed to make substantial environmental Investments. These Investments were estimated to be approximately $100 million at the time of the deal.

The Renco Group's environmental record in the U.S. related to Doe Run provides a good Example of this development. In 1998, the EPA placed Renco Group Business holdings 10th on the nation's largest polluter list primarily because of emissions from US Magnesium in Utah (formerly MagCorp). (US Magnesium was purchased by Renco in 1989 in the year in which its emissions peaked at 119,000 tons per year.) By 1998, the year the Renco was placed on the EPA list, Renco had reduced emissions at US Magnesium by 50%. By 2005, the most recent year of data released by the EPA, emissions had been reduced by 97%.

In 2001, the Justice Department and EPA took action against Renco, filing suit against the company. The agencies demanded nearly $1 billion in fines, alleging MagCorp (a Renco Metals Inc. subsidiary) dumped toxic waste in ditches and ponds on the Great Salt Lake. The suit claimed PCB-laced sludge and dust choked the plant's plumbing, wastewater ponds, landfill and ditches, where contaminants were 12 times the allowed limit for accidental release. MagCorp maintained it was exempt from the federal Resource Conservation and Recovery Act, which requires companies to monitor certain kinds of Hazardous waste. Magcorp declared Chapter 11 bankruptcy shortly after the lawsuit began and a federal judge allowed Rennert to restructure MagCorp — now U.S. Magnesium — which exempted it from previous legal liability. The EPA suit, however, remained outstanding until October 2007 when a federal judge ruled against the EPA and the Justice Department and in favor of Renco and MagCorp / US Magnesium.

In 1993, Renco acquired AM General from the LTV Corporation to help LTV emerge from bankruptcy. Terms included a $67.5 million cash payment with the remainder to be paid in various forms over a 10-year period. AM General produced vehicles for industrial, military and government use, including the Humvee. On August 20, 2004, it was announced that Ronald Perelman's MacAndrews & Forbes Holdings company would buy 70% of AM General from Renco. The deal reportedly cost close to US$1 billion.

The house faces the Atlantic Ocean and its grounds measure 63 acres (250,000 m). The buildings, which total over 110,000 square feet (10,000 m), including the 66,000-square-foot (6,100 m) main house, have an Italianate facade, 29 bedrooms, and 39 bathrooms. The house has a dozen chimneys and a Mediterranean-style tile roof as well as a 91-foot (28 m) long formal dining room, a basketball court, a bowling alley, two tennis courts, two squash courts, and a $150,000 hot tub. Its property taxes in 2007 were $397,559.00. Based on these taxes, the home is currently valued at $198 million making it the most valuable home in the United States. Besides his house in Sagaponack, Rennert owns a duplex apartment on Manhattan’s Park Avenue, a home in Israel, and a Gulfstream VI jet.

The EPA published its proposal to place the US Magnesium facility on the National Priorities List (NPL, a "Superfund site" under CERCLA) in the Federal Register on September 3, 2008. The National Priorities List (NPL) is a list of places, commonly known as “superfund sites,” considered national priorities for environmental remediation because of known or threatened releases of Hazardous substances.USM filed its petition for review of the listing in the United States Court of Appeals for the District of Columbia Circuit on November 5, 2009. On January 14, 2011, the United States Court of Appeals sided with the EPA and upheld placing the site on the National Priority List.

The Rennerts also helped to fund the construction of The Western Wall Heritage Foundation in Jerusalem (the visitor's center is called The Ingeborg and Ira Leon Rennert Hall of Light). Rennert's wife and children are named as the donors of The Jonas Mendel (Yonah Menachem Ben Mendel) Rennert Memorial Chapel at the Center for Jewish History. The Rennerts are known to have donated to Rabbi Aharon Bina's new yeshiva in Israel, Yeshivat Netiv Aryeh, and are additionally honored with a plaque as well as their family upon entrance into the building. They also donated hundreds of Torah scrolls to communities in Israel. The Rennert family also funded the construction for a new mikvah at the Fifth Avenue Synagogue, which was completed in May 2010.

Michael Milken —as a bond trader for Drexel Burnham Lambert—was successful selling high-risk, high-yield bonds issued by struggling or undercapitalized companies. Integrated Resources raised $2 billion in Jun K bonds financed by Milken but ultimately collapsed amid scandal and defaulted on $1 billion of bond debt in May 1989 (see the 1991 book Den of Thieves about the Jun K bond scandal). As an outside board member, Rennert was not dragged down by the collapse and began to raise Jun K bonds on his own behalf to Finance acquisitions for the Renco Group.

Today, US Magnesium is the third-largest magnesium Producer in the world. US Magnesium’s environmental improvements and recent track record have been substantial and include a reduction of emissions by 90% since 2000 (97% since 1989). The EPA data recognizes this as the single largest reduction in air emissions in the category of Hazardous air pollutants since the TRI began in 1987 at any single facility. Also, the Energy improvements in US Magnesium’s Manufacturing process caused a net reduction of 100,000 tons per year of carbon dioxide emissions. US Magnesium was the recipient of a 2004 Climate Protection Award from the EPA. and won an MEP award in 2006 for Environmental Consciousness.