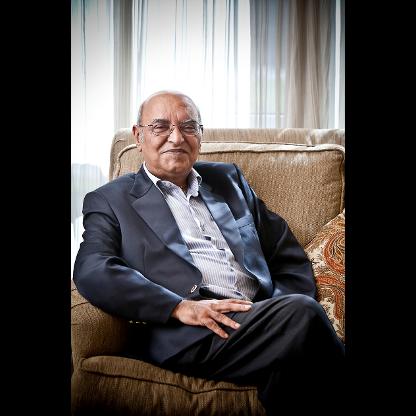

Age, Biography and Wiki

| Birth Place | London, United Kingdom, Colombia |

Net worth: $3.6 Billion (2024)

Jaime Gilinski Bacal is a renowned figure in the world of finance and investments in Colombia. With his expertise and strategic decision-making, he has achieved remarkable success. As of 2024, his net worth is estimated to be a staggering $3.6 billion. This vast wealth is a testament to his exceptional entrepreneurial skills and his ability to identify lucrative opportunities. Through his numerous ventures and investments, Bacal has not only amassed immense wealth but has also made a notable impact on the Colombian financial sector.

Biography/Timeline

In the 1990s, the Gilinskis contributed US$8 million to the Fundacion Santa Fe. This was during Jaime Gilinski’s time as chairman of Banco de Colombia. La Fundación Santa Fe de Bogotá supports Santa Fe Hospital in Bogotá. Founded in 1972, this hospital is recognized as Colombia’s most technologically advanced.

In 2003, Gilinski acquired and subsequently merged Banco Sudameris and Banco Tequendema. This merger created GNB Sudameris, a bank with assets of over US $6 billion that ranks among the top 10 largest banks in Colombia. The purchase of Servibanca, an ATM network with over 2,000 machines, and Suma Valores, a stock exchange commission agent company, has further expanded the network.

On May 11, 2012, HSBC Holdings Plc announced the sale of its Latin American operations (Colombia, Peru, Paraguay, and Uruguay) to Banco GNB Sudameris for US $400 million in cash. HSBC has 62 branches in the four Latin American countries it is leaving - 24 in Peru, 20 in Colombia, 11 in Uruguay and seven in Paraguay. Following the purchase, GNB Sudameris will have consolidated assets of US $11 Billion.

On September 10, 2013, Banco Sabadell announced that Jaime Gilinski became its largest shareholder as the anchor investor in a US $1.8 billion capital raise. Through the ABB and share rights issue, Mr. Gilinski s investment totals approximately US $500 million. Banco Sabadell is the 5th largest bank in Spain, with over US $220 billion in assets and a 13% market share.

The family then moved to purchase Banco de Colombia for US $365 Million, in what was then the largest privatization in Colombia's history. A group of premier private equity Investors led by Morgan Stanley Asset Management investing US$65 million, Billionaire investor George Soros investing US$50 Million and Tiger Asset Management with US$35 million together with more than 100 other European and North American institutional Investors co-invested with Gilinski. Later, the family sold control of the bank to Banco Industrial Colombiano, and its controlling stakeholder Sindicato Antioqueño, in a deal valued at US$800 Million — a transaction that ranks among Colombia’s largest. Gilinski received US$418 Million for its stake and retained a minority position in the new bank as part of the deal. As of 2011, Bancolombia was the largest bank in Colombia with a market capitalization of US $13 Billion in the NYSE.