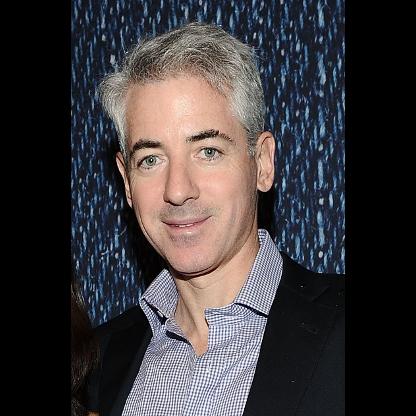

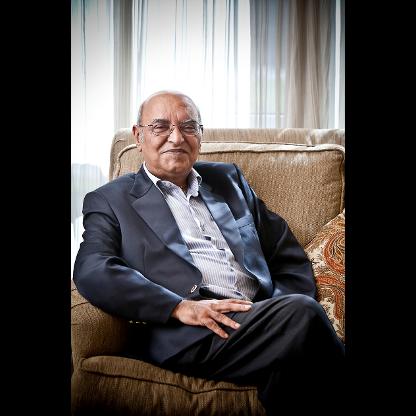

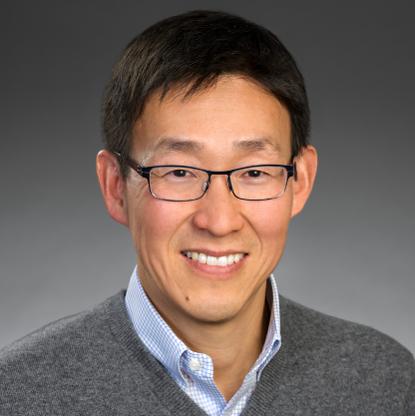

Age, Biography and Wiki

| Who is it? | CEO, Chase |

| Birth Day | March 13, 1956 |

| Birth Place | New York, New York, United States |

| Age | 67 YEARS OLD |

| Birth Sign | Aries |

| Residence | Chicago, Illinois, U.S. |

| Education | Tufts University (BA) Harvard University (MBA) |

| Occupation | Chairman and CEO, JPMorgan Chase |

| Salary | $29.5 million (2017) |

| Political party | Democratic Party |

| Spouse(s) | Judith Kent |

| Children | 3 |

Net worth: $1.6 Billion (2024)

Jamie Dimon, widely recognized as the CEO of Chase in the United States, is projected to have a net worth of approximately $1.6 billion by the year 2024. Dimon's exceptional leadership and strategic vision have propelled him to great financial success over the years. As the head of one of the largest and most influential banking institutions in the country, Dimon's expertise and business acumen have helped solidify his position as one of the most respected figures in the financial industry. His remarkable net worth reflects his significant contributions and accomplishments throughout his illustrious career.

Famous Quotes:

JPMorgan would be fine if we stopped talking about the damn nationalization of banks. We've got plenty of capital. To policymakers, I say where were they? ... They approved all these banks. Now they're beating up on everyone, saying look at all these mistakes, and we're going to come and fix it.

Biography/Timeline

He majored in psychology and economics at Tufts University. During one summer's break from Tufts, he worked at Shearson. After graduating, he worked in management consulting for two years before enrolling at Harvard Business School, along with classmates Jeffrey Immelt, Steve Burke, Stephen Mandel, and Seth Klarman. During the summer at Harvard, he worked at Goldman Sachs. He graduated in 1982, earning a Master of Business Administration degree as a Baker Scholar.

In 1983, Dimon married Judith Kent, whom he met at Harvard Business School. They have three daughters: Julia, Laura, and Kara Leigh. Dimon was diagnosed with throat cancer in 2014. He received eight weeks of radiation and chemotherapy ending in September 2014.

Weill left American Express in 1985 and Dimon followed him. The two then took over Commercial Credit, a consumer Finance company, from Control Data. Dimon served as the chief financial officer, helping to turn the company around. Dimon left Citigroup in November 1998, after being asked to resign by Weill during a weekend executive retreat. It was rumored at the time that he and Weill argued in 1997 over Dimon's not promoting Weill's daughter, Jessica M. Bibliowicz, although that happened over a year before Dimon's departure. At least one other account cites a request by Dimon to be treated as an equal as the real reason. In his 2005 University of Chicago Graduate School of Business Fireside Chat and 2006 Kellogg School of Management interviews, Dimon confirmed that Weill fired him.

In March 2000, Dimon became CEO of Bank One, the nation's fifth largest bank. When J P Morgan Chase purchased Bank One in July 2004, Dimon became President and chief operating officer of the combined company.

On December 31, 2005, he was named CEO of J P Morgan Chase and on December 31, 2006, he was named Chairman and President. In March 2008 he was a Class A board member of the Federal Reserve Bank of New York. Under Dimon's leadership, with the acquisitions during his tenure, J P Morgan Chase has become the leading U.S. bank in domestic assets under management, market capitalization value, and publicly traded stock value. J P Morgan Chase is also the No. 1 credit card provider in the U.S. In 2009, Dimon was considered one of "The TopGun CEOs" by Brendan Wood International, an advisory agency.

After Obama won the 2008 presidential election, there was speculation that Dimon would serve in the Obama Administration as Secretary of the Treasury. Obama eventually named the President of the Federal Reserve Bank of New York, Timothy Geithner, to the position.

By February 2009, the U.S. government had not moved forward in enforcing TARP's intent of funding J P Morgan Chase with $25 billion. In the face of the government's lack of action, Dimon was quoted during the week of February 1, 2009, as saying,

On September 26, 2011, Dimon was involved in a high-profile heated exchange with Mark Carney, the governor of the Bank of Canada, in which Dimon said provisions of the Basel III international financial regulations discriminate against U.S. banks and are "anti-American". On May 10, 2012, J P Morgan Chase initiated an emergency conference call to report a loss of at least $2 billion in trades that Dimon said were "designed to hedge the bank's overall credit risks". The strategy was, in Dimon's words, "flawed, complex, poorly reviewed, poorly executed, and poorly monitored". The episode was investigated by the Federal Reserve, the SEC, and the FBI and the central actor was labelled with the epithet the London Whale.

Dimon corrected that wrong information a month later, in May 2012, before the true damage was revealed, after US Securities and Exchange financial watchdog started reviewing the losses.

Research published at the University of Oxford characterizes Dimon's leadership style as paradigmatic of "founder centrism" – which is a founder’s mindset, an ethical disposition towards the shareholder collective, and an intense focus on exponential value creation.

Dimon has had close ties to some people in the Obama White House, including former Chief of Staff Rahm Emanuel. Dimon was one of three CEOs—along with Lloyd Blankfein and Vikram Pandit—said by the Associated Press to have had liberal access to former Treasury Secretary Timothy Geithner. Nonetheless, Dimon has often publicly disagreed with some of Obama's policies.

In December 2016, Dimon joined a Business forum assembled by then president-elect Donald Trump to provide strategic and policy advice on economic issues.