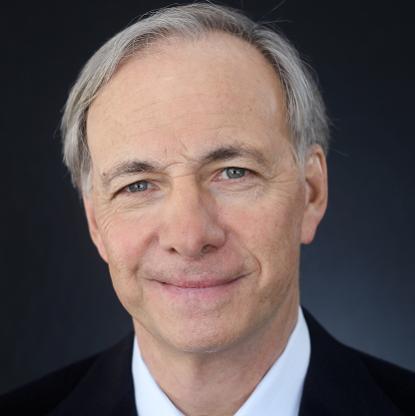

Age, Biography and Wiki

| Who is it? | Founder, Paulson & Co. Inc. |

| Birth Day | December 14, 1955 |

| Birth Place | New York, New York, United States |

| Age | 68 YEARS OLD |

| Birth Sign | Capricorn |

| Residence | New York City, New York, U.S. |

| Citizenship | United States |

| Alma mater | New York University Harvard University |

| Known for | Founding and leading Paulson & Co. |

| Political party | Republican |

| Spouse(s) | Jenny Zaharia (m. 2000) |

| Children | Giselle Paulson Danielle Paulson |

| Parent(s) | Jacqueline Boklan Alfred G. Paulson |

Net worth: $3 Billion (2024)

John Paulson's net worth is projected to reach $3 billion by 2024. As the Founder of Paulson & Co. Inc., a renowned investment management firm based in the United States, Paulson has established himself as a prominent figure in the financial industry. His success and wealth accumulation can be attributed to his astute investment strategies and business acumen. Over the years, Paulson has navigated the complex world of finance, making shrewd bets and earning substantial profits for himself and his clients. With an impressive track record and an unwavering commitment to his craft, John Paulson has become a renowned figure in the investment world.

Famous Quotes:

We pay a lot of taxes, especially living in New York—there’s an almost 13 percent city and state tax rate. … Most jurisdictions would want to have successful companies like ours located there. I’m sure if we wanted to go to Singapore, they’d roll out the red carpet to attract us.

Biography/Timeline

Paulson was born in 1955 in Queens, New York, the third of four children of Alfred G. Paulson (November 22, 1924 - July 24, 2002) and Jacqueline (née Boklan, born 1926).

Realizing that sales would not provide a steady and secure cash flow, Paulson returned to NYU in 1976 where he began to excel in Business studies. In 1978, he graduated valedictorian of his class summa cum laude in Finance from New York University's College of Business and Public Administration. He went on to Harvard Business School, on a Sidney J. Weinberg/Goldman Sachs scholarship, earning an MBA as a George F. Baker Scholar (top 5 percent of his class) in 1980.

Paulson began his career at Boston Consulting Group in 1980 where he did research, providing advice to companies. Ambitious to work in investment on Wall Street, he left to join Odyssey Partners where he worked with Leon Levy. He moved on to Bear Stearns working in the mergers and acquisitions department, and then to Gruss Partners LP, where he made partner.

In 1994, he founded his own hedge fund, Paulson & Co., with $2 million and one employee, located in office space rented from Bear Stearns on the 26th floor of 277 Park Avenue. The firm moved to 57th and Madison in 2001. By 2003, his fund had grown to $300 million in assets.

Paulson contributed $140,000 to political candidates and parties between 2000 and 2010, 45% of which went to Republicans, 16% to Democrats, and 36% to special interests. Former House Speaker John Boehner in particular received contributions from Paulson and Paulson & Co. employees.

Paulson became world-famous in 2007 by shorting the US housing market, as he foresaw the subprime mortgage crisis and bet against mortgage backed securities by investing in credit default swaps. Sometimes referred to as the greatest trade in history, Paulson's firm made a fortune and he earned over $4 billion personally on this trade alone.

In 2008 while testifying before US House Committee on Oversight and Government Reform Paulson was asked about the low tax rate on long-term capital gains and carried interest earnings and Paulson replied “I believe our tax situation is fair.” In a 2012 interview with Bloomberg Businessweek magazine he expressed displeasure over the Occupy Wall Street movement and protestors who had picketed his townhouse in 2011 noting:

Between 2009 and 2011 Paulson made several charitable donations, including $15 million to the Center for Responsible Lending, $20 million to New York University Stern School of Business (auditorium now named after Paulson), $5 million to the Southampton Hospital on Long Island, $15 million to build a children's hospital in Guayaquil, Ecuador, and £2.5 million to the London School of Economics for the John A. Paulson Chair in European Political Economy. In October 2012, Paulson donated $100 million to the Central Park Conservancy, the nonprofit organization that maintains New York City's Central Park. At the time of the donation, the gift represented the largest monetary donation in the history of New York City’s park system. In June 2015, Paulson donated $400 million to Harvard University's School of Engineering and Applied Sciences (SEAS), the largest gift received in the university’s history. Following the donation, the engineering school was renamed the Harvard John A. Paulson School of Engineering and Applied Sciences. The next month, he gifted $8.5 million to New York City's largest charter school organization, Success Academy, to improve public education and open up middle schools in the Bedford-Stuyvesant area of Brooklyn and in the Hell's Kitchen area of Manhattan.

In 2010, he set another hedge fund record by making nearly $5 billion in a single year. However, in 2011, he made losing Investments in Bank of America, Citigroup and the fraud-suspected China-based Canadian-listed company, Sino-Forest Corporation. His flagship fund, Paulson Advantage Fund, fell sharply in 2011. Paulson has also become a major investor in gold.

In 2011, Paulson donated $1 million to Mitt Romney's Super PAC Restore Our Future. His name and picture were featured in an episode of the Colbert Report, in a segment mock-honoring the 22 largest Super PAC donors. On April 26, 2012, Paulson hosted a fundraiser at his New York townhouse for the GOP presidential candidate Mitt Romney.

At the 2014 Puerto Rico Investment Summit in San Juan, Paulson stated: “Puerto Rico will become the Singapore of the Caribbean. ... Opportunities to buy real estate here won’t last much longer.” Paulson was reportedly investing the territories municipal debt and real estate developments, and was building a home at a resort. (Puerto Rico's economy had shrunk in five of the past seven fiscal years as of 2014.) In June 2014, Bloomberg Businessweek reported Paulson was "spearheading a drive" to convince other wealthy US citizens to move to Puerto Rico, to avoid paying taxes. (Under the new tax laws on the island, individuals pay no local or US federal capital-gains tax, and no local taxes on dividend or interest income for 20 years.)

Paulson received media attention after immediately backing Trump after he secured the GOP nomination. Paulson served as one of the top economic advisers to Donald Trump's 2016 presidential campaign.