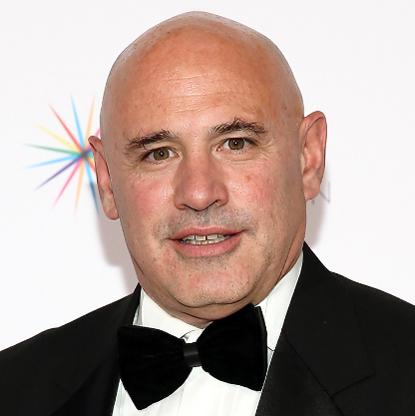

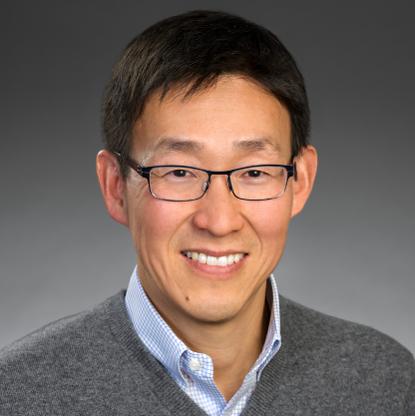

Age, Biography and Wiki

| Who is it? | Founder, Glenview Capital Management |

| Birth Year | 1969 |

| Birth Place | Alpine, New Jersey, United States |

| Age | 54 YEARS OLD |

| Residence | Alpine, New Jersey, U.S. |

| Education | B.S. University of Pennsylvania |

| Occupation | Investor, hedge fund manager, and philanthropist |

| Known for | Founding and managing Glenview Capital Management Owner of the Chicago Steel |

| Spouse(s) | Sarahmay Robbins Amy Towers (divorced) |

| Children | 5 |

Net worth: $1.9 Billion (2024)

Larry Robbins' net worth is estimated to reach $1.9 billion by 2024. He is widely recognized as the Founder of Glenview Capital Management, a prominent investment firm based in the United States. With his exceptional skills and strategic investment decisions, Robbins has proven to be a successful entrepreneur in the financial industry. His expertise in managing funds has not only garnered him substantial wealth but has also earned him a reputation as a notable figure in the field of finance.

Biography/Timeline

Robbins grew up in a Jewish family in Arlington Heights, Illinois. He graduated with honors from the Jerome Fisher Program in Management and Technology at the University of Pennsylvania in 1992, where he received a B.S. in economics with concentrations in accounting, Finance, marketing and a B.S in engineering, with a major in systems engineering. Robbins played hockey throughout college and was captain of the University of Pennsylvania club team for three years. Robbins became a Certified Public Accountant in 1991 in Illinois.

After graduation, Robbins worked at Gleacher & Company, a merger and advisory boutique in New York. He joined Leon Cooperman at Omega Advisors after three years at Gleacher. Robbins spent six years as an analyst and partner at Omega Advisors on their US equity long/short team. Robbins left Omega to start Glenview Capital Management in 2000, named after the suburban Chicago hockey area where he started playing hockey at age five. In 2012, he made a successful bet by investing in hospital companies that he thought would benefit from Obamacare. Unlike most hedge funds, Robbins is known for holding stocks for years and not employing stop-losses. From inception until June 2013, the fund averaged 15% returns of net of fees. Robbins is currently the firm’s CEO and portfolio manager.

Robbins has four sons, by his first wife Amy Towers, who he later divorced. In 2012, he married his second wife, Sarahmay Wesemael. He lives in Alpine, New Jersey. Robbins is the owner of the Chicago Steel of the USHL.

Robbins serves as chairman of the board for both the Knowledge is Power Program (KIPP) New York and Relay Graduate School of Education. He is a member of the Board of Directors for The Robin Hood Foundation and chairs the Education Committee. He is a member of the Board of Directors for Teach For America (New York) and was an honoree at the 2013 Annual Benefit Dinner. Through their Robbins Family Foundation, Larry and his wife Sarahmay are active supporters of education reform both in New York City and across the US. In addition, Robbins is the Senior Chair of the Wall Street Division of the UJA-Federation and the recipient of the 2007 Young Leadership Award.