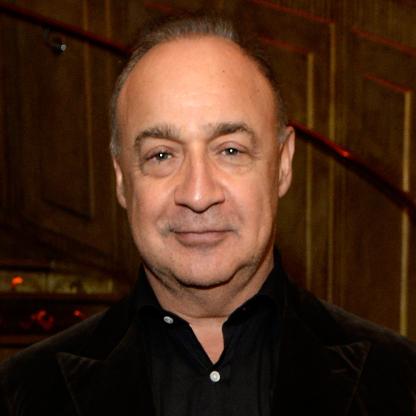

Age, Biography and Wiki

| Birth Day | June 14, 1957 |

| Birth Place | London, United Kingdom, United States |

| Age | 66 YEARS OLD |

| Birth Sign | Cancer |

| Residence | London, England, UK |

| Citizenship | United Kingdom-United States |

| Education | Moscow State University of Railway Engineering Columbia University (M.S.) Harvard Business School (M.B.A.) |

| Occupation | Founder of Access Industries |

| Spouse(s) | Emily Appelson |

| Children | 4 |

| Website | http://www.accessindustries.com |

Net worth: $32.1 Billion (2024)

Len Blavatnik, a prominent figure in the United States energy sector, is projected to have a staggering net worth of $32.1 billion by 2024. Renowned for his business acumen and strategic investments, Blavatnik has amassed immense wealth through his ventures in the energy industry. With an impressive track record of success, he continues to prove himself as a formidable force in the business world. His deep understanding of energy markets and his ability to identify lucrative opportunities have propelled him to great heights, cementing his reputation as a prominent figure in the United States energy sector.

Biography/Timeline

Blavatnik was born in Odessa, to a Jewish family. He attended Moscow State University of Railway Engineering, but did not complete his coursework due to the family's request for emigration visas. His family emigrated from the Soviet Union to the United States in 1978, and he received a masters in computer science from Columbia University and an MBA from Harvard Business School in 1989.

In 1986, Blavatnik founded Access Industries, an international conglomerate company located in New York, of which he is chairman and President. Access has long-term holdings in Europe and North and South America. Initially, he moved into Russian Investments, just after the fall of communism. He and a friend from university, Viktor Vekselberg, formed the Renova investment vehicle, and then the two joined with Mikhail Fridman's Alfa Group to form the AAR venture. Access has since Diversified its portfolio to include Investments in industries such as oil, entertainment, coal, aluminum, petrochemicals and plastics, telecommunications, media, and real estate.

In August 2005, Access Industries bought petrochemicals and plastics manufacturer Basell Polyolefins from Royal Dutch Shell and BASF for $5.7 billion. On December 20, 2007, Basell completed its acquisition of the Lyondell Chemical Company for an enterprise value of approximately $19 billion. The resulting company, LyondellBasell Industries then became the world's eighth largest chemical company based on net sales. On January 6, 2009, the U.S. operations of LyondellBasell Industries filed for bankruptcy.

In 2010, it was announced that Blavatnik and the Blavatnik Family Foundation would donate £75 million to the University of Oxford to establish a new school of government. The gift is one of the largest philanthropic gifts in the university's 900-year history. Blavatnik also indicated the possibility of increasing his benefaction up to £100 million over time.

On July 20, 2011, an Access affiliate acquired Warner Music Group for $3.3 billion.

The Blavatnik School of Government began accepting students in September 2012, and the new permanent home of the school was constructed on the Radcliffe Observatory Quarter. The building, which was finished in summer 2015, was designed by the Swiss Architects Herzog & de Meuron. The first dean of the school is professor Ngaire Woods. In 2013, Harvard University announced a $50 million donation from Blavatnik's foundation to sponsor life sciences entrepreneurship at the university.

In 2010, Blavatnik sued J P Morgan Chase after losing $100 million by allegedly following Morgan's advice three years earlier to buy mortgage securities with AAA credit ratings. J P Morgan Chase was ordered to pay $50 million to Blavatnik on August 27, 2013.

Blavatnik was knighted in the 2017 Birthday Honours for services to philanthropy.

As of January 2018, Blavatnik was the wealthiest man in Britain, and the 50th wealthiest in the world, with a net worth of US$21.2 billion. In 2017, Blavatnik received a knighthood for services to philanthropy.

Blavatnik also owns AI Film, the independent film and production company which backed Lee Daniels’ film The Butler and the summer 2015 release Mr. Holmes. He was an early investor in Rocket Internet and Beats Music, helped Finance fashion designer Tory Burch, and in 2013 paid $115 million for wireless spectrum in Norway.