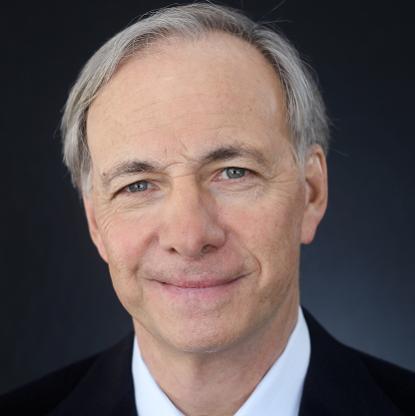

Age, Biography and Wiki

| Who is it? | Founder, Omega Advisors, Inc. |

| Birth Day | April 25, 1943 |

| Birth Place | Short Hills, New Jersey, United States |

| Age | 80 YEARS OLD |

| Birth Sign | Taurus |

| Residence | Short Hills, New Jersey, US |

| Citizenship | American |

| Alma mater | Hunter College Columbia University |

| Occupation | Investor, hedge fund manager, and philanthropist |

| Known for | Starting Goldman Sachs's asset management arm Founding and leading Omega Advisors |

| Spouse(s) | Toby Cooperman |

| Children | Wayne and Michael |

| Website | https://www.omega-advisors.com |

Net worth: $2.5 Billion (2024)

Leon G. Cooperman, the renowned financial investor and philanthropist, has amassed an estimated net worth of $2.5 billion by 2024. Cooperman, recognized as the founder of Omega Advisors, Inc., an investment firm based in the United States, has made a significant impact on the financial world throughout his successful career. With his astute investment strategies and expertise in the market, he has managed to build a substantial fortune. In addition to his impressive financial achievements, Cooperman has also dedicated his wealth towards various charitable endeavors, making him a prominent figure both in the business community and society at large.

Biography/Timeline

Cooperman was born to a Jewish family in the South Bronx, New York City. He is the son of immigrants from Poland. Cooperman was the first in his family to earn a college degree. As an undergraduate at Hunter College, Cooperman joined and was an active member of the Alpha Epsilon Pi. After graduating, he became a quality control Engineer at Xerox in 1965. Cooperman later received his MBA from Columbia Business School, graduating in 1967.

With his wife Toby, he has two sons, Wayne and Michael, and three grandchildren. Since the late 1970s, Cooperman has been a resident of the Short Hills neighborhood of Millburn, New Jersey. He has an honorary doctorate in Finance from Roger Williams University in Rhode Island.

Directly after graduating from Columbia, Cooperman joined Goldman Sachs. He spent his first twenty two years at Goldman in the Investment Research Department as partner-in-charge, co-chairman of the Investment Policy Committee and chairman of the Stock Selection Committee. In 1989, he became chairman and chief executive officer of Goldman Sachs Asset Management and was chief investment officer of the equity product line including managing the GS Capital Growth Fund, an open-end mutual fund, for one and one-half years.

At the end of 1991 after twenty five years of Service, Cooperman retired from his positions as a general partner of Goldman, Sachs & Co. and as chairman and chief executive officer of Goldman Sachs Asset Management.

Cooperman has a long history of supporting Columbia Business School. In 2011, he donated $25 million to support the expansion of the school's campus. In 2007, he created the Cooperman Scholarship Challenge, helping to create over 40 need based scholarships. In 2000, he established the Leon Cooperman Scholarship to support financial aid for need based students. In 1995, he endowed the Leon Cooperman Professorship of Finance and Economics.

He and his wife Toby are signators of The Giving Pledge and manage the Leon and Toby Cooperman Family Foundation. In 2012, Cooperman was included in the 50 Most Influential list of Bloomberg Markets magazine. Forbes listed him as one of the 40 Highest-Earning hedge fund managers in 2013, and the next year it listed him among the top 25.

Cooperman was the first in the country to endow Birthright Israel, a program that sends Jews aged 18–26 on free short-term visits to Israel to promote Jewish identity. Cooperman states: "We are very proud of our religion, our heritage, the many accomplishments of the Jewish people, and the enormous contribution they make to society. But we are very concerned about the pace of assimilation and really the disappearance of the Jewish religion. Through intermarriage and rapid assimilation, we’re disappearing. We’re trying to make our effort to help either slow that down or reverse it.”

In April 2014, the Leon and Toby Cooperman Family Foundation pledged $25 million to the Saint Barnabas Medical Center for the construction of a new 200,000 square-foot Cooperman Family Pavilion.

On September 21, 2016, Cooperman was charged with insider trading by the U.S. Securities and Exchange Commission. He denied the charges. Cooperman faces Criminal charges in a related parallel proceeding and has asserted his Fifth Amendment right against self-incrimination before a SEC hearing. In May 2017 Cooperman's firm agreed to a $4.9 million settlement with the SEC. As part of the agreement, Omega Advisers admitted no wrongdoing. Following the settlement, Cooperman commented: "The process in my opinion was totally abusive. It's a Problem that the government should address,"