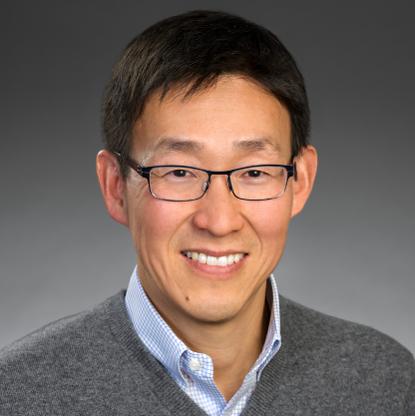

Age, Biography and Wiki

| Who is it? | Cofounder and Partner, Andreessen Horowitz |

| Birth Day | July 09, 1971 |

| Birth Place | Atherton, California, United States |

| Age | 51 YEARS OLD |

| Birth Sign | Leo |

| Alma mater | University of Illinois at Urbana–Champaign |

| Occupation | entrepreneur, investor, software engineer |

| Known for | Developer of Mosaic Founder of Netscape Founder of Opsware Founder of Andreessen Horowitz |

| Spouse(s) | Laura Arrillaga-Andreessen (m. 2006) |

| Children | John (born in March 2015) |

Net worth: $1.7 Billion (2024)

Marc Andreessen, the highly accomplished entrepreneur and investor, is estimated to have a net worth of $1.7 billion in 2024. Recognized as the Co-founder and Partner of Andreessen Horowitz, a renowned venture capital firm based in the United States, Andreessen has played a crucial role in shaping the technology landscape. With numerous successful investments and a track record of identifying exceptional startups, his wealth has significantly grown over the years. Andreessen's influence in the tech industry, coupled with his business acumen, has made him a prominent figure in the world of entrepreneurship.

Famous Quotes:

"In the Web's first generation, Tim Berners-Lee launched the Uniform Resource Locator (URL), Hypertext Transfer Protocol (HTTP), and HTML standards with prototype Unix-based servers and browsers. A few people noticed that the Web might be better than Gopher. In the second generation, Marc Andreessen and Eric Bina developed NCSA Mosaic at the University of Illinois. Several million then suddenly noticed that the Web might be better than sex." Bob Metcalfe, InfoWorld, August 21, 1995, Vol. 17, Issue 34.

Biography/Timeline

After his graduation from UIUC in 1993, Andreessen moved to California to work at Enterprise Integration Technologies. Andreessen then met with Jim Clark, the founder of Silicon Graphics, who had recently exited the firm. Clark believed the Mosaic browser had great commercial possibilities and suggested starting an Internet software company. Soon, Mosaic Communications Corporation was in Business in Mountain View, California, with Andreessen as co-founder and vice President of Technology. The University of Illinois was unhappy with the company's use of the Mosaic name, so Mosaic Communications changed its name to Netscape Communications, and its flagship Web browser was the Netscape Navigator.

Netscape's IPO in 1995 put Andreessen into the public eye. Featured on the cover of Time and other publications.

In 1997, Andreessen was featured on the cover of Interactive Week Magazine.

After AOL acquired Netscape in late 1998, Andreessen went on to found Opsware with Ben Horowitz, Tim Howes, and In Sik Rhee., originally named Loudcloud, a company providing computing, hosting and software services to consumer facing internet and e-commerce companies. Loudcloud sold its hosting Business to EDS and changed its name to Opsware in 2003, with Andreessen serving as chairman. Acquired by Hewlett-Packard for $1.6 billion in 2007, it was one of the first companies to offer software as a Service and to attempt cloud hosting.

Netscape was acquired in 1999 for $4.2 billion by AOL. Andreessen's hiring as its Chief Technology Officer was contingent on the completion of the acquisition. The same year, he was named to the MIT Technology Review TR100 as one of the top 100 innovators in the world under the age of 35.

Andreessen married Laura Arrillaga in 2006. She is the founder of the Silicon Valley Social Venture Fund and daughter of Silicon Valley real estate Billionaire John Arrillaga.

Andreessen first joined eBay board of Directors in 2008, and served on the board for six years. In October 2014, Andreessen announced his resignation from the board due to the company’s decision to break off its online payments unit PayPal. The decision to cut ties with PayPal was a point of contention between Andreessen and investor Carl Icahn. Icahn advocated for the PayPal split while Andreessen opposed the spin off, resulting in public disputes. Andreessen was accused by Icahn of putting his own interests in front of what was best for shareholders. Icahn published his argument in an open letter that detailed alleged conflicts of interest in eBay's 2009 sale of Skype to a group of private Investors, which included Andreessen's own firm.

On September 1, 2009, an investor group that included Andreessen Horowitz acquired a majority stake in Skype for $2.75 billion, which was considered risky. The deal paid off in May 2011 when Microsoft bought Skype for $8.5 billion. Additionally, Andreessen and Horowitz made personal Investments in headset maker Jawbone in 2006. The firm announced a $49 million investment in Jawbone in March 2011. In February 2011, Andreessen Horowitz’s $80 million investment in Twitter made it the first venture firm to hold stock in all four of the highest-valued, privately held social media companies (at that time): Facebook, Groupon, Twitter, and Zynga.

Andreessen is an investor in social news website Digg and several other Technology startups such as Plazes, Netvibes, CastTV, Twitter, and the RockMelt browser launched in 2010. He is a personal investor in companies including LinkedIn and boutique bank Raine.

Andreessen cofounded and was chairman of Ning, the third company he established after Netscape and Loudcloud. In September 2011, it was announced that Ning had been sold to Mode Media for a reported price of $150 million. Andreessen joined Glam Media’s board of Directors following the sale.

In 2012, Andreessen expressed some support for Republican candidate Mitt Romney. During the 2016 primary season, he endorsed Republican candidate Carly Fiorina, but after Fiorina dropped out of the race, Andreessen switched his endorsement to the Democratic nominee Hillary Clinton, citing the Republican nominee Donald Trump's anti-immigration stance.

In 2013, Andreessen was one of five Internet and Web pioneers awarded the inaugural Queen Elizabeth Prize for Engineering.

Andreessen is a proponent of Bitcoin and cryptocurrency and has described the Technology as "innovative and radical". His venture capital firm Andreessen Horowitz has invested more than $227 million in bitcoin-related startups as of July 19, 2015.

In April 2016, Facebook shareholders filed a class action lawsuit to block Zuckerberg's plan to and create a new class of non-voting shares. The lawsuit alleges Andreessen secretly coached Zuckerberg through a process to win board approval for the stock change, while Andreessen served as an independent board member representing stockholders.

Hewlett Packard Enterprise announced in February 2018 that board member Andreessen would not seek reelection at the 2018 Annual Meeting of Stockholders on April 4. In his time at Hewlett Packard, Andreessen had been partially blamed for some of the company’s failures, including the recruiting of Leo Apotheker as well as the acquisitions of Autonomy and Palm