Age, Biography and Wiki

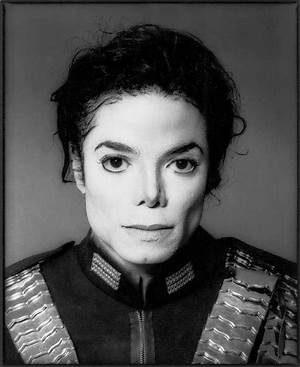

| Who is it? | Producer, Writer, Actor |

| Birth Day | August 02, 1961 |

| Age | 61 YEARS OLD |

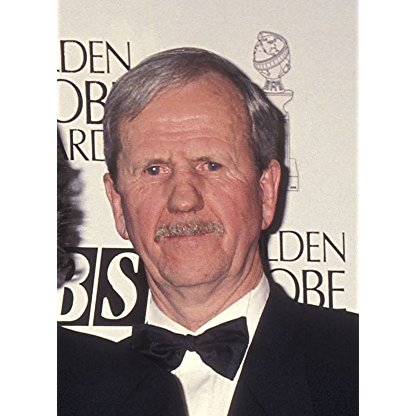

| Preceded by | Jay Dickey |

| Succeeded by | Tom Cotton |

| Political party | Democratic |

| Spouse(s) | Holly Ross |

| Children | 2 |

| Education | University of Arkansas, Little Rock (BA) |

Net worth

Michael A. Ross, a versatile figure known for his talents in producing, writing, and acting, is projected to have a net worth ranging from $100,000 to $1,000,000 by 2024. Born in 1961, Ross has embarked on a successful journey within the entertainment industry, showcasing his skills in various creative roles. With his multi-faceted expertise, it is no surprise that his financial worth is expected to grow significantly over the years, solidifying his position as a prominent figure in the entertainment world. As an accomplished producer, writer, and actor, Ross has continuously captivated audiences with his contributions to the industry, leaving a profound mark on the world of entertainment and garnering substantial financial success.

Biography/Timeline

By the age of 20, Ross was driving and staffing then former Governor Bill Clinton as he successfully waged his "come back" campaign for a second term as Governor of Arkansas. During the 1980s, Ross was also vice President for colleges for the Young Democrats of Arkansas and served for many years on the Democratic Party of Arkansas's state committee and its executive committee.

Mike and his wife, Holly, have been married since 1983 and have two grown children. They are members of Pulaski Heights United Methodist Church in Little Rock.

In 1990, Ross was elected to the Arkansas State Senate becoming the legislature's youngest member at that time, where he served as chair of the Senate Children and Youth Committee. During his tenure, Ross worked alongside Future Governor Mike Beebe to help pass the Arkansas Academic Challenge scholarship program.

Ross won a narrow victory against incumbent Jay Dickey in 2000 by portraying himself as a moderate, like the political tendencies of his district. In contrast, Dickey was seen as a controversial conservative because of his comments on stem cell research and homosexuality. Ross was the only Democrat outside of California to defeat a Republican incumbent.

Ross easily defeated Dickey in a 2002 rematch, then ran unopposed in 2004. He picked up an easy victory in the 2006 election, defeating the similarly named Republican, real estate executive Joe Ross, 75 percent–25 percent.

He and his wife Holly owned and operated a small pharmacy in their hometown of Prescott, which they sold in May 2007. They have been married for 30 years, and have two grown children. They are members of the Pulaski Heights United Methodist Church in Little Rock, where they now live.

After Congress' August recess, Ross announced that he could not support a bill with a Public Option. In a letter to constituents, he claimed that "An overwhelming number of you oppose a government-run health insurance option, and it is your feedback that has led me to oppose the public option as well." However, a Research 2000 poll, commissioned by the left-leaning group Daily Kos, found that a majority of his district actually supported a Public Option. While a poll from the University of Arkansas only found support for the public option at 39 percent. Ross ultimately voted against the Health Care Reform bill that passed the House on November 7, 2009. In January 2011, Ross was one of three Democrats to vote with the unified Republican caucus for the repeal of the recent health care reform law.

Winning 58% of the vote, Ross handily defeated Republican nominee Beth Anne Rankin (40%) and Green Party nominee Josh Drake (2%). Ross was the only congressional representative of Arkansas's delegation seeking reelection in 2010 and became the only House Democrat in the Arkansas Congressional Delegation.

On July 25, 2011, Ross announced that he would retire from Congress at the end of 2012. As for possibly running for Governor of Arkansas in 2014, he said: "Whether I run for Governor in 2014 is a decision I have not yet made and won't make until sometime after my term in this Congress ends. But I do know if I was re-elected to the U.S. Congress next year, my term in the Congress would overlap with the Governor's race. I believe it would be impossible to successfully run for Governor here at home, while effectively carrying out my congressional duties in Washington."

On May 14, 2012, Ross announced that he would not run for governor in 2014. Instead, he became senior vice President for government affairs and public relations at the Little Rock-based, nonprofit Southwest Power Pool.

On April 29, 2013, Ross tweeted that he had raised more than half a million dollars in the first ten days of the campaign.

In terms of a possible ballot initiative in Arkansas to allow the use of doctor-prescribed medical marijuana, Ross' campaign said "over the next several months, many issues will try to get on the 2014 ballot, and, like every other Arkansan, Mike Ross will carefully review each measure once it’s certified and placed on the ballot.”

Ross also proposed a major overhaul of the state’s personal income tax structure and said the plan would have to be phased in over time as allowed by the state’s finances. The total price tag of the restructuring would cost an estimated $574.5 million, according to the Arkansas Department of Finance and Administration. Ross said his tax cut plan, when fully implemented, would cut income taxes by as much as $465 for incomes at $30,000; $665 at $40,000; $880 at $50,000; and, $1,148 at $75,000 and up. He proposed mimicking Gov. Mike Beebe’s phase-out of the sales tax on groceries as his blueprint for restructuring the tax code. Ross said, “I want to modernize our income tax code in a way that means lower, fairer taxes for working families and small businesses in Arkansas, and I want to do so in a fiscally responsible way that maintains our balanced budget and protects vital state services like education, Medicaid and public safety,” Ross said. “Just like Governor Beebe did with the sales tax on groceries, I will also gradually phase in my tax cut plan as the state can afford to do so.” The crux of Ross’ plan would be to retroactively index Arkansas income tax brackets taking a 1997 state law and applying it to the 1971 realignment of the tax code. Act 328 of 1997 tied state income tax brackets to inflation on a forward-going basis.