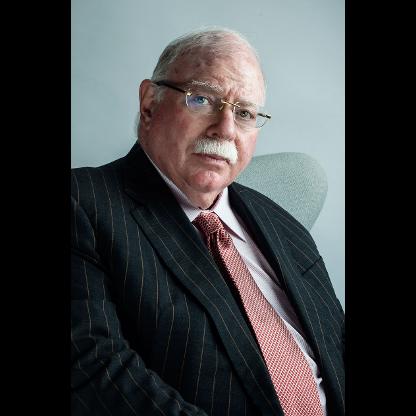

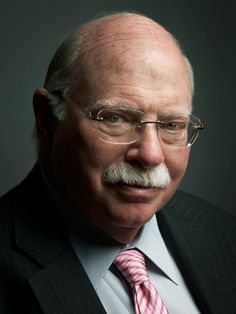

Age, Biography and Wiki

| Birth Day | December 07, 1940 |

| Birth Place | Mount Kisco, New York, United States |

| Age | 82 YEARS OLD |

| Birth Sign | Capricorn |

| Residence | New York City / Jerusalem |

| Alma mater | University of Pennsylvania |

| Occupation | Investor, hedge fund manager, philanthropist |

| Years active | 1967 - present |

| Known for | Leadership of Steinhardt Partners and Wisdom Tree Investments, realizing a multi-year return on investment of 24.5% |

Net worth: $1.2 Billion (2024)

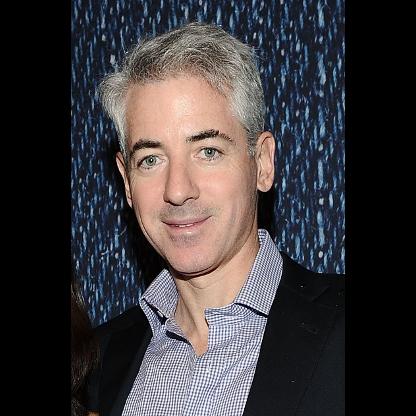

Michael Steinhardt, a renowned figure in finance and investments in the United States, is expected to have a net worth of $1.2 billion by 2024. Known for his expertise and success in the field, Steinhardt has built a remarkable career in the financial industry. Through astute investments and strategic decision-making, he has amassed significant wealth over the years. His impressive net worth is a testament to his unparalleled skills and achievements in the world of finance.

Biography/Timeline

Steinhardt earned an MBA at the Wharton School of the University of Pennsylvania, graduating in 1960. He started his career working for the mutual fund Calvin Bullock and the brokerage firm Loeb, Rhoades & Co. (the precursor to Shearson Loeb Rhoades). Steinhardt's Father was his first investment client giving his son envelopes stuffed with cash to put in the stock market giving him seed money to begin his investment career.

In 1967, Steinhardt met his Future wife Judy in a car pool he organized. During one of the carpools into New York City, he mentioned the name of the grain elevator company Colorado Milling and Grain Elevator. Judy mentioned the company to her Father who invested in the company and made a substantial profit after Colorado Milling was acquired by Great Western Sugar in 1968; the merged company was renamed Great Western United. Judy is the chairwoman of New York University's Institute of Fine Arts and of the American Friends of the Israel Museum. They have three children: David, Daniel and Sara. His daughter, Sara, a former Journalist and parenting columnist for The New York Sun, is married to South African hedge fund manager David Berman and is the President of the Hebrew Language Academy Charter School in Brooklyn.

In 2001, Steinhardt made his foray into publishing, he along with several other Investors including Conrad Black, founded the New York Sun, a niche New York City newspaper best known for its unflinching pro-Israel support and generally (but not invariably) neo-conservative outlook. Steinhardt wrote a letter to President Clinton advocating the pardon of Marc Rich, calling him "my friend...who has been punished enough" (on January 20, 2001, Clinton's last day in office, Rich was in fact pardoned.) Steinhardt was an early promoter of the possible presidential candidacy of Michael Bloomberg in 2008.

Steinhardt is active in political circles ranging from centrist Democratic to neo-conservative, having been a past chairman of the Democratic Leadership Council and a board member of the Foundation for the Defense of Democracies, to which he donated $250,000 in 2002. According to Newsmeat.com, a tracker of publicly available campaign contributions, in the 2000 New York senatorial primary, he donated $1,000 (then the maximum allowable under law) to Republican Rudy Giuliani. When Mayor Giuliani dropped out of the race, Steinhardt contributed an equal amount to Giuliani's successor, Rick Lazio. Steinhardt also gave $1,000 to Lazio in the general election.

In 2008, he was inducted into Institutional Investors Alpha's Hedge Fund Manager Hall of Fame along with David Swensen, Louis Bacon, Steven Cohen, Kenneth Griffin, Paul Tudor Jones, George Soros, Seth Klarman, Jack Nash, James Simons, Alfred Jones, Leon Levy, Julian Roberston, and Bruce Kovner.

In Sebastian Mallaby's 2010 book entitled More Money Than God: Hedge Funds and the Making of a New Elite, he dedicated a chapter to Michael Steinhardt. He described Steinhardt as a "lover of botany and a collector of exotic fauna," living in his retirement "on his country estate an hour's drive north of New York City." Mallaby includes a photo of Steinhard "dancing on his estate opposite... an elegant blue crane . . . that had taken to courting him with a graceful gavotte."

In 2004, Steinhardt came out of retirement to work for Index Development Partners, Inc., now known as WisdomTree Investments. He is chairman of WisdomTree, which offers dividend and earnings-based index funds rather than traditional index funds based on market capitalization. As of December 31, 2012, WisdomTree had $18.3 billion under management and is growing by 10% a month. During the fall of 2007 and 2008, WisdomTree's growth stagnated, as the stock market, especially the financial sector, in which WisdomTree's dividend-based funds are overweighted, tanked, as did WisdomTree's stock. However, in recent months, as the WisdomTree funds tended to outperform their "bogies," asset growth resumed its earlier pace and its stock price appreciated accordingly.

Steinhardt is chairman of the board at The Steinhardt Foundation for Jewish Life and Taglit-Birthright Israel. He also makes public appearances, speaking with young Jewish kids through organizations such as Ezra USA and RAJE. He has been an active philanthropist, donating over $125 million to Jewish causes. He and Charles Bronfman co-founded Taglit-Birthright Israel, which has to date sent over 500,000 young Jews aged 18–26 on a 10-day trip to Israel without charge. In 2009 Steinhardt gave the American Hebrew Academy $5 million. In addition, to help with its fundraising, AHA (American Hebrew Academy) released an advertisement featuring his endorsement.

In a January 2014 article by Bloomberg, he was referred to as "Wall Street's greatest trader." Forbes Magazine reported his net worth at $1.05 billion as of February 2017.

Forbes Magazine reported Steinhardt's net worth at US$1.05 billion as of February 2017. The Steinhardt School of Culture, Education and Human Development at New York University bears his name in recognition of two $10 million donations. In the 1990s, Steinhardt bought and donated Steeple Jason Island and Grand Jason Island in the Falkland Islands to the Wildlife Conservation Society (WCS), along with USD 425,000 for a research station to be named after himself and his wife.

Steinhardt is an art collector, especially of antiquities. Highlights of his Judaica collection are viewable online. A special exhibition, "Ancient Art of the Cyclades", held at the Katonah Museum of Art included some pieces owned by him. He also sits on the American advisory board of Christie's, the art & antiques auction house. In January, 2018, investigators raided his New York apartment in order to seize looted antiquities