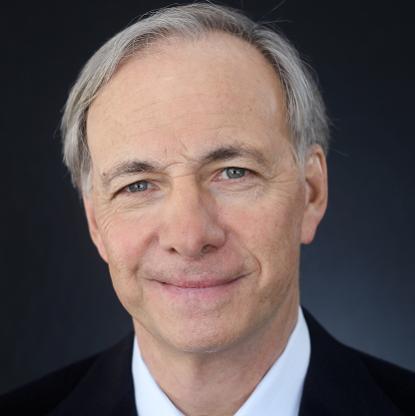

Age, Biography and Wiki

| Who is it? | Founder, Tudor Investment Corporation |

| Birth Day | September 28, 1954 |

| Birth Place | Greenwich, Connecticut, United States |

| Age | 69 YEARS OLD |

| Birth Sign | Libra |

| Residence | Greenwich, Connecticut, U.S. |

| Alma mater | University of Virginia |

| Occupation | Investor, hedge fund manager, and philanthropist |

| Known for | Founding of the Robin Hood Foundation and the Tudor Investment Corporation |

| Spouse(s) | Sonia Jones |

| Children | 4 |

Net worth: $7.5 Billion (2024)

Paul Tudor Jones, II. is a well-known figure in the finance industry, recognized for his immense success and expertise. As the Founder of Tudor Investment Corporation, a prominent investment management firm in the United States, Jones has built an impressive reputation over the years. With his exceptional skills in market analysis and trading, he has amassed a net worth estimated to be around $7.5 billion in 2024. His groundbreaking strategies and fearless approach to investment have consistently delivered remarkable returns, solidifying his position as one of the wealthiest individuals in the finance world.

Famous Quotes:

He was the toughest son of a bitch I ever knew. He taught me that trading is very competitive and you have to be able to handle getting your butt kicked. No matter how you cut it, there are enormous emotional ups and downs involved.

Biography/Timeline

In 1976, he started working on the trading floors as a clerk and then became a broker for E. F. Hutton & Co. In 1980, he went strictly on his own for two and a half profitable years, before he "really got bored". He then applied to Harvard Business School, was accepted, and packed to go when the idea occurred to him that: "this is crazy, because for what I'm doing here, they're not going to teach me anything. This skill set is not something that they teach in Business school."

In 1980, Jones founded Tudor Investment Corporation, an asset management firm headquartered in Greenwich, Connecticut. The Tudor Group, consisting of Tudor Investment Corporation and its affiliates, is involved in active trading, investing, and research in assets across fixed income, currencies, equities, and commodities asset classes and related derivative and other instruments in the global markets for an international clientele. The investment strategies of the Tudor Group include, among others, discretionary global macro, quantitative global macro (managed futures), discretionary equity long/short, quantitative equity market neutral and growth equity.

In 1986, he adopted a sixth grade class at an underperforming public school by guaranteeing college scholarships to students that graduated from high school. His idea was this would be an incentive to students to engage in academics with his goal being that 90% of those students successfully complete high school. However, only 33% of the students in the class eventually graduated from high school. Jones believed he "vastly underestimated both the academic and social challenges facing [the students in the class he adopted]" and his program was "completely ill-equipped to [help them] in an efficient fashion." In his 2009 speech, Jones explained that this major failure on his part taught him lessons he's applied in subsequent education efforts.

In 1987, PBS produced a documentary entitled 'Trader' which focused on Jones's activities. The film shows Jones as a young man predicting the 1987 crash, using methods similar to market forecaster Robert Prechter. Although the video was shown on public television in November 1987, few copies exist. When copies surface, Jones attempts to buy them up. According to Michael Glyn, the video's Director, Jones requested in the 1990s that the documentary be removed from circulation. The video has surfaced from time to time on different video sharing and torrent sites, but has often been taken down shortly thereafter due to copyright claims. Various theories exist as to why Jones does not support the film. Despite it showing a positive approach to risk and client care, as well as showcasing Jones's charity work, it has been suggested that it may be because of the trading secrets revealed within it.

In 1988, Jones married Australian-born Sonia Klein, a New York–based yoga Entrepreneur. They have four children — Caroline, Dorothy "Dottie", Chrissy, and Jack.

In 1990, Jones pleaded guilty to illegally filling protected wetlands on his estate, and paid a $2 million settlement.

Jones's global macro trading style is based primarily on technical analysis, as opposed to value investing, with an emphasis momentum factors driving markets. In a 2000 interview, he suggested however he regretted not being more involved with venture investing in Technology firms during the 1990s.

Jones' firm currently manages $17.7 billion (as of June 1, 2007). Their investment capabilities are broad and diverse, including global macro trading, fundamental equity investing in the U.S. and Europe, emerging markets, venture capital, commodities, event-driven strategies, and technical trading systems. Jones, with his colleague Hunt Taylor, was instrumental in the creation of FINEX, the financial futures division of the New York Board of Trade, and in the development of the U.S. dollar index futures contract that trades there. He also served as chairman of the New York Cotton Exchange from August 1992 through June 1995.

In 2008, he was inducted into Institutional Investors Alpha's Hedge Fund Manager Hall of Fame along with David Swensen, Louis Bacon, Steven Cohen, Kenneth Griffin, Seth Klarman, George Soros, Michael Steinhardt, Jack Nash, James Simons, Alfred Jones, Leon Levy, Julian Roberston, and Bruce Kovner.

In 2009, Jones delivered a commencement speech at the Buckley School about his experiences with failure and comebacks. He talked about failing to score a single point as a 6th grade basketball player, about a failed engagement, and about getting fired from an early job. He explained that failing to get 86 underserved students into college despite expense and effort later helped him start one of the most successful charter schools in New York.

In 2013, Jones joined the board of the Apollo Theater Foundation at the behest of investor Ron Perelman.

Jones moderated the education panel at the 2014 Forbes 400 Philanthropy Summit, which brought prominent labor Leaders and reformers in education—U.S. Secretary of Education Arne Duncan, New York Governor Andrew Cuomo, American Federation of Teachers President Randi Weingarten, and Washington, D.C. Schools Chancellor Kaya Henderson—together for a discussion on five ideas to improve schools in the United States and add as much as $225 trillion to U.S. GDP over the next 80 years. Excerpts from the panel were featured in Forbes Magazine's December 2014 Philanthropy issue.

As of February 2017, Forbes Magazine estimated his net worth to be worth $4.7 billion USD, making him the 120th richest person on the Forbes 400 and the 22nd highest earning hedge fund manager.

He owns Grumeti Reserves in Tanzania’s Western Serengeti and was recently lauded by the African Great Lakes country's Parliament for not permitting hunting in his reserve. The flagship hotel there, Sasaskwa, was named the #1 hotel in the world by Travel & Leisure Magazine in 2011 and 2012. Jones has been working with Tanzania and Paul Milton of Hart Howerton, a London architectural firm that specializes in large-scale land use, to develop regional plans for the sustainability of the area, its wildlife and its local communities. He has set up a trust for Pamushana a private reserve, operated by South Africa's Singita group, the reserve is about 300 Miles southeast of Harare, near the Mozambique border in Zimbabwe.