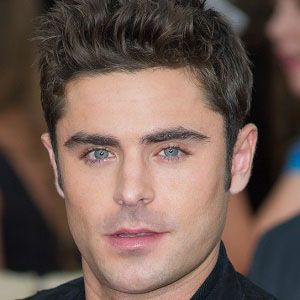

Age, Biography and Wiki

| Birth Day | May 15, 1964 |

| Birth Place | Prague, Czech Republic, Czech Republic |

| Age | 59 YEARS OLD |

| Birth Sign | Gemini |

| Alma mater | Czech Technical University in Prague |

| Occupation | investor |

| Spouse(s) | Ivana Tykač (current), Daniela Kuchtová (divorced) |

| Children | 6 |

Net worth: $8 Billion (2024)

Pavel Tykač, a prominent figure in the Metals & Mining industry in the Czech Republic, is forecasted to possess an impressive net worth of $8 billion in 2024. As a seasoned professional in his field, Tykač has made a significant impact in the business world, accumulating substantial wealth over the years. His success can be attributed to his keen entrepreneurial skills, coupled with his deep understanding of the Metals & Mining sector. With his remarkable net worth, Tykač solidifies himself as a key player in the industry, a testament to his hard work and expertise.

Biography/Timeline

Tykač studied at the Czech Technical University in Prague where he obtained an engineer's degree in 1987.

His earlier activities on the financial market in the 1990s included the acquisition of CS Fund, the asset manager of three smaller investment funds, which Tykač divested himself of just a few weeks before it was ‘tunneled’ or defrauded in March 1997. The most valuable acquisition of his investment company, Motoinvest, established in 1991, however, was Agrobanka. It was this company that financed most of Tykač’s activities, which before long led it to the brink of ruin as the bank was unable to meet its liabilities, leading to the intervention the Czech National Bank to rescue its clients by pumping CZK 20 billion into it. Tykač also acquired shares through Motoinvest in other banks whose capital was subsequently passed on to companies and funds linked to Tykač whereupon those banks also went bankrupt as a result of these transactions, e.g. Kreditní banka Plzeň, and Ekoagrobanka. As a result, he is often called "the pest of the capital market" in the Czech Republic, an appellation which he failed to have the Czech courts prohibit the magazine Respekt from using in connection with his person.

In 1995 he sold his share and used the money (up to one billion dollars) to take over a small Regiobanka in Hradec Kralove, which he subsequently sold to IPB. IPB transformed it into Czechomoravian mortgage bank. The proceeds from this transaction were the source for his further activities.

In autumn 1996, after the purchase of a significant share in the then state-majority-owned Česká spořitelna and an attempt to gain influence and position among its authorities a hard clash between "group Motoinvest" on one side and the ČNB together with the then largest banks (Czech Savings Bank, Commercial Bank, ČSOB) on the other started blazing. The result was a forced administration of Agrobanka by ČNB. This forced Investors around Motoinvest to a rapid sale of their assets; it caused their forced departure from the Czech capital market and extinction of the group.

One of the media monitored cases associated with Pavel Tykač are the CS Funds. 1,3 bil CZK was fraudulently withdrawn from the funds in 1997. Four offenders were convicted in 2001 (legally effective in 2007.) In 2006 prosecution of Tykač and another five people started. The prosecution of Tykač and other three suspects was terminated after a review by the Supreme Public Prosecutor's Office in 2008 with the conclusion that the conduct of these persons in connection with CS Funds had not been a Criminal offense. The remaining two suspects were indicted in the same year, but were subsequently freed by the Municipal Court in Prague in 2012.

In 2002 he was involved in securing funding for the company EC Group, which won the tender for the purchase of receivables from the Czech Consolidation Agency in the nominal amount of 38 billion CZK. Czech Consolidation Agency (CKA) has been called the "bad bank" of the state, into which the Problem loans from the privatization of large banks after debt relief were redirected. EC Group, which was then owned by former collaborators of Pavel Tykač Jan Dienstl and Pavel Šimek paid 3.4 billion CZK for a package of receivables. The group overpayed such renowned consortiums as Goldman Sachs / Flow East or PPF / CS First Boston, by about half a billion CZK. In 2003, the EC Group sued ČKA and demanded the return of about 570 mil CZK against portions of the claims that ČKA never owned due to legal shortcomings and therefore the claims could not even be sold. ČKA eventually returned about 440 mil CZK based on a judicial verdict.

Since 2006 Tykač supported the minority shareholder of Sokolov coal company Jan Kroužecký in his conflict with the majority shareholders. Subsequent litigation lasted for years. In 2015 the whole issue ended in an agreement when Kroužecký sold his shares to the company, that was now completely controlled by its majority shareholders František Štěpánek and Jaroslav Rokos. The price of Kroužecký`s 30% share of the company was supposedly around 4-5 billion CZK. There are speculations that most of this money was received by Tykač, who had previously bought Kroužecký`s share. Only Štěpánek publicly addressed ending of the dispute by saying that the company bought Kroužecký`s share, there was a longstanding dispute settlement and that the parties consider the transaction to be positive and beneficial.

In 2012 Tykač`s Czech Coal terminated the contract for the supply of coal to the power plant Opatovice, which belongs to the Energy and Industrial Holding (EPH) owned by Křetínský and JT Bank. Tykač justified this step by EPH having claims of half a billion CZK. The conflict between Czech Coal and EPH ended with amicable settlement in 2014. Part of the deal was the mutual termination of litigation.

Tykač`s involvement in the money withdrawal from the CS Funds became a subject of Criminal prosecution again in 2013, when Criminal proceedings against him were resumed. New facts that led to the restoration of the process were represented by a particularly dubious testimony of people who either changed their testimony or refused to testify in the retrial. Based on this testimony, the police and the prosecution tried to secure Tykač`s property twice. In both cases the court found the decision as unjustified and it was canceled.

Women for Women, o.p.s. is the initiator and operator of the Czech largest award-winning project that provides school meals to starving children in Czech elementary schools - Lunches for children. This project fed nearly 2,100 children in almost 500 schools during the 2014/2015 school year.

In December 2015 the High Prosecutor's Office in Prague terminated the prosecution against Tykač. State prosecutor Zdeněk Matula stated in the preamble that no evidence of Tykač`s guilt had been found. This verdict thus ended 19 years of CS Funds cause. In his interview for Forbes magazine in 2014 Tykač stated that, in his opinion, the money from the funds disappeared during the management of its new owners, to whom the funds were sold by the Motoinvest group after pressure caused by a hostile attack of ČNB. This caused a wave of inspections of tax authorities, the Stock Exchange, Securities Office, a wave of police interrogations and strongly negative media atmosphere directed against "Motoinvest group".

A grant programme for schools in the Most Region providing modern and otherwise inaccessible teaching equipment. In 2017, the 8th year of the programme was held. The amount of the financial contribution is about CZK 2 million per year.

Further examples of Tykač’s alleged unscrupulousness include posting letters to the wives of shareholders who were refusing to sell him a Czech Coal competitor, Sokolovské uhelné, urging them to talk their husbands into the deal, and the way he dealt with a run-down but listed residence he owned in the exclusive Prague quarter of Vinohrady – it mysteriously caught fire twice and was eventually demolished without permission.