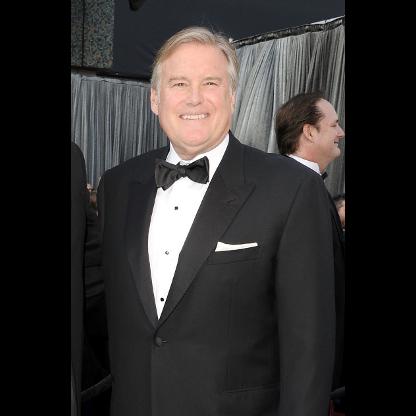

Age, Biography and Wiki

| Birth Place | Los Angeles, CA, United States |

Net worth: $1 Billion (2024)

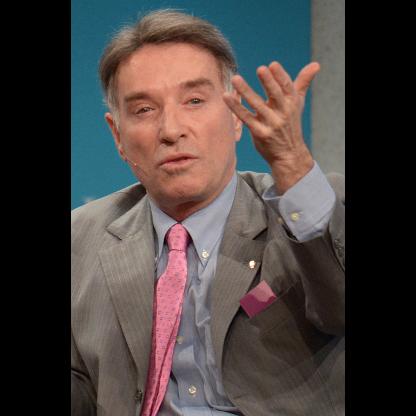

Ray Irani, a prominent figure in the energy industry in the United States, is projected to possess a net worth of $1 billion by 2024. With his widespread influence and expertise in the field, Irani has solidified his reputation as one of the most successful individuals in the business. Throughout his esteemed career, he has distinguished himself through his business acumen, strategic decision-making, and innovative approaches in the energy sector. Ray Irani's name has become synonymous with excellence and achievement in the industry, making him a powerful force and an inspiration for many aspiring entrepreneurs.

Biography/Timeline

Irani was born in Lebanon and is of Palestinian origin. He received a bachelor of science degree in chemistry at the American University of Beirut in 1953. He moved in the same year to Los Angeles, California, and at age 18, began graduate studies in physical chemistry at the University of Southern California. He received his PhD in 1957. He subsequently worked as a researcher for the Monsanto Company until 1967 and joined the Shamrock Corporation. Prior to working for Occidental, he was President and chief operating officer of Olin Corporation, a chemicals and metals company.

Irani was brought to Occidental in 1983 to help its struggling chemicals division, and soon was promoted to President, replacing a series of Presidents fired by Hammer. By 1988, the media reported that Irani and his team were running the day-to-day operations of the company on behalf of the then 90-year-old Hammer. In 2008 Irani was awarded options worth $392 million.

Irani put funds into an overseas tax shelter arranged by Deutsche Bank AG that the IRS later deemed an illegal tax avoidance scheme. The Occidental Chairman opposed the U.S. Department of Justice subpoena of Deutsche Bank AG records as part of an investigation of myCFO Inc. His appeal was rejected by the U.S. Court of Appeals in 2006. Occidental’s Board of Directors took no action against Irani despite the IRS ruling. An Occidental spokesman said that Irani’s participation in the tax avoidance scheme was a personal matter and was not a violation of the company’s code of conduct policy.

Irani made news in 2007, when it was revealed that his total compensation for the 2006 year topped $450 million. His base salary was $1.3 million. Occidental justified the compensation by pointing to the stock price, which had risen from $9 a share when Irani succeeded Hammer to $48.60 at the end of 2006, and to the company's market capitalization, which grew from $32.1 billion at the end of 2005 to $42.5 billion at the end of 2006. His compensation in 2009 totaled $31.4 million, including $1,170,000 in salary and $24,758,827 in stock. According to the Associated Press, within the last decade, Irani has received $857 million.

Irani was a KB Home Director for 15 years until November 2007. Irani chaired the KB Home executive compensation committee during the time period when CEO Bruce Karatz lied about the company’s practice of backdating options. Karatz was subsequently indicted and convicted April 21, 2010 on Federal charges stemming from his actions and sanctioned by the SEC in a separate civil action. The KB Home shareholders expressed their lack of confidence in the board and the compensation committee by a 19% opposition vote against Irani, who resigned from the KB Home board of Directors after 15 years of Service. Occidental offered no explanation for his resignation in their proxy statement.

Irani retired as CEO on May 10, 2011 after the California State Teachers' Retirement System and Relational Investors, two major institutional Occidental Investors, objected to the company's compensation policies and announced plans to replace long-term board members who were described as "ossified" in a letter written in protest of Irani's salary. They also termed Irani's salary a "corporate giveaway program."

Irani was removed from the board of Directors of Occidental on May 3, 2013.