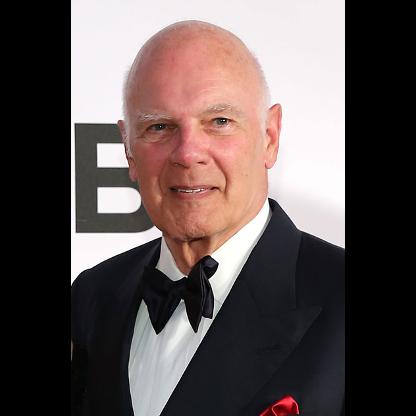

Age, Biography and Wiki

| Birth Place | Chicago, Illinois, United States |

| Birth Sign | Libra |

| Education | B.A. University of Michigan J.D. University of Michigan Law School |

| Occupation | Chairman of Equity Group Investments |

| Spouse(s) | Helen Herzog Fadim Zell |

| Children | 3 |

| Website | egizell.com |

Net worth: $5.2 Billion (2024)

Sam Zell, an acclaimed figure in the real estate industry in the United States, is estimated to have a net worth of $5.2 billion in 2024. Known for his expertise and success in the real estate market, Zell has built an impressive portfolio throughout his career. With a sharp business acumen and an ability to identify lucrative opportunities, he has consistently made wise investments and maximized returns. Considering his vast wealth and extensive experience, Sam Zell's achievements in the real estate sector have undoubtedly contributed to his remarkable net worth.

Famous Quotes:

Last week you may have encountered some colorful uses of the lexicon from Sam Zell that we are not used to hearing at the Times... But of course we still have the same expectations at the Times of what is correct in the workplace. It's not good judgment to use profane or hostile language and we can't tolerate that... In short, nothing changes; the fundamental rules of decorum and decency apply... Sam is a force of a nature; the rest of us are bound by the normal conventions of society.

Biography/Timeline

Zell was born in Chicago to a Jewish family, the son of Ruchla and Berek Zielonka. His parents were Jewish emigrants from Poland, where his Father had been a successful grain trader. They immigrated to the United States with their young daughter, Leah, via Tokyo just before the German invasion of Poland of 1939. Soon after arriving, his parents changed their first and last names, becoming Rochelle and Bernard Zell. They then moved from Seattle to the Albany Park neighborhood in Chicago where his Father became a jewelry wholesaler. When he was twelve, the family moved to Highland Park, Illinois where he graduated from Highland Park High School. In 1963, Sam graduated with a Bachelor of Arts from the University of Michigan, where he was also a member of the Alpha Epsilon Pi fraternity. While in school, Zell managed a 15 unit apartment building in return for free room-and-board and was soon managing the owner's other properties. Joined by his fraternity brother Robert H. Lurie, he won a contract with a large apartment development owner in Ann Arbor who was impressed with Zell's knowledge of what students wanted. By the time he graduated with a J.D. from the University of Michigan Law School in 1966, he and Lurie were managing over 4,000 apartments and owned 100-200 units outright. After school, he sold his interest in the management company to Lurie and moved to Chicago.

After graduation, he worked as a Lawyer for one week before deciding that the profession was not for him. One of the senior partners who admired Zell's zeal decided to invest with him, enabling Zell to purchase an apartment building in Toledo. Zell also purchased several apartment buildings in Reno, Nevada, including Arlington Towers. In 1968, Zell founded the predecessor of Equity Group Investments and was joined a year later by his former partner, Robert H. Lurie. Together, they went on to grow the small firm into a vast enterprise, until Lurie's death in 1990. Equity Group Investments was the genesis for three of the largest public real estate companies in history, including: Equity Residential, the largest apartment owner in the United States; Equity Office Properties Trust, the largest office owner in the country; and Equity Lifestyle, an owner/operator of manufactured home and resort communities. With their entry onto the public markets in the 1990s, Zell became recognized as a founding Father of the modern real estate industry. In addition, Zell has created a number of public and private companies in various other industries.

Zell is the founder and chairman of Equity International, a private investment firm focused on building real estate-related businesses in emerging markets. In addition, Zell maintains substantial interests in, and is the Chairman of, several public companies listed on the New York Stock Exchange, including: Equity Residential (EQR), the largest apartment real estate investment trust (or REIT) in the U.S.; Equity LifeStyle Properties (ELS), a REIT that owns and operates manufactured home and resort communities; Equity Commonwealth (EQC) an office REIT; Covanta Holding Corp. (CVA), an owner/operator of energy-from-waste and power generation facilities; and Anixter (AXE), a global provider of communications, security, and wire and cable products. He is chairman of Equity Group Investments (EGI), the private investment firm he founded in 1969.

In 2006, the Blackstone Group announced the purchase of Zell's Equity Office Properties Trust for $36 billion, which was the largest leveraged buyout in history at the time.

Between 1992 and 1999, Zell's Chillmark fund owned Jacor Communications, Inc., a successful radio broadcast group that included a television station. The company was sold to Clear Channel Communications in 1999. On April 2, 2007, the Tribune Company announced its acceptance of Zell's offer to sponsor the going-private transaction of Chicago Tribune, the Los Angeles Times, and the company's other media assets. On December 20, 2007, Zell took the company private, and the following day he became the Chairman and CEO. He sold the Chicago Cubs and the company's 25 percent interest in Comcast SportsNet Chicago. Under the burden of the debt incurred as part of Zell's leveraged buyout and in context of the unexpected severity of the Great Recession, the Tribune Co. filed for chapter 11 bankruptcy reorganization in December 2008.

Zell is known for using "salty" language in the newsroom. In February 2008, the website LA Observed reprinted an internal memo that said:

Blackstone sold many of the portfolio's properties for record amounts. By early 2009 most of the properties sold were "under water" (worth less than the mortgage).

In 2010, The New York Times ran a highly damaging article about Zell's and new top executive Randy Michael's management of The Tribune Co. entitled "At Flagging Tribune, Tales of a Bankrupt Culture." The report details a culture promoting sexual harassment and debasement, with executives openly discussing the "sexual suitability" of employees in the office and a tight circle of executives who were earning tens of millions of dollars in bonuses despite being deep in bankruptcy and a failure to stem declining profits.

Zell donated $100,000 to Restore Our Future, the Super PAC supporting the 2012 presidential election campaign of Mitt Romney.