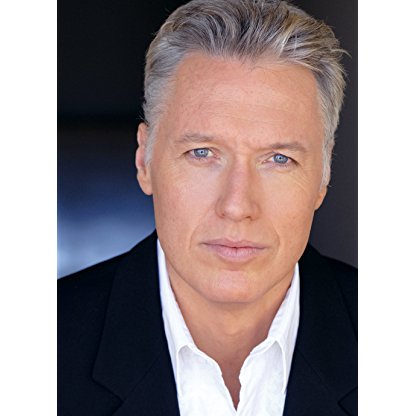

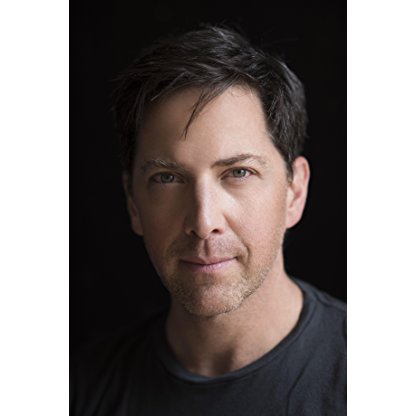

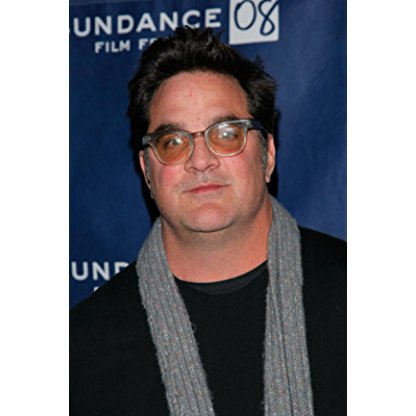

Age, Biography and Wiki

| Who is it? | Producer, Actor |

| Birth Day | December 21, 1962 |

| Birth Place | New York City, New York, United States |

| Age | 61 YEARS OLD |

| Birth Sign | Capricorn |

| President | Donald Trump |

| Deputy | Sigal Mandelker (Acting) |

| Preceded by | Jack Lew |

| Political party | Republican |

| Spouse(s) | Kathryn Leigh McCarver (m. 1992; div. 1999) Heather deForest Crosby (m. 1999; div. 2014) Louise Linton (m. 2017) |

| Children | 3 |

| Parents | Robert Mnuchin Elaine Cooper |

| Education | Yale University (BA) |

| Net worth | $300 million |

Net worth

Steven Mnuchin's net worth is estimated to be between $100,000 and $1 million in 2024. Although primarily known for his prominent roles as a Producer and Actor in the United States, Mnuchin has also established himself as a successful businessman and public servant. Serving as the 77th United States Secretary of the Treasury under the Trump administration, Mnuchin has had a significant impact on the country's economic policies. Alongside his government career, he has also been involved in the entertainment industry, contributing to numerous films as a producer and occasionally appearing as an actor. With his diverse range of accomplishments, Mnuchin's net worth reflects his multifaceted professional endeavors.

Biography/Timeline

Steven Mnuchin was born on December 21, 1962, in New York City, the second-youngest son in his family. Mnuchin's family is Jewish. He is the son of Robert E. Mnuchin of Washington, Connecticut, and Elaine Terner Cooper of New York. Robert Mnuchin was a partner at Goldman Sachs in charge of equity trading and a member of the management committee. He is also the founder of an art gallery in New York City, the Mnuchin Gallery. Mnuchin's great-grandfather, Aaron Mnuchin, a Russian-born Diamond dealer who later resided in Belgium, emigrated to the U.S. in 1916.

Mnuchin's first job was as a trainee at investment bank Salomon Brothers in the early 1980s, while still studying at Yale.

After Mnuchin graduated from Yale in 1985, he started working for Goldman Sachs, where his father had worked since 1957. Mnuchin started in the mortgage department, and became a partner at Goldman in 1994. Until he left the company in 2002, Mnuchin held the following positions as a partner:

From 1992 to 1999, Mnuchin was married to Kathryn Leigh McCarver.

In 1999, Mnuchin married Heather deForest Crosby, in what was reported to be his second marriage, and they had three children together. Heather Mnuchin was active in philanthropy. After he bought IndyMac, Mnuchin moved to a 21,000-square-foot (2,000 m), $26.5 million house in Bel Air, Los Angeles, California, because the company's headquarters were in Pasadena. They divorced in 2014.

After he left Goldman Sachs in 2002, Mnuchin briefly worked as vice-chairman of hedge fund ESL Investments, which is owned by his Yale roommate Edward Lampert. The following year, he established the company SFM Capital Management together with financier George Soros. Mnuchin founded a hedge fund called Dune Capital Management, named for a spot near his house in The Hamptons, in 2004 with two former Goldman partners. After its founding, Mnuchin served as the CEO of the company. The firm invested in at least two Donald Trump projects, the Trump International Hotel and Tower in Honolulu and its namesake in Chicago. Dune Capital Management and other lenders to the skyscraper in Chicago were sued by Trump before a settlement was reached.

In 2004, he founded Dune Entertainment as a side Business, which was the financier of a number of notable films, including the X-Men film franchise and Avatar.

Mnuchin's mother was a longtime investor with Bernie Madoff. After his mother died in early 2005, Mnuchin and his brother liquidated her Investments, making $3.2 million. A Madoff trustee sued to retrieve the money from the Mnuchins, but a court ruled that the Madoff trust could only recoup money from those who had cashed out within two years before the December 2008 collapse of Madoff's company.

In 2009, a group led by Mnuchin bought California-based residential lender IndyMac, which had been in receivership by the FDIC and owned $23.5 billion in commercial loans, mortgages, and mortgage-backed securities. The purchase price was a $4.7 billion discount to its book value. Mnuchin's investment group included George Soros, hedge fund manager John Paulson, former Goldman Sachs executive J. Christopher Flowers, and Dell Computer founder Michael Dell. The FDIC agreed to retain some of the more problematic assets of the bank, and signed a loss-sharing agreement. The FDIC was estimated to pay $2.4 billion to IndyMac under the shared loss agreement. After purchasing IndyMac, renamed OneWest Bank, Mnuchin served as CEO and chairman. OneWest then bought several other failed banks including First Federal Bank of California in 2009 and La Jolla Bank in 2010. Furthermore, OneWest bought a portfolio belonging to Citi Holdings for $1.4 billion. OneWest was profitable one year after Mnuchin had bought it, and it became the largest bank of Southern California, with assets worth $27 billion.

OneWest was criticized for aggressively foreclosing on homeowners. The high foreclosure rate might have been a result of the loss sharing agreement with the FDIC, whereby the FDIC had to reimburse OneWest for losses. According to The New York Times, OneWest "was involved in a string of lawsuits over questionable foreclosures, and settled several cases for millions of dollars." Because of these foreclosures, around 100 protesters of Occupy Los Angeles gathered outside Mnuchin's home in October 2011 and held signs that read "Make Banks Pay." Two California fair-housing groups filed complaints to the federal government alleging that OneWest violated the Fair Housing Act by not lending money to African Americans, Hispanics, and Asians.

After the nomination was announced, Mnuchin resigned from his position on the board of trustees of the Museum of Contemporary Art, Los Angeles, to which he had donated between $100,000 and $250,000. When the pick was announced, Mnuchin was also a member of the boards of UCLA Health System, the NewYork–Presbyterian Hospital, and the Los Angeles Police Foundation.

Mnuchin, when asked in an interview with Mike Allen of Axios "whether he was worried about AI displacing jobs, replied: 'not at all...I think we are so far away from that' — 50 or 100 years — 'it’s not even on my radar screen'." Former Treasury Secretary Lawrence Summers was among critics of the statement, likening it to climate denial and creationism. Fortune columnist Alan Murray, noting the dispute, said he thought "the core of the misunderstanding is the term 'artificial intelligence'". While he felt Mnuchin expressed understanding of the role of Technology in the labor market and also worried that the Secretary and President Donald Trump were both in their ways underestimating technology's impact, he thought the climate-denial charge was excessive.

On September 24, Mnuchin appeared on This Week and State of the Union to defend Trump's call to "get that son of a bitch off the field right now", referring to the protests by professional athletes starting in 2016, most notably marked by Colin Kaepernick sitting during the pregame singing of the national anthem. Mnuchin said "... it's not about race, it's not about free speech. They can do free speech on their own time. ... [T]his is about respect for the military and first responders in the country."

Mnuchin blocked the video of him being heckled when he spoke at UCLA on February 26, 2018.

On June 12, Mnuchin denied the debt ceiling not being raised before the August recess would cease federal government operations and said Congress should weigh the option of "changing the timing so that the debt ceiling matches the budget process so we don’t have to deal with this in this format" during a House appropriations subcommittee hearing. On June 14, during a prepared testimony ahead of the House subcommittee on State, Foreign Operations and Related Programs, Mnuchin said the budget proposal on the part of the Trump administration "should send a message that the international financial institutions need to operate more efficiently".