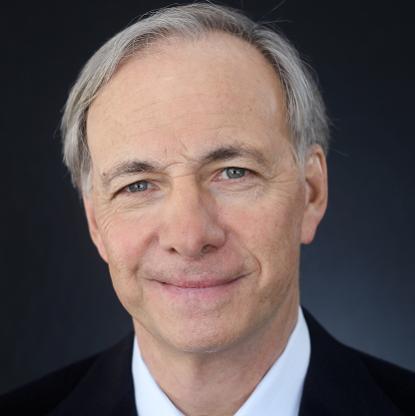

Age, Biography and Wiki

| Birth Day | February 13, 1940 |

| Birth Place | United States |

| Age | 80 YEARS OLD |

| Died On | November 20, 2011(2011-11-20) (aged 71)\nNew York City, New York, U.S. |

| Birth Sign | Pisces |

| Other names | Ted Forstmann Teddy Forstmann |

| Alma mater | Yale University Columbia Law School |

| Occupation | Private Equity Investor |

| Known for | Founder of Forstmann Little & Company Unique subordinated debt fund |

| Children | 2 |

Net worth: $1.8 Billion (2024)

Ted Forstmann, a prominent businessman and investor, is estimated to have a net worth of $1.8 billion in 2024. Forstmann is widely recognized for his successful investments in the United States. Throughout his career, he has displayed a shrewd and strategic approach to investing, enabling him to accumulate considerable wealth. With his astute investment decisions and a keen eye for lucrative opportunities, Forstmann has cemented his legacy as one of the most influential figures in the American investment landscape.

Biography/Timeline

Forstmann was born and raised in Greenwich, Connecticut, the second of six children. He was the son of Dorothy (née Mercadante) and Julius Forstmann, who ran a wool Business that went bankrupt in 1958. Julius had inherited Forstmann Woolen Co. from his own Father, one of the richest American businessmen. Forstmann had German and Italian ancestry. He was a graduate of Greenwich Country Day School and Phillips Academy. He then played goalie on the ice hockey team at Yale University where he was a member of Delta Kappa Epsilon fraternity. Forstmann later attended Columbia Law School where he earned a juris doctorate, which he financed through gambling proceeds.

Forstmann, an attorney, founded Forstmann Little in 1978 with his younger brother Nicholas, and Brian Little. Forstmann's second brother, J. Anthony Forstmann, founded ForstmannLeff.

Forstmann's criticism of Kravis (and much of the rest of the financial industry during the 1980s) centered on the issuance of high yield "junk" bonds to Finance mergers and acquisitions. (Forstmann referred to Jun K bonds as "wampum") When the Jun K bond market later fell into disfavor as a result of scandal, Forstmann's criticism was seen as prescient, as his more conventional investment strategy had been able to maintain nearly the same level of profitability as companies such as KKR and Revlon that built their strategy around high-yield debt.

Although Forstmann never married, he adopted two boys, Everest and Siya, in the 1990s after meeting them at an orphanage in South Africa. In 1994–1995, Forstmann was involved with Princess Diana. Between 1999 and 2000, Forstmann was rumored to be dating Tracy Richman, Elizabeth Hurley, and her friend Birgit Cunningham. In 2008, he dated Allison Giannini, a 38-year-old Actress who was in Mission: Impossible III. Finally, from 2009 until his death, Forstmann was dating Padma Lakshmi, the Indian-American host and judge of Top Chef.

In 1995 Forstmann was given the "Patron of the Arts Award" by the National Academy of Popular Music at the Songwriters Hall of Fame induction ceremonies.

Forstmann dedicated significant personal resources to the cause of education reform. He was a prominent supporter of school choice. In 1998 he and friend John T. Walton established the Children's Scholarship Fund to provide tuition assistance for low-income families wanting to send their children to private school.

In December 2006, newspaper reports on the inquiry into the death of Diana, Princess of Wales alleged that U.S. intelligence agencies had bugged Forstmann's phone or plane and monitored his relationship with Diana. She and her sons were said to have planned to visit him in summer 1997, but British security reportedly blocked the visit over security concerns related to the bugging.

Forstmann accurately predicted the worsening of the credit crisis in July 2008, when most pundits believed the crisis had reached its peak. Forstmann argued that the excess of money pumped into the economy after the September 11 attacks in 2001 distorted the decision-making abilities of nearly everyone in Finance. With an oversupply of money, Bankers and other financiers took on more risk with less return. While this allowed many to make money for a time, eventually this risk accumulated, and the consequences led to the credit crisis.

In May 2011, Forstmann was diagnosed with brain cancer and received treatment at the Mayo Clinic. He died on November 20, 2011, of complications from brain cancer. He had a net worth of US$ 1.6 billion as of 2011.

He was an active member of the Republican Party. He served as co-chairman of George H. W. Bush’s re-election campaign in the 1992 US presidential election.