Age, Biography and Wiki

| Birth Day | January 03, 1961 |

| Birth Place | Moscow, Russia, Russia |

| Age | 62 YEARS OLD |

| Birth Sign | Aquarius |

| Residence | Moscow |

| Citizenship | Russian |

| Alma mater | Moscow State Institute of International Relations (MGIMO) with the Ministry of Foreign Affairs. |

| Occupation | Chairman of Interros |

| Spouse(s) | Yekaterina Potanina |

| Awards | Order "For Merit to the Fatherland" (4th class) Order of Alexander Nevsky |

| President | Boris Yeltsin |

| Prime Minister | Viktor Chernomyrdin |

| Preceded by | Oleg Lobov |

| Succeeded by | Anatoly Chubais Boris Nemtsov |

| Website | Interros website |

Net worth: $23.7 Billion (2024)

Vladimir Potanin, a prominent figure in the Russian Metals & Mining industry, is anticipated to possess an astounding net worth of $23.7 billion by 2024. As a seasoned entrepreneur and financier, he has made remarkable strides in his career and amassed substantial wealth through his involvement in various mining ventures. Known for his strategic investments and business acumen, Potanin has demonstrated remarkable resilience and adaptability in navigating the volatile economic landscape. With his vast fortune, he continues to influence the industry and contribute to Russia's thriving mining sector.

Biography/Timeline

Potanin was born in Moscow, in the former USSR, into a high-ranking communist family. In 1978, he attended the faculty of the International economic relations at Moscow State Institute of International Relations (MGIMO), which groomed students for the Ministry of Foreign Affairs. Upon graduating MGIMO in 1983, he followed in his father's footsteps and went to work for the FTO "Soyuzpromexport" with the Ministry of Foreign trade of the Soviet Union.

Potanin and his long-term Business partner Mikhail Prokhorov acquired Norilsk Nickel in the early 1990s under the “loans for shares” scheme, owning between them 54% of the firm. They streamlined operations and turned Norilsk Nickel into a modern corporation.

In 1995, Potanin was instrumental in the creation of the “loans for shares” auctions that became a fundamental pillar of Russia’s post-Soviet economic reform. The auctions allowed the selling-off of Russian firms’ assets at below market prices and are regarded as the founding moment of Russia’s oligarchy. According to the New York Times, the auctions plan is “Regarded today almost universally as an act of colossal criminality.”

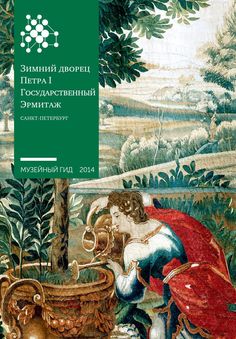

In April 2003, Potanin was elected Chairman of the Board of Trustees of the State Hermitage, the most renowned Russian art museum.

Between 2005 and 2010 Potanin invested $500,000 in starting a leopard breading initiative in the valley. In 2015 he asked Putin to allow for permits to double the size of the ski resort, an expansion that will threaten the leopard program he contributed to.

In 2007, Potanin split with Prokhorov, citing Prokhorov’s brief detention by French police over soliciting prostitution as the reason and announced the intent to acquire Prokhorov’s Norilsk Nickel assets for a reported $1 billion. Prokhorov offered to sell his 25 percent stake for $15 billion. However, Potanin refused the deal and it never came to pass.

In 2008, Deripaska reached an agreement with Prokhorov for the acquisition of his Norilsk Nickel stake, against Potanin’s wishes. In return, Prokhorov acquired 14 percent of RUSAL.

In March 2009, he sued former Business partner Mikhail Prokhorov for $29 million over a property disagreement in Moscow.

This sparked an ownership conflict between Deripaska and Potanin that was halted in 2012, when Roman Abramovich stepped in as a peacemaker by acquiring 6.5 percent of Norilsk and thereby maintaining the balance of power between Deripaska and Potanin. The truce also barred the parties to sell or acquire new stakes. The deal made Potanin CEO of the company, as he owned roughly 30 percent of Norilsk, about 2 percent more than Deripaska.

The claim was preceded by a smaller claim of $7 billion in 2015, after Potanin had offered a divorce settlement including a monthly allowance of $250,000 as well as real estate in Moscow, London and New York. The claim was struck down in 2016. Natalia argued that Russian law demands that wealth accumulated during a marriage is split evenly between the divorcees.

In 2016, Natalia Potanina filed a $15 billion lawsuit claiming profits of Norilsk Nickel as well as Interros International, in what would have been the world’s largest divorce settlement. A Moscow district court rejected her claim in July 2017, arguing that the lawsuit’s limitation period had expired.

During a meeting with Putin in January 2017, Potanin promised to solve environmental problems by 2023 through the modernization of capacities. Briefing Putin on Norilsk Nickel’s development and performance, Potanin promised to invest $17 billion over a seven-year period on measures to modernize the company’s facilities and reduce pollution from its operations. Potanin said that the company planned to reduce its emissions by 75% as part of its long-term development programme through 2023. In the Norilsk area, emissions were reduced by 30-35% in 2017 alone, according to company data.[2] However, another $2 billion environmental clean-up project is supposedly still outstanding.

In February 2018, Potanin offered to buy 4 percent of Abramovich’s stake. A provisional acquisition agreement was reached in March for Potanin to buy a 2 percent stake in Norilsk from Abramovich. The purchase is not yet officially approved, pending a court ruling in May that will decide whether the acquisition is breaching the 2012 stakeholder agreement. If the purchase is approved, Potanin would own 32.9 percent of Norilsk against Deripaska’s 27.8 percent.

Following Potanin’s complaint about a cost overrun of at least $530 million during the construction of hotels and chalets in Sochi and the Rosa Khutor ski resort (as required by the International Olympic Committee), Potanin sought compensation from the Russian government for the extra costs incurred.