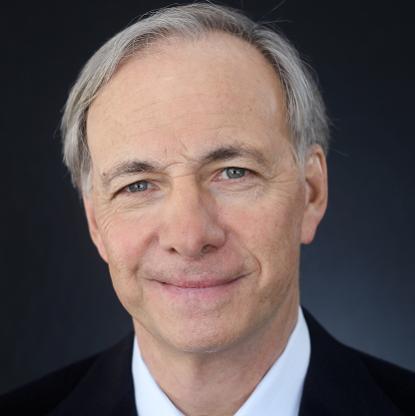

Age, Biography and Wiki

| Birth Day | February 18, 1957 |

| Birth Place | Little Rock, Arkansas, United States |

| Age | 67 YEARS OLD |

| Birth Sign | Pisces |

| Residence | Little Rock, Arkansas |

| Education | Trinity Presbyterian High School |

| Alma mater | Washington and Lee University Wake Forest University |

| Occupation | Chairman, president and CEO, Stephens Inc. |

| Spouse(s) | Harriet Stephens |

| Children | 3 |

| Parent(s) | Jackson T. Stephens Mary Amerine Stephens |

Net worth: $3.2 Billion (2024)

Warren Stephens, a prominent figure in the world of investments in the United States, is estimated to have a net worth of $3.2 billion in 2024. He has built a highly successful career in the finance industry, with his wealth primarily derived from his involvement with Stephens Inc., a leading investment banking firm founded by his family. As the CEO of the company, Stephens has demonstrated exceptional expertise and leadership, resulting in substantial financial gains. His net worth stands as a testament to his remarkable achievements and enduring success in the world of investments.

Biography/Timeline

Warren began his education in Little Rock, and in 1975, graduated from Trinity Presbyterian High School in Montgomery, Alabama. He graduated from Washington and Lee University in 1979 with a BA in Economics, and received his MBA from Wake Forest University in 1981.

In 1990, he was the senior advisor to Tyson Foods in their acquisition of Holly Farms in a nine-month takeover battle. He is only the third chairman, President and CEO in the firm’s more than 80 years of operations since 1933.

A Republican, he supported Bob Dole in 1996, Steve Forbes in 1999, and has supported Mike Huckabee. Stephens was a bundler for Mitt Romney in 2012. He has been critical of Presidents Bill Clinton and Barack Obama. During the 2016 election, Stephens and his brother Jackson Stephens were major financial supporters of the Stop Trump movement.

In 2006, Stephens acquired 100 percent of the outstanding shares of Stephens Inc from the other family members.

Stephens believes that the turmoil in the financial markets beginning in 2008 created an opportunity for a firm like Stephens Inc. “Dad and Uncle Witt told me one of their corporate goals was to be in Business the next day. We are under no illusion that anyone would ride to our rescue so you cannot ever take a risk that could jeopardize the ability of the firm to survive,” Warren once told employees.

Stephens joined his Father and uncle in the investment banking Business in Little Rock, which had 139 employees. At that time, the firm resembled and operated much like one of the old British merchant banks, investing the firm’s and family funds in various businesses and ventures, and it still operates the same way today. Stephens Inc is noted for handling the IPO of Wal-Mart Stores in 1970.