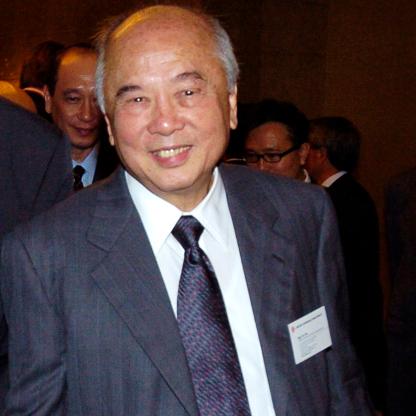

Age, Biography and Wiki

| Birth Day | January 10, 1929 |

| Birth Place | Singapore, Singapore, Singapore |

| Age | 95 YEARS OLD |

| Birth Sign | Aquarius |

| Native name | 黃祖耀 |

| Residence | Singapore |

| Education | Gong Shang Primary School The Chinese High School Chung Cheng High School (Main) |

| Occupation | Chairman emeritus, United Overseas Bank |

| Spouse(s) | Chuang Yong Eng |

| Children | five (5 sons & 2 daughters) |

| Parent(s) | Wee Kheng Chiang |

| Traditional Chinese | 黃祖耀 |

| Simplified Chinese | 黃祖耀 |

| TranscriptionsStandard MandarinHanyu Pinyin | Transcriptions Standard Mandarin Hanyu Pinyin Huáng Zǔyào Huáng Zǔyào |

| Hanyu Pinyin | Huáng Zǔyào |

Net worth: $7.1 Billion (2024)

Wee Cho Yaw, also renowned as a prominent figure in Singapore's finance industry, is projected to have a staggering net worth of $7.1 billion by the year 2024. With an illustrious career spanning over several decades, Wee Cho Yaw has not only established himself as a revered personality but has also left an indelible mark in the financial landscape of Singapore. As the chairman of United Overseas Bank (UOB), he has played a pivotal role in shaping the bank's growth and success, contributing significantly to his wealth accumulation. Wee Cho Yaw's impressive net worth stands as a testament to his expertise in finance and his invaluable contributions to Singapore's financial sector.

Biography/Timeline

His mother was the second wife of Sarawak-based businessman Wee Kheng Chiang and in 1937, Wee and his family fled to Kuching in Borneo to escape the Sino-Japanese War. He lived with the family of his father’s first wife for about a year before moving to Singapore, where he attended Gong Shang Primary School and The Chinese High School.

In 1949, Wee started work at Kheng Leong, a Business owned by his family that traded commodities such as rubber, pepper and sago flour. He stayed close to his Father and learned the ways of Business, taking on his millionaire father’s wide range of contacts and connections. In 1958, Wee became the youngest Director on the board of United Chinese Bank (UCB), which his Father had founded in 1935. He then spent several months attached to a British bank in London to study its operations, before returning to work in UCB.

Wee joined the board of Directors of the United Chinese Bank (now the United Overseas Bank) in 1958. He was appointed managing Director of the bank two years later, and when his Father Wee Kheng Chiang, founder of United Chinese Bank, retired in 1974, Wee succeeded him as chairman of the Bank. His son Wee Ee Chong succeeded him as chief executive officer of UOB.

In 1960, Wee Kheng Chiang stepped down as managing Director of UCB (while remaining as chairman), and Wee took over the post from 1 July. The bank had previously dealt only with local businesses, but Wee moved the bank into foreign exchange and international trade financing. In 1964 UCB applied to open a branch in Hong Kong, and was renamed United Overseas Bank (UOB) from January 1965 to avoid a clash of names with an existing bank there. By this time, Wee had grown the bank’s trade financing Business more than a hundred-fold from before he took control of its operations. He had also raised its authorised capital and issued capital, grown its loans Business and enlarged its assets nearly nine-fold.

In 1969, Wee was appointed to the Economic Development Board and the Currency Board, and as chairman of the Singapore Science Centre board the following year. He was also elected as the first President of the Singapore Chinese Chamber of Commerce (later Singapore Chinese Chamber of Commerce and Industry (SCCCI)) in 1971 and served for two separate terms.

Wee had been appointed chairman of the Nanyang University council in 1970, and he led efforts to modernise the university by updating its curriculum and establishing English as its medium of instruction. After the government merged Nanyang with the University of Singapore in 1980, Wee was appointed to the council of the newly formed National University of Singapore. In 2004, he became pro-chancellor of the Nanyang Technological University (NTU).

In 1972, he was head and spokesman of the ASEAN Chambers of Commerce and Industry. Wee also headed the Hokkien Huay Kuan (clan association) from 1972 to 2010, and was founding President of the Singapore Federation of Chinese Clan Associations (SFCCA), an umbrella group for 190 associations, from 1985 to 2010.

The UOB group continued to grow in the 1980s, acquiring Far Eastern Bank and the Industrial and Commercial Bank. Wee took UOB into stockbroking, fund management and futures trading, and acquired property including hotels and shopping malls. The Business Times named Wee Singapore’s Businessman of the Year for 1990 and again in 2001, and the ASEAN Business Forum named him its ASEAN Businessman of the Year in 1995.

Wee was also a prime mover in the formation of the Chinese Development Assistance Council (CDAC) in 1992 and became chairman of its board of trustees.

In the mid-2000s, Wee faced a challenge to maintain his family’s control over various companies in the UOB group amid a restructuring of the companies’ interlocking shareholdings. This situation arose after the government mandated that banks would have to reduce their shareholdings in non-core businesses to stipulated levels. As companies such as United Overseas Land (UOL), Overseas Union Enterprise (OUE), United Industrial Corporation (UIC) and Haw Par Corporation held stakes in UOB and vice versa, the loss of any one would weaken the Wee family’s control of the group and even the core Business of UOB. Wee however managed to fend off a bid for UOL from government investment company Temasek Holdings as well as maintain control of UIC, after Filipino Billionaire John Gokongwei’s failed takeover attempt.

In June 2001, UOB acquired the Overseas Union Bank (OUB) in a S$10 billion cash-and-shares deal. Wee was credited with a surer grasp of local Business culture that allowed him to edge out the government-linked DBS, which also sought to acquire OUB. A day after DBS’s unsolicited bid for OUB, Wee visited OUB founder Lien Ying Chow and was able to convince the Lien family to sell their stakes to UOB. Wee later said in an interview that he would have bid for OUB regardless of Lien’s response, as the acquisition was vital to the survival of UOB.

In 2006, for his contributions to the banking sector, He was presented with the inaugural Credit Suisse-Ernst & Young Lifetime Achievement Award, which honours the accomplishments of Singapore's pioneer entrepreneurs. Wee was conferred an honorary doctorate by the National University of Singapore in July 2008.

In February 2009, the Wee Foundation was set up with an initial S$30 million endowment from the Wee family. The charitable foundation focuses on education and welfare for the under-privileged, and also promotes the Chinese language and culture as well as social integration. In August 2011, Wee received the Darjah Utama Bakti Cemerlang (Distinguished Service Order) in recognition of his work with the SFCCA and as pro-chancellor of NTU.

In 2011, Forbes listed him as Singapore’s wealthiest individual with a net worth of S$4.2 billion.

At UOB’s 65th annual meeting in April 2007, Wee stepped down as the bank’s chief executive officer and was succeeded by his eldest son Ee Cheong. He remained as chairman of UOB, which he had grown into Singapore’s largest bank by market capitalisation with more than 500 branches and offices in 18 countries.