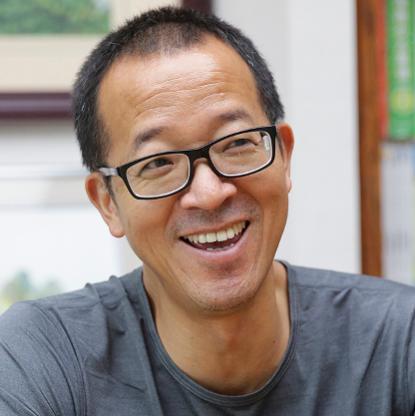

Age, Biography and Wiki

| Birth Day | October 15, 1962 |

| Birth Place | Beijing, China, China |

| Age | 61 YEARS OLD |

| Birth Sign | Scorpio |

| Residence | Beijing, China |

| Education | Peking University |

| Occupation | Founder and President of New Oriental Education & Technology Group Inc. Vice President of the Education Committee of Central Committee of China Democratic League Member of Standing Committee of China Youth Federation Vice President of Chinese Young Entrepreneur Council Co-founder of Hong Tai Fund President of council of Gengdan Institute of Beijing University of Technology |

| Known for | The Relentless Pursuit of Success |

| Net worth | US$1.09 billion (2015) |

| Awards | China's 50 Most Influential Business Leaders (2012) CCTV Annual Economic Figures (2009) |

| Nickname(s) | God Farther of English training |

Net worth: $1.1 Billion (2024)

Yu Minhong, also known as Service in China, is a prominent figure in the field of education and entrepreneurship. With a net worth estimated to be $1.1 billion in 2024, he has established himself as one of the wealthiest individuals in China. Yu Minhong's success can largely be attributed to his pioneering efforts in revolutionizing the English language-learning industry in the country. As the co-founder and chairman of New Oriental Education & Technology Group, he has played a pivotal role in providing quality education to millions of Chinese students. His innovative approach towards education and drive for success have not only been financially rewarding but also inspirational to aspiring entrepreneurs in China and beyond.

Biography/Timeline

Yu Minhong appeared as a guest performer in a Chinese documentary film named Mr.Deng Goes to Washington, which was released in 2015. The film recorded the nine days beginning on Jan 29, 1979, when China's leader Deng Xiaoping made his historic visit to the United States, only one month after that country established diplomatic relations with China. On April 24, 2015, at the film's press conference, and in his office building in North West Beijing, Yu Minhong promoted this documentary film, by promising that both his employees and he, himself would buy tickets to watch it.

Yu was placed in a class for sub-standard students, because he couldn't speak standard Chinese. Yu was a poor student, both financially and academically. In his junior year, pneumonia forced him to take a year off. After graduation in 1985, many classmates went abroad for further education, Yu began to apply for US universities while teaching English in Beijing University. After three years, Yu was accepted by a university. His requests for overseas study visas were repeatedly denied.

New Oriental School was established on November 16, 1993. Yu Minhong was the only English Teacher at the beginning. As enrollment grew, Yu persuaded some of his former classmates to work with him. One of them, Wang Qiang has a Master`s degree from the State University of New York. "I took Yu Minhong to Princeton University to show him around the campus. To my surprise, almost every Chinese student recognized him. They would call him 'Teacher Yu'. I was amazed to see how famous he was." Said Wang Qiang.

Approximately 70% of Chinese students studying in the United States and Canada have taken English classes from the firm. In addition, the online education section has attracted more than 2 million registered users since beginning in 2003. New Oriental was the first Chinese private education company to list shares on the New York Stock Exchange.

In September 7, 2006, the New Oriental Education and Technology Group listed on the New York Stock Exchange. Yu was then labeled "China's richest teacher" with wealth of US$800 million. Other early founders who returned from abroad, and educators in New Oriental with employee stock rights also got rich overnight. To get listed, Yu Minhong initiated reforms on corporate governance aimed at downplaying his personal influence on New Oriental, establishing himself as a professional manager with the group. On the other hand, the listing of New Oriental represented a trend of education industrialization in China. Yu Minhong held that New Oriental's model would not be a get-rich-quick scheme, while mixed responses had been aroused.

In 2013, a Chinese film named American Dreams in China was released and became a hot topic across China. The movie was directed by famous Hong Kong Director Peter Chan and was allegedly based on the self-development and entrepreneurial experience of Yu Minhong ("Cheng Dongqing"), Xu Xiaoping ("Meng Xiaojun"), and Wang Qiang ("Wang Yang"), under the context of China from the 1980s till now. Yu Minhong admitted that basically, he was the prototype of Cheng Dongqing, but denied that the character based on him was Common. He claimed that no investment was made to the film by New Oriental.

Yu converted the Business into the New Oriental Education and Technology Group. In 2010 it was the largest private educational enterprise in China, with approximately 10.5 million enrollment, 465 learning centers in 44 cities and 29 bookstores. As of November 30, 2015, New Oriental had a network of 63 schools, 720 (includes 63 schools) learning centers, 25 New Oriental bookstores and over 5,000 third-party bookstores and over 17,000 teachers in 53 cities, as well as an online network with approximately 11.9 million registered users. Many start-up online education companies claimed they would overthrow New Oriental, whose advantages lie mainly in offline education. Facing the challenge, New Oriental and Yu Minhong have confidence in participating in innovations.

After Investments in several Chinese funds (including the other two of the founders of New Oriental-Xu Xiaoping and Wang Qiang's Zhenfund), Yu Minhong didn’t feel the joys of investment, so in 2014, he decided to set up an angel investment fund together with Sheng Xitai, an old hand in PE industry. The fund was named Hong Tai Fund (or Angel Plus) and focused on the angel and early-stage projects in media, culture, education, entertainment as well as high-tech and mobile Internet industries. It also had plans to invest in Silicon Valley.